Fraud detection software is designed to identify, prevent, and mitigate fraudulent activities in various sectors, including banking, e-commerce, insurance, and healthcare.

These systems use advanced algorithms, machine learning, and real-time data analysis to detect patterns and anomalies in financial transactions, account behavior, and other sensitive activities. By monitoring user behavior, transactions, and interactions, fraud detection software can flag suspicious actions or transactions that might indicate fraud.

Here is our list of the best fraud detection software:

- ClearSale EDITOR’S CHOICE This cloud-based system offers automated fraud checks on payment transactions. There are no upfront enrollment costs, and fees are levied as a transaction processing charge.

- Signifyd A solution for large businesses, this SaaS platform is available for automated fraud checks and provides marketing analysis.

- ThreatMetrix A staged series of identity checks, includes technical reviews, a fraud backlist, and last-minute card fraud clearance. But, again, this is a cloud platform.

- Fraud.net This cloud platform offers a long list of services that include a blacklist database and live credit checks, plus chargeback prevention.

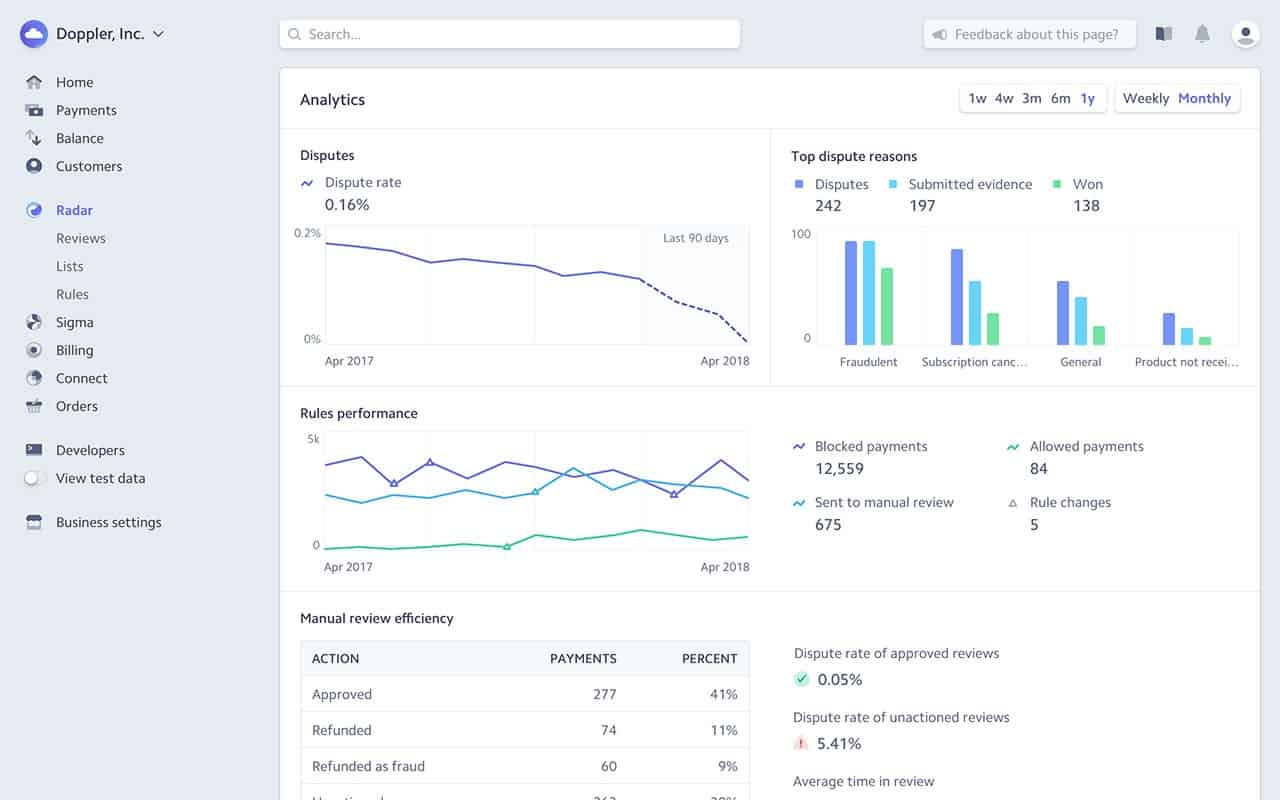

- Stripe Radar An online service that includes account protection and identity verification, and also chargeback protection processes.

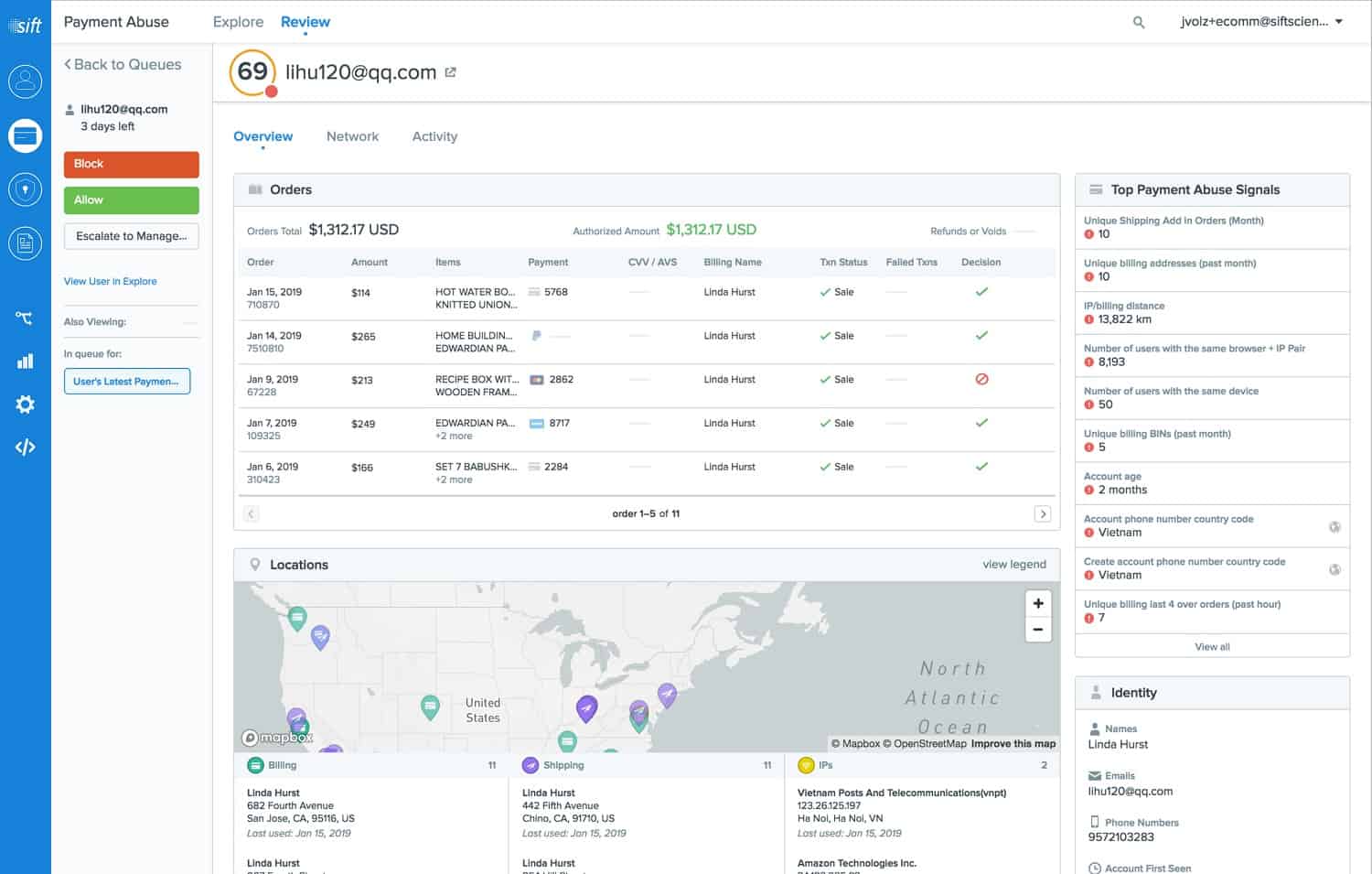

- Sift Payment fraud prevention is part of a platform of digital reputation protection services.

Automated systems for fraud detection typically operate by analyzing large volumes of data and identifying trends or activities that deviate from normal behavior. For example, if a user attempts to make a large withdrawal from an ATM in a foreign country, the system might trigger an alert if it detects that this is inconsistent with the user’s usual patterns of activity. Similarly, in e-commerce, the software may flag purchases made from unusual locations or with payment details that don’t match the customer’s previous purchase history.

Many fraud detection systems incorporate machine learning, which allows the software to learn from past fraud attempts and adjust its detection models over time. This adaptability makes fraud detection tools more effective as they become more familiar with the typical behavior of users and can detect even the most sophisticated types of fraud.

In addition to detection, these systems often come with features that facilitate rapid response and prevention. Some software solutions automatically block fraudulent transactions, while others may trigger alerts for manual investigation by security teams. Many fraud detection systems also integrate with other security tools such as identity verification services, which help to authenticate users and prevent unauthorized access.

Fraud detection software plays a crucial role in safeguarding businesses and consumers from financial loss, reputational damage, and regulatory penalties by quickly identifying and stopping fraudulent activity.

The parallel between computer viruses and fraud is a good one. When a virus is discovered in the world of cybersecurity, software producers investigate the system weakness that the hackers have found and then create an update to close that vulnerability down. The hackers then perform research to discover another loophole, and they get into systems, then the software producers shut that weakness down. Thus, the cybersecurity battle against hackers and their viruses is a never-ending war.

Fraudsters are just as tricky as hackers. They are constantly finding new ways to fleece businesses. As the figures show, identity theft is the most common method used by online fraudsters. However, there are many different scams that a thief can implement when masquerading as someone else. As soon as the business community finds a way to detect that trick, they will go on and see another lucrative con.

Fraud detection software needs to deploy flexible methods to catch thieves. You don’t want identity checks to be so tight that they discourage online shoppers from buying. There is only so much that each business can do to prevent fraud before the buying experience become unattractive and potential customers go elsewhere.

Who needs fraud detection software?

Businesses that sell online are apparent targets for fraudsters, and these are businesses that can easily apply software solutions to fraud prevention. However, even brick-and-mortar businesses can benefit from fraud detection software.

The most significant damage from commercial fraud occurs at the payment phase, and physical outlets rely on credit card processing almost as much as online sellers. When incorrect charges are eventually discovered, it is the seller that has to absorb the loss. Too many refunds issued by payment card providers can result in the business incurring fees, delayed payments, or even being banned from accepting cards for payment. Without the ability to process card payments, most real-world sellers would be unable to operate.

While in-person buyers can be scrutinized for their identity with the demand for a picture ID, those credentials can easily be faked. As the card payment processing occurs through computers, these businesses should also apply fraud detection software before the payment transaction goes through.

Fraud detection services

Fraud detections systems aren’t just a software bundle that needs to be installed on a computer. There is much more to spotting a fraudster, and information sharing is the retailer’s biggest weapon. Therefore, most fraud detection software is delivered as part of a platform that includes access to a live fraud event database.

As has already been explained, fraud detection systems need to be constantly updated to account for newly discovered scams. But, unfortunately, most sellers are focused on their trade and don’t operate an IT-first organization. Thus, system considerations are often pushed down the priority list, and in small businesses, there might not even be a professional systems administrator employed to manage software.

On-site software can quickly get out of date, and that makes the business vulnerable to new scams. For this reason, it is better to look for a Software-as-a-Service platform, which includes software management and will apply all updates automatically without the account holder’s intervention.

The best fraud detection software

Your expectations from fraud detection software depend on your business’s circumstances and whether you have IT and risk assessment experts on your team.

Our methodology for selecting fraud detection software

We reviewed the fraud detection platform market and analyzed tools based on the following criteria:

- A fast identity checker that doesn’t hold up payments

- A service that can integrate with your current payment processing system

- A clear and easy-to-use dashboard

- Facilities for manual risk assessment

- Logging of all transactions, including scoring for successful fraud prevention

- A free trial, a demo, or a money-back guarantee for a risk-free assessment

- A service that fully protects the business from fraud without costing too much

With these selection criteria in mind, we produced various options to suit businesses of all sizes.

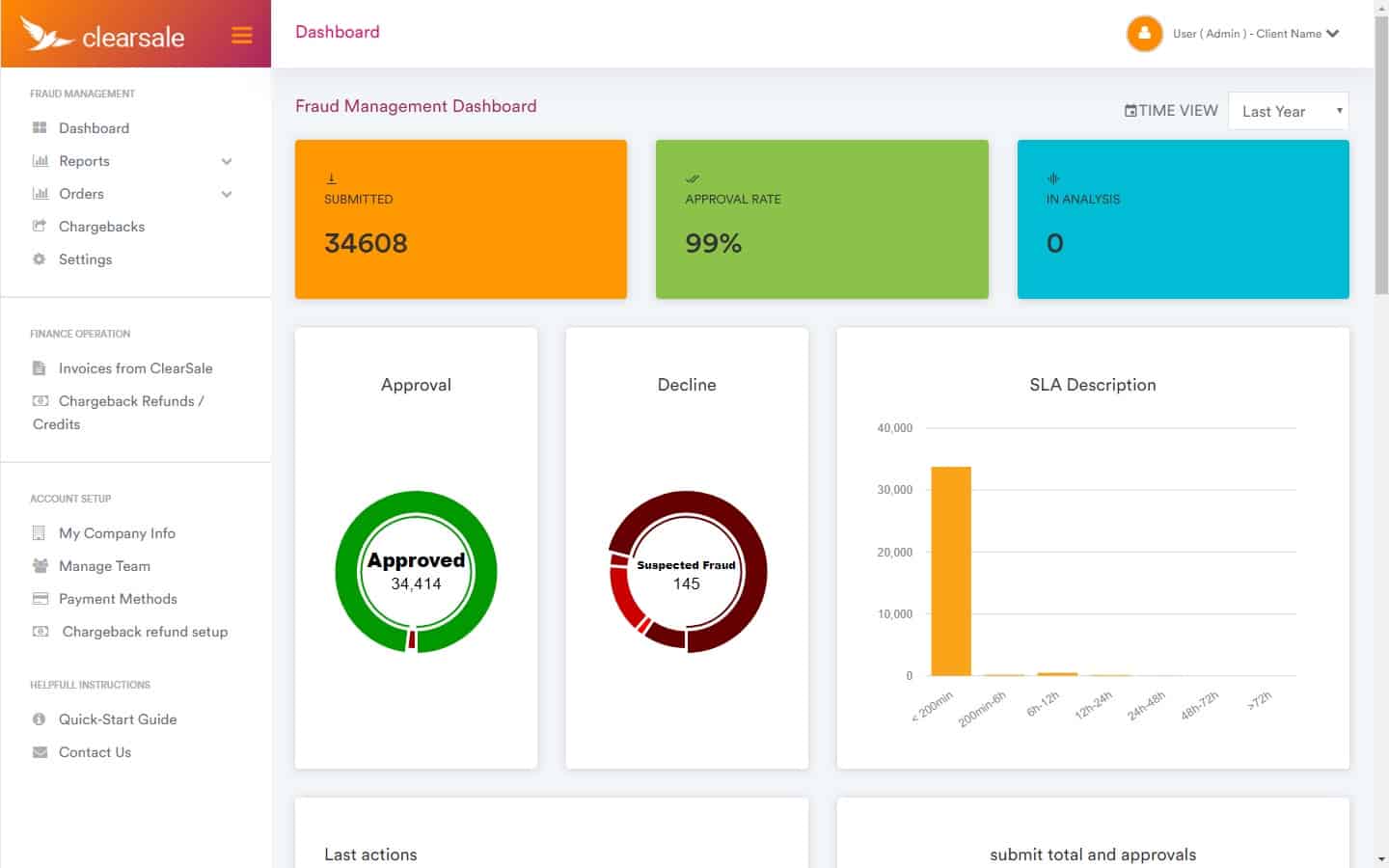

1. ClearSale

ClearSale sorts out fraud detection without too much hassle. This is the ideal solution for small eCommerce businesses because it integrates on-demand with the popular online selling platforms. These include WooCommerce, BigCommerce, Shopify, PrestaShop, Magento, and Shift4Shops.

Key Features:

- Automatic Fraud Detection: Implemented during payment processing

- Transaction Prices: No monthly fee

- For Businesses of All Sizes: Startups can sign up without a credit history

- Chargeback Insurance: Protects you from back retentions

- eCommerce Platform Integration: Integrates with Shopify, WooCommerce, Magento, and others

Why do we recommend it?

ClearSale is a worthwhile service for any online business because if the system fails and your eCommerce business gets hit with chargebacks, it pays you compensation. The service’s guarantees against losses mean that it has real confidence in the success of its product. It doesn’t indulge in big marketing claims that its service can’t deliver.

The integrations of ClearSale make it a clear winner for any small eCommerce concern that just doesn’t have time to manage a complicated fraud detection program. In addition, the service costs nothing to set up, and you don’t have to spend too much time working out which subscription plan you are going to go for.

The direct damage that a payment fraud act will cause you is in chargebacks. Also, remember that excessive chargebacks can get you banned by the payment processor. ClearSale puts in every effort to prevent fraud-related chargebacks because they have to pay you back in full for any chargeback in one of its plans, so they are very confident that they can eliminate this business problem.

ClearSale has also attracted large businesses and includes Walmart, Staples, Chanel, and Calvin Klein among its user community.

ClearSale offers two charging models, and both of these have straightforward prices without extra hidden charges. The first option is a KPI-based price. This is like a chargeback management plan, and you get a refund if the number of chargebacks in the month exceeds your agreed limit. However, that’s a refund on the monthly charge and no compensation for the total amount of chargebacks. In other words, this is a service-level agreement.

The second plan just takes a percentage fee off each transaction – which is 0.4 to 0.5 percent, depending on the product type. This works out more expensive per transaction than the KPI-based plan. However, this second plan is a chargeback insurance scheme, and ClearSale gives you total compensation for any chargebacks.

Who is it recommended for?

This is an important service for any eCommerce business. The company has 20 years of experience in the field of fraud protection, which means it is a reliable system that works – with its guarantee, the company would have gone bust if its system didn’t work.

Pros:

- Performs Automated Fraud Detection as Part of the Payment Processing Task: The seller doesn’t need to get involved

- Easy Setup on the Major eCommerce Platforms: Available as a service within the environment

- No Setup Fees: No subscription charge

- Doesn’t Require Any Expertise to Use: Get it operating on your very first site

- Wide Customer Base: Appeals to large corporations as well as SME startups

Cons:

- Better for Sales with High Profit Margins: Half a percent of the sales price can be a big chunk out of your profits if you operate with thin margins.

ClearSale is a cloud platform, so you don’t need to install any software on your premises. In addition, the service offers a 30-day moneyback guarantee, and you can also negotiate a free trial period with the Sales Department.

EDITOR’S CHOICE

ClearSale is our top pick for fraud detection software because it is straightforward to use and has a transaction-based charging system that requires no upfront payments from the retailer. In addition, ClearSale is available as a plug-in for many of the most widely used eCommerce platforms, such as Shopify, BigCommerce, WooCommerce, and PrestaShop. It is also suitable for large businesses through its Oracle and Salesforce integrations.

Get a free trial: www2.clear.sale/getstarted

Operating system: Cloud-based

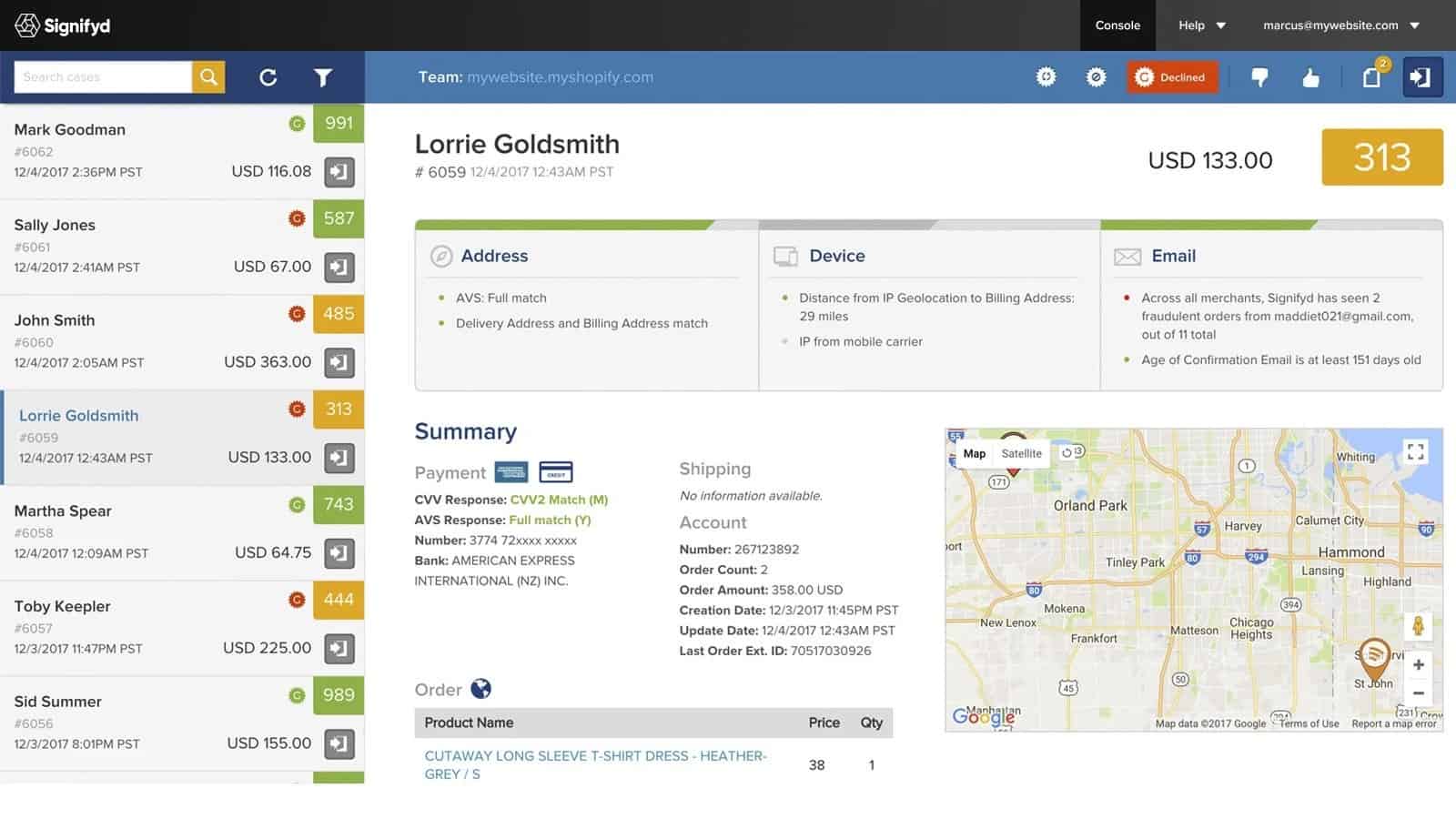

2. Signifyd

If you run a large business with an entire IT department and risk assessors on staff, the fully integrated systems of ClearSale might not be so necessary for you. However, Signifyd is very highly rated by its user community for the range of services that its platform offers.

Key Features:

- Gathers Retailer Transaction Data: Provides a blacklist

- Identifies Fraudsters: Looks for typical behavior patterns

- Provides Buyer Journey Analysis: See why site visitors change their minds and don’t buy

- Fast Customer Checks: Barely noticeable to the buyer

Why do we recommend it?

Signifyd is a platform of services for online businesses that include fraud protection. The core of this system is a blacklist of bad payers. The system works as a plug-in to your payment processing and it returns a pass or fail for each transaction. This is called the Signifyd Commerce Network.

Signifyd gathers fraud event data from an extensive list of online retailers and essentially runs a blacklist of identities known to be used by fraudsters. Scanning through vast lists of IDs could prove a hold-up in payment processing. However, the Signifyd-created delay is barely noticeable. In many ways, the service gives each potentially compromised identity the benefit of the doubt.

Rather than automatically blocking a suspicious payee, the service kicks in extra checks that use AI processes to look into the viability of the purchase and ensure that this is very likely to be a fraud attempt. This is a double-check service that only gets applied in certain circumstances. This means that the same degree of scrutiny is not applied to all customers, enabling genuine users to complete their purchases rapidly.

The Signifyd platform offers more than just fraud detection. It also includes market analysis features. You can use the platform to identify your big sellers and work out how to boost sales of big-margin products and improve profitability. Market information comes for all Signifyd users all over the world, not just your sales.

Who is it recommended for?

The client list of Signifyd includes some very large companies, which include Samsung, Philips, and Omega Watches. The full platform’s services help you to optimize sales and tailor your marketing. Unfortunately, the platform doesn’t publish its prices, which makes recommending the service for small businesses difficult.

Pros:

- Two-in-One Service for Sales: Offers a combination of fraud prevention and market analysis

- Checks Buyer Identities Against a Blacklist: Cuts out global players quickly

- Gathers Market and Fraud Data from Around the Globe: You benefit from the experience of others

- Performs Triage: Focuses deeper checks on likely fraudsters

Cons:

- Doesn’t Integrate with eCommerce Platforms: Not as suitable for startup SME as ClearSale

You can contact the Sales Department of Signifyd to request a demo.

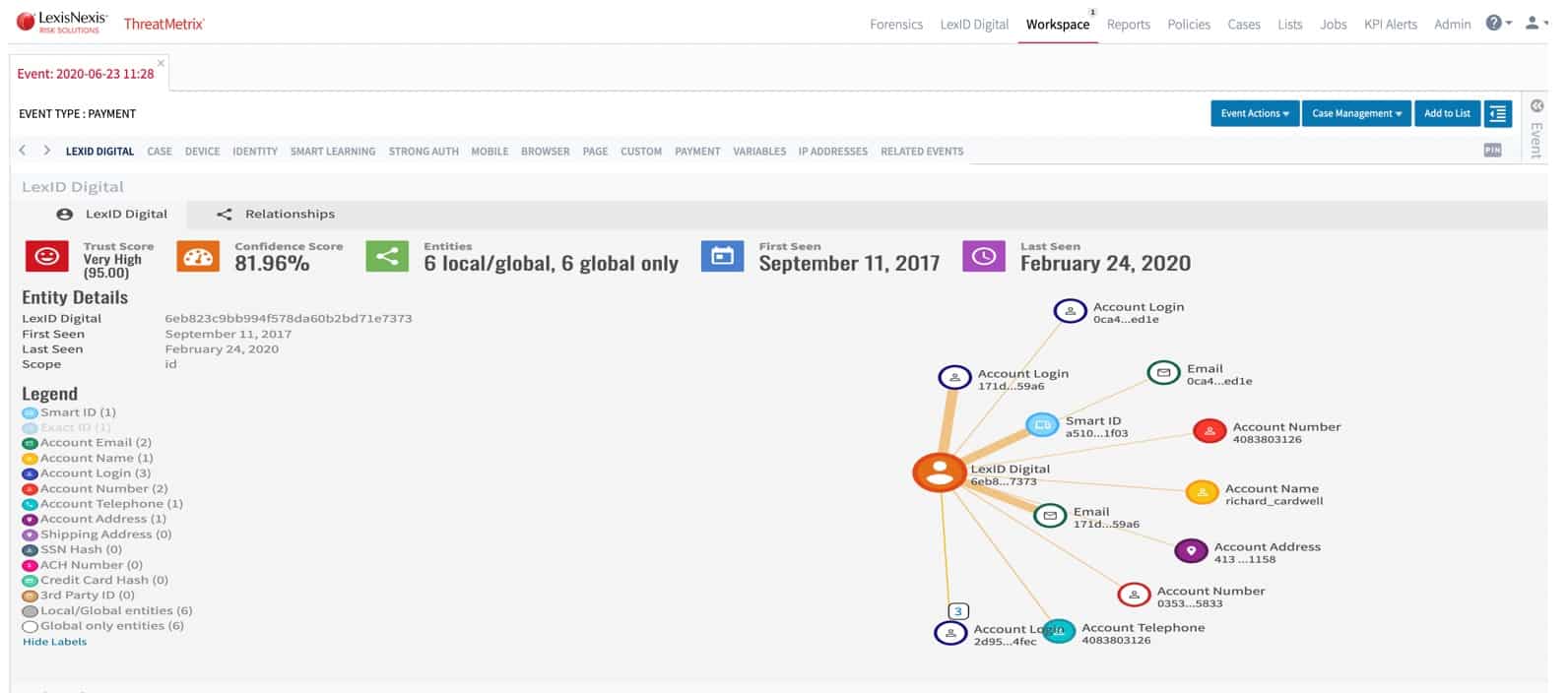

3. ThreatMetrix

ThreatMetrix is a service offered by LexisNexis and is one of several risk management solutions provided by the organization. The ThreatMetrix system threads through the buyer journey on your site so that all of the identity checks don’t have to be left until the very last minute when the buyer makes a purchase.

Key Features:

- Identity Checks in Stages: Integrates threat identification into the buyer journey

- Site Visitor Accounts: Simplifies identification of bona fide buyers

- Location Checks: Heightens behavior tracking for visitors from locations known for fraud

Why do we recommend it?

ThreatMetrix is part of the LexisNexis Risk Solutions platform. This is a reputation assessment service for customers that applies its assessment in stages rather than leaving it all to the point of payment processing. However, this system also manages customer accounts. So, the whole customer area of your website is provided by the ThreatMetrix service.

The ThreatMetrix cloud platform aims to process buyer information quickly to prevent genuine buyers from abandoning the purchase process. The scenario of ThreatMetrix encourages site visitors to set up an account before deciding to buy. This many identity checks can be performed before the instant that the user presses the Buy button.

As well as checking on the identity of each account holder, the ThreatMetrix system performs technological checks, identifying whether the user is hiding an actual location with the use of proxies or VPN. This is particularly useful for location-restricted services, such a video clubs. The system also tracks the IP addresses of frequent offenders and runs a blacklist of card numbers and home addresses.

Who is it recommended for?

This is a high-end service that provides a lot of customer management functions, including user behavior tracking. Although LexisNexis doesn’t publish a price list, the likelihood is that such a comprehensive service is going to be pricey, so it is going to be more appealing to large businesses than to SMBs or startups.

Pros:

- Uses Technical Identifiers: Tracks IP addresses as well as human identities

- Runs a Blacklist: A global database of known fraud-linked payment cards

- Provides Marketing Insight: Constant user monitoring can be useful for site designers as well as for fraud protection

Cons:

- Not a Plug-In Solution: Requires your whole buyer services strategy to be reorganized

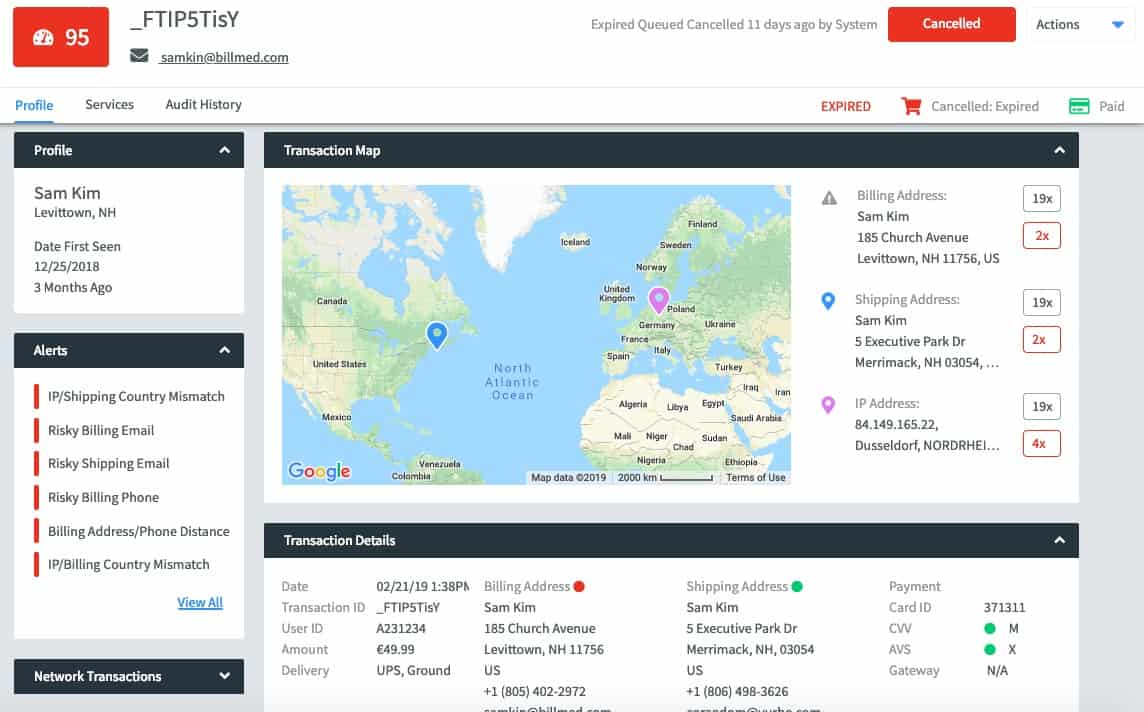

4. Fraud.net

The Fraud.net fraud detection software is part of a cloud platform of services tailored towards specific industries, namely eCommerce, travel, and the financial services sector. The platform is organized as a menu of modules, and you can decide which of those services to use.

Key Features:

- Identity Checks: Uses multiple detection methods

- Blacklisting: Cut out known fraudsters immediately

- Chargeback Insurance: Compensation if the system fails

Why do we recommend it?

Fraud.net includes many different methods to assess the reputation of customers and prevent fraud. Techniques include user behavior tracking, blacklisting, and credit referencing. All of the different sources are meshed into an AI engine to quickly provide an assessment on the likelihood of a customer being fraudulent.

The facilities offered by Fraud.net include identity, address, email address, and phone verification, plus IP address blacklisting. Other modules include visitor activity tracking that can identify possible fraudulent activity. Login activity credibility is another way to spot fraud. For example, if an account holder logged in from Germany a few minutes ago, how can they be logging in from Brazil now?

Identity verification works on a scoring basis; one odd attribute to a user’s actions or identity shouldn’t cause too much concern. However, a combination of unusual factors will raise a red flag. Among the services of Fraud.net are chargeback protection, account takeover detection, and the use of stolen identity credentials. These checks can be applied to call centers, gift card schemes, in-person identity checks, and online systems.

Fraud.net holds an extensive database of discovered fraudulent actors and the identities that they use. The company also offers Dark Web identity disclosure checks for given identities and account credentials.

Who is it recommended for?

The Fraud.net platform provides a range of related security services, such as Dark Web scanning and social media profiling to protect online companies from payment fraud and reputation damage. This is a large platform of tools rather than an off-the-shelf solution and is suited to large businesses.

Pros:

- A Menu of Many Different Fraud Detection Services: Your fraud team needs to identify necessary services

- Technical Checks Available: Also behavior analysis to spot account takeovers

- A Database of Fraudulent or Compromised Identities: Professional fraudsters change their identities regularly

Cons:

- Not an Off-the-Shelf Solution: It doesn’t offer one single plug-in for small businesses

Check out all of the Fraud.net services by requesting a demo.

5. Stripe Radar

Stripe is an online payment processor. However, you don’t have to be using the Stripe service to benefit from the Stripe Radar fraud detection system. Radar is an automated, online service that verifies customers just as their payment transaction goes through. Stripe extends its blacklist database and fraud detection services to the broader business community with this tool.

Key Features:

- Constantly Recalibrated Fraud Indicators: Keeps up with new fraud techniques

- Chargeback Insurance: Don’t get hit by bank retentions

- Multiple Authentication Methods: Doesn’t rely on one single strategy

Why do we recommend it?

Stripe Radar offers fraud risk assessments for eCommerce businesses through the Stripe online payment platform. You don’t have to use Stripe for payment processing, however, many Stripe customers who do use that system for pay,ment processing can get the service for free. This is a slick, fast, and effective threat-detection service.

As a primarily online business, Stripe understands the importance of speed to eCommerce. Their checks are thorough but fast. The service can gather information about buyer behavior, identifying when a particular account holder starts to behave differently to the typical buyer on your site or even starts to behave differently to that account’s historical pattern of activities. Stripe’s global transaction analysis system can also define standard indicators of fraudulent activity and intercept those few miscreants before their fraud unfolds.

Stripe Radar also offers additional authentication facilities for the user accounts that you run for your sales sites. This tightens security with multi-factor authentication and reduces the opportunities for fraudsters to acquire the accounts of genuine users.

Chargeback protection in the Stripe Radar service draws data from the major credit card companies to identify high-risk payment cards. In addition, the system can use device fingerprinting and proxy detection to ensure that a single fraud squad trying to project multiple identities can be bound to their true activity history.

Stripe Radar is charged per screening transaction, but some grades of Stripe customers get the service for free.

Who is it recommended for?

Any business that uses Stripe for payment processing will certainly want to sign up for Stripe Radar. The fact that the fraud protection will be integrated into your customer user account management and payment processing is a winner. Businesses that use other payment processors should maybe consider switching to Stripe if the fraud protection service in that other system doesn’t match the Stripe Radar package.

Pros:

- A Backlist of Known Fraudulent Identities: Gathered from all Stripe users around the world

- Root Identity Detection: Ties multiple identities to the same single real-world person

- Free for Some Stripe Accounts: Built into the payment clearing service

Cons:

- Requires a Stripe Account: However, it can be used to front any payment processor

6. Sift

Sift operates the Digital Trust and Safety Suite. This platform of online services includes account takeover protection, payment fraud prevention, and content protection.

Key Features:

- Account Takeover Detection: Performs behavior analysis

- Payment Fraud Detection: Operates a blacklist

- Content Protection: Prevents impersonator sites

Why do we recommend it?

Sift provides quick and effective payment fraud checks that rely on a blacklist and a database of typical indicators of fraudulent activities. This service can be applied to customer account behavior tracking to reduce the load on the fraud check at the point of payment.

The payment fraud protection services include chargeback management and dispute handling automation. This service is used by some enormous organizations, including Twitter and Airbnb. The system consists of a machine learning module that establishes normal behavior for all your customers and individual accounts. This facility helps to speed up and tailor the Sift fraud detection process.

Sift maintains a database of fraudulent activities, and that gives them an alert list of IP addresses, names, addresses, and other identity markers that can quickly shine a searchlight on fraudsters.

The database is also distilled to provide constantly updated fraudulent activity indicators. New frauds happen in waves. Either one team perpetrates its recent attack as widely as possible as quickly as possible, or one well-known con gets learned by many actors and then spreads around the world. Sift knows all of those tricks and spots new fraud strategies as soon as they appear.

Who is it recommended for?

Sift is easy to implement because it provides off-the-shelf services that don’t require much setup. So, it would be a great option for small businesses that don’t have cybersecurity or risk management experts on the payroll. However, Sift doesn’t publish its price list, which is a major issue for small businesses.

Pros:

- An Extensive Database of Previous Frauds: Lists a range of identifiers

- A Database of Attack Strategies: Threat intelligence for behavior tracking

- Machine Learning: Identifies behavior that is unusual for your buyer community

Cons:

- Operates on the Cloud and Needs to be Threaded into your Site: Integrating calls to the platform can be complicated

Check out the Sift demo system to get a full assessment of the platform’s services.

Fraud detection software FAQs

What are the types of fraud detection?

There are five categories of customer fraud detection

- Blacklisting – Compiled from the records of many retailers

- Statistical assessment – Do all identity indicators synchronize?

- Technical checks – Includes location detection

- AI-based systems – Looks for anomalous behavior

- Hybrid systems – Combinations of the above

Businesses also need to guard against insider fraud, such as unauthorized discounting, kickbacks, or outright embezzlement.

Can you track a scammer?

The tracking of scammers requires industry cooperation through the compilation and distribution of blacklists. Each successive fraud attempt is added to the scammer’s record, building up a profile of typical behavior, which could include a number of different techniques or target types.

How accurate is Shopify fraud detection?

Shopify provides its own fraud detection system on its platform that collates event information from across all Shopify retailer sites. This will flag a suspicious transaction and it is advisory rather than a block on the transaction. Relying on transaction analysis from across all of the Shopify platforms gives you a better chance of spotting fraud than just examining each of your buyers for indicators of suspicious activity.