According to IdentityForce, financial identity theft hit 47% of American consumers in 2020. IdentityForce may not be as well known as LifeLock, but IdentityForce is a TransUnion brand, giving it plenty of credibility. (TransUnion is one of the three major US credit reporting bureaus.) IdentityForce monitors how your personal information appears on the internet, looking to alert you to oddities that could increase your chance of suffering identity theft.

I tested the IdentityForce service first-hand, signing up for it just as you would. In my 2022 IdentityForce review, I will seek to answer questions that readers often experience when trying to decide whether to subscribe to an identity theft protection service like IdentityForce, including:

- Is IdentityForce worth the money?

- Can I trust IdentityForce?

- How easy is IdentityForce to use?

- Is IdentityForce customer service any good?

- Is IdentityForce better than LifeLock?

During my hands-on review of IdentityForce, I found that it offers the features you’d expect to receive in terms of providing alerts about oddities concerning your personal information on the internet. Additionally, IdentityForce’s professionals will help you work to recover your identity if you suffer a breach of your personal data. Ultimately, its below-average price point gives it an edge that competitors struggle to match, and it offers an impressive number of features for that price. The one area where IdentityForce struggles is when you have a highly complex financial life. However, for those who just want the basics, IdentityForce is a strong contender.

Summary of benefits: IdentityForce

| No value | Identity Force |

| Website | identityforce.com | Free trial | Average email response time | Identity theft insurance | Up to $1 million | Stolen funds reimbursement | Up to $1 million | Special offer | $17.99 | Highest price per month | $23.99 | Credit monitoring | Investment account alerts | Social media monitoring | Home title monitoring | Lock your credit | Phone takeover monitoring | Address allocation | Dark web monitoring | Crime in your name monitoring | Credit reports | Credit score |

|---|---|

| Best deal (per month) | Free trial Get a 14-day FREE trial! |

IdentityForce: Hands-on review

With an IdentityForce subscription, the service will keep an eye on your personal information, as it promises to do. Should you end up suffering a loss of your personal information at any point, causing you to become an identity theft victim, IdentityForce’s professionals will help guide you toward recovering your identity. These are the primary reasons why people subscribe to an identity theft protection service, so IdentityForce fulfills the basics.

IdentityForce’s dashboard has an easy-to-use design, so you can find the exact features you want to use quickly. Setup goes quickly as well. Depending on the pricing tier you pick, you may even have a 30-day free trial period available if you would like to try IdentityForce before you commit your money.

Now, I must mention a couple of key items. First, subscribing to an identity theft protection service like IdentityForce does not guarantee that you will never become the victim of identity theft. This service seeks to warn you when your personal data suffers an unsafe exposure on the internet, but it cannot guarantee you will never fall victim to identity theft.

Second, you may be able to replicate many of the functions on your own that IdentityForce does for you. For example, you can monitor your credit reports closely for any odd activity free of charge. However, many people do not have the time or desire to perform this work themselves. Subscribing to an ID theft protection service means you are paying the service to take these steps for you.

Understanding this, you may prefer the peace of mind that comes from having a service like IdentityForce working on your behalf. The cost may be worth it for you. What I found during my review is that IdentityForce is trustworthy and easy to use, helping you receive the services you expect to have. It doesn’t have quite the level of features someone with a highly complex financial life may need, though. If this describes you, consider looking elsewhere.

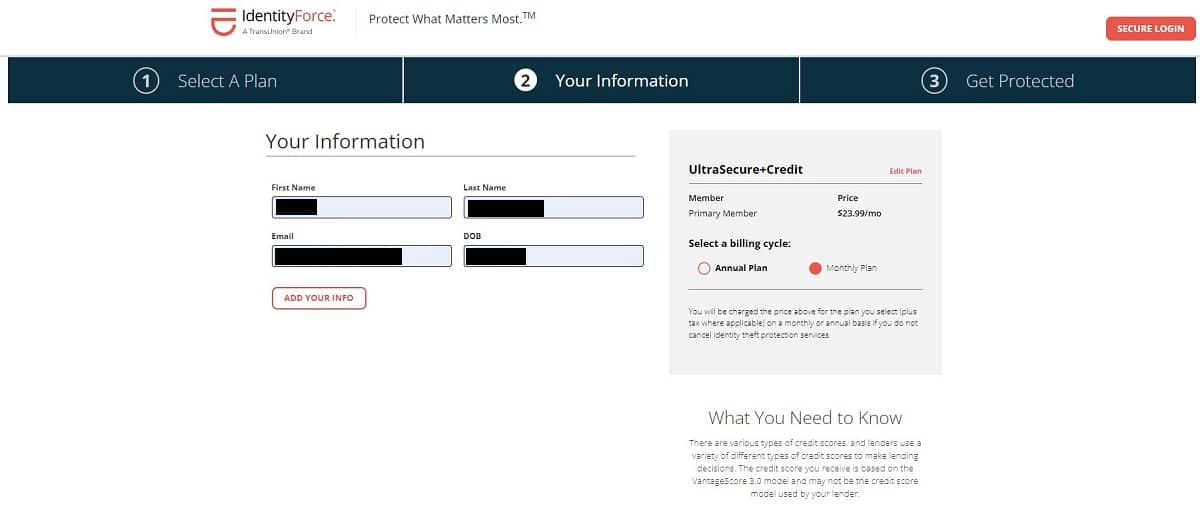

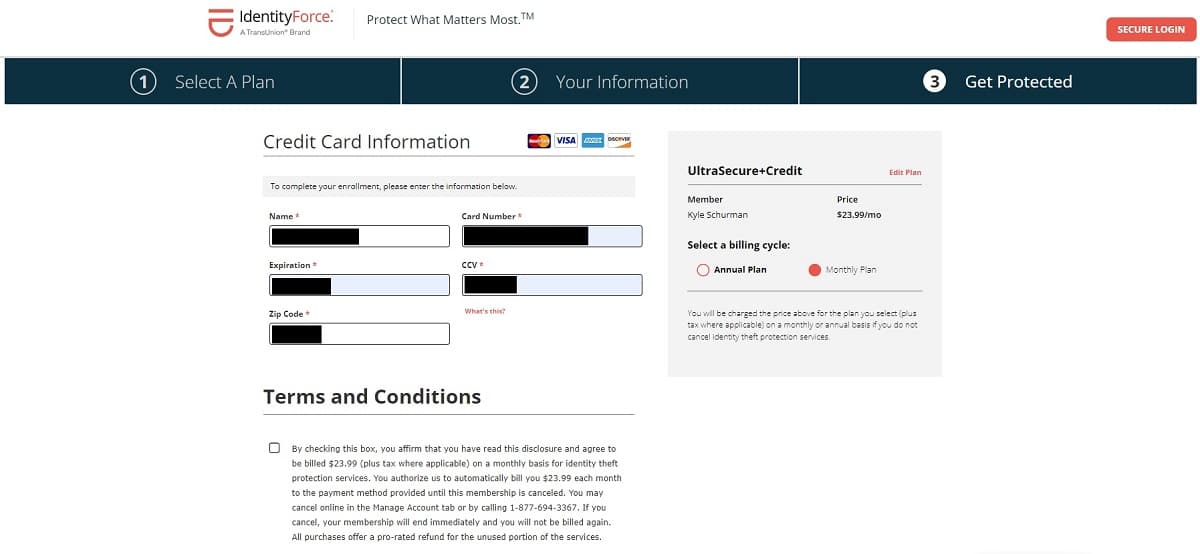

Before laying out the specifics of what I found with IdentityForce during my review, I want to point out that I subscribed to IdentityForce, just like you would do. I did not receive a special account from IdentityForce. I used my own personal information for monitoring, and I paid $23.99 per month for the UltraSecure+Credit pricing tier.

IdentityForce features and insurance

Here are the various features available in IdentityForce and how I ranked them in my hands-on IdentityForce review.

Insurance and compensation

IdentityForce-enter-info-3IdentityForce-enter-info-3

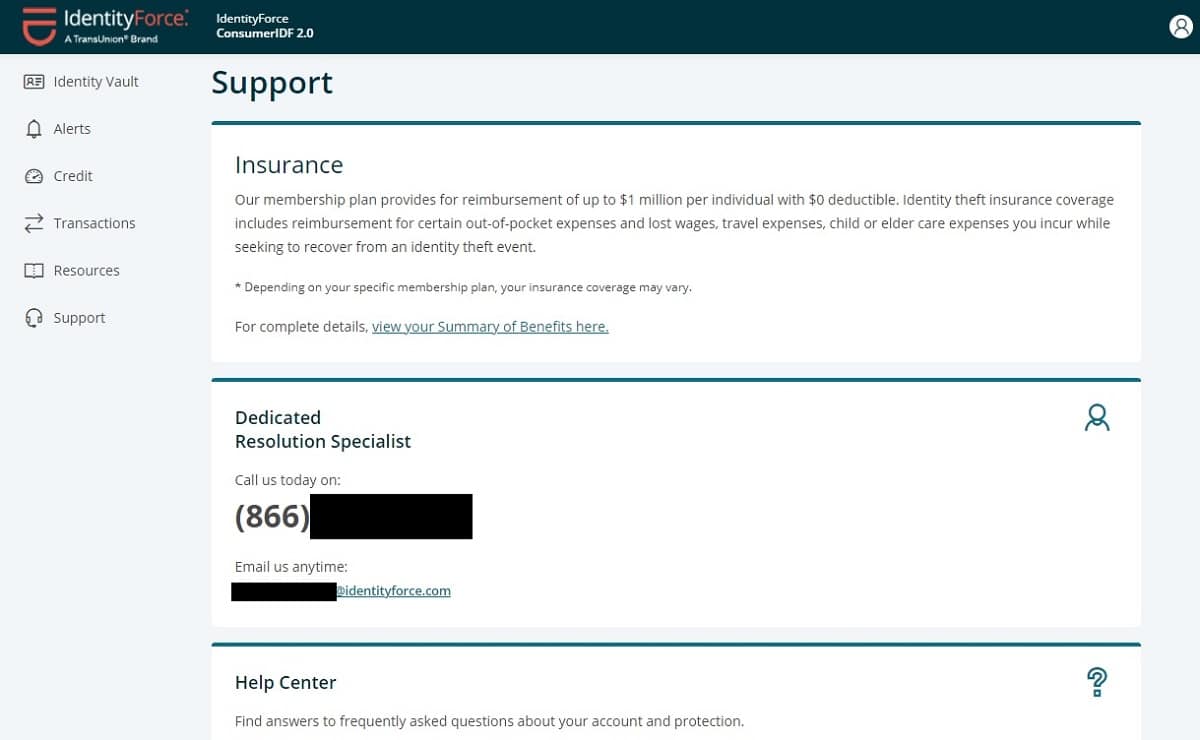

When you subscribe to IdentityForce, you receive up to $1 million in insurance coverage to reimburse you for expenses related to trying to recover your identity. Such expenses can include lost wages because you missed work to deal with your identity theft situation. Additionally, you may need to hire attorneys, private investigators, and accountants to help you sort out your financial information after suffering an ID theft.

IdentityForce provides specialists who can help you determine the steps you need to take to attempt to restore your identity. This can be helpful, as most of us would struggle to figure out where to start after suffering identity theft.

You also have compensation available if the identity theft situation leads to you suffering an actual financial loss. It is possible to receive up to $1 million in stolen funds replacement, depending on your subscription tier. (Unfortunately, I did not receive a clear answer as to the maximum reimbursement you could receive in a lower pricing tier, which is a concerning omission.)

To receive any of these payments, you will need to prove to IdentityForce that you suffered a breach of your identity. You will need documentation of your losses as well. IdentityForce does not just hand out money because you claim identity theft losses without proof.

Activity alerts

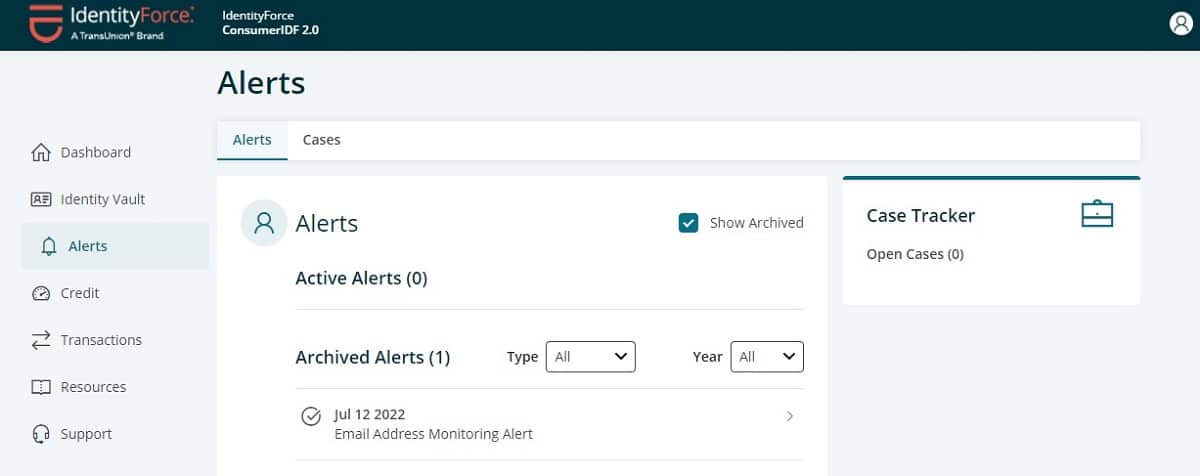

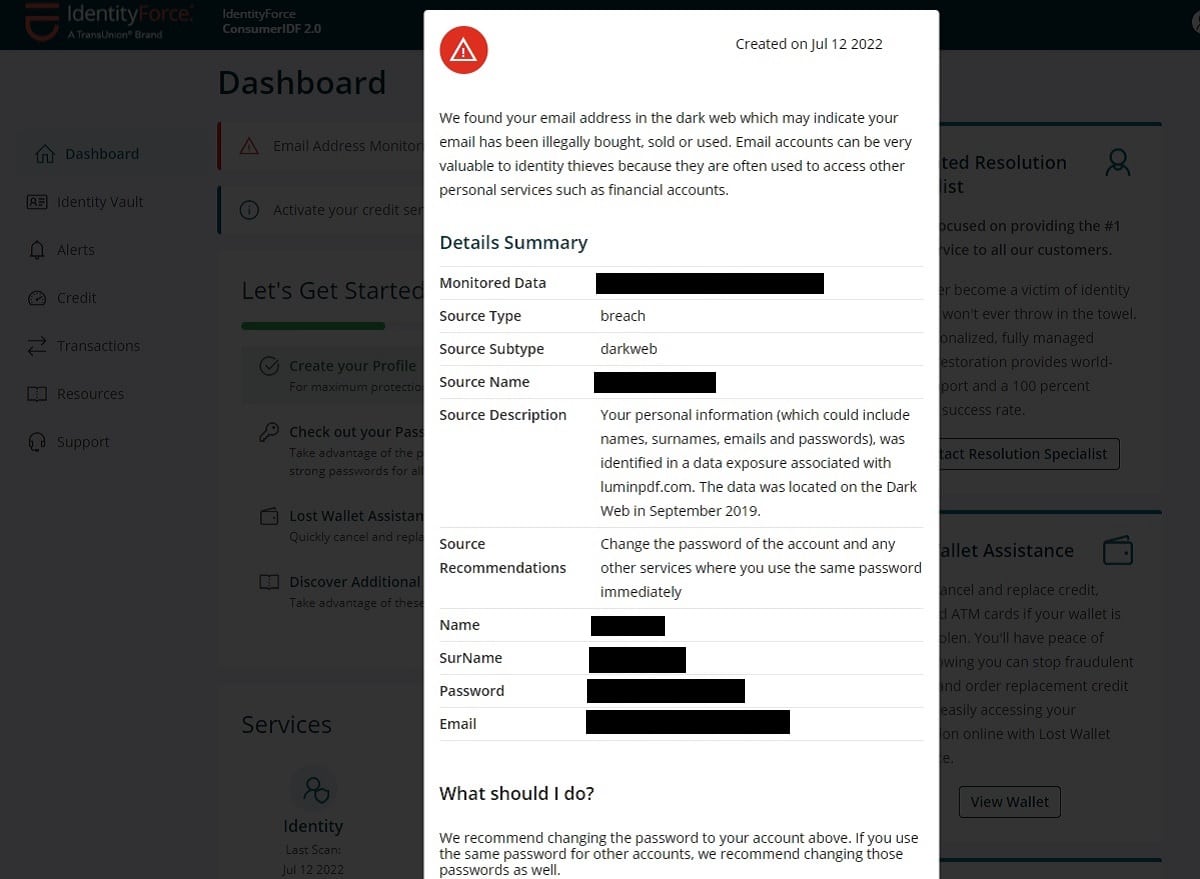

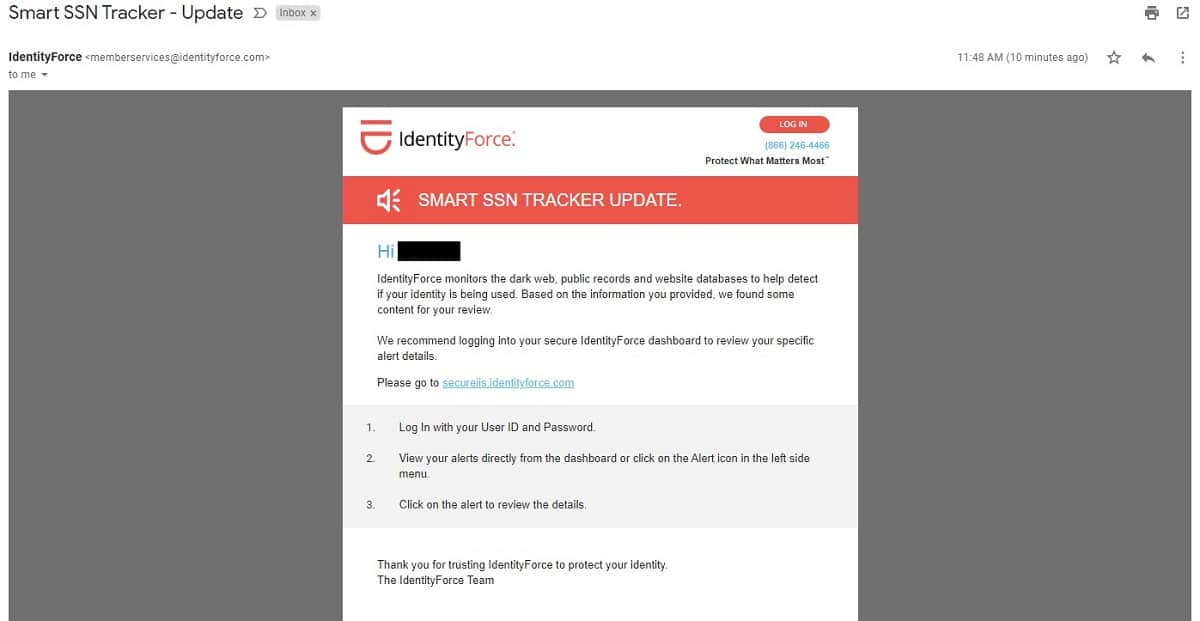

Should IdentityForce notice any oddities with your personal information, it will generate an alert. You will receive an email message about the alert, and you can see your alerts listed in the IdentityForce dashboard or in the mobile app.

As part of the alert, IdentityForce will provide some advice about whether you should make changes to try to minimize any damage from the breach of your personal information. For example, if IdentityForce finds evidence that one of your account passwords may be available on the dark web, the service may recommend that you change the password.

I must mention here that IdentityForce does not perform the changes for you; you must do them yourself. Like other ID theft protection services, IdentityForce only makes suggestions on how you can proceed to protect your identity. You will decide whether you want to take the steps, and you must do them yourself.

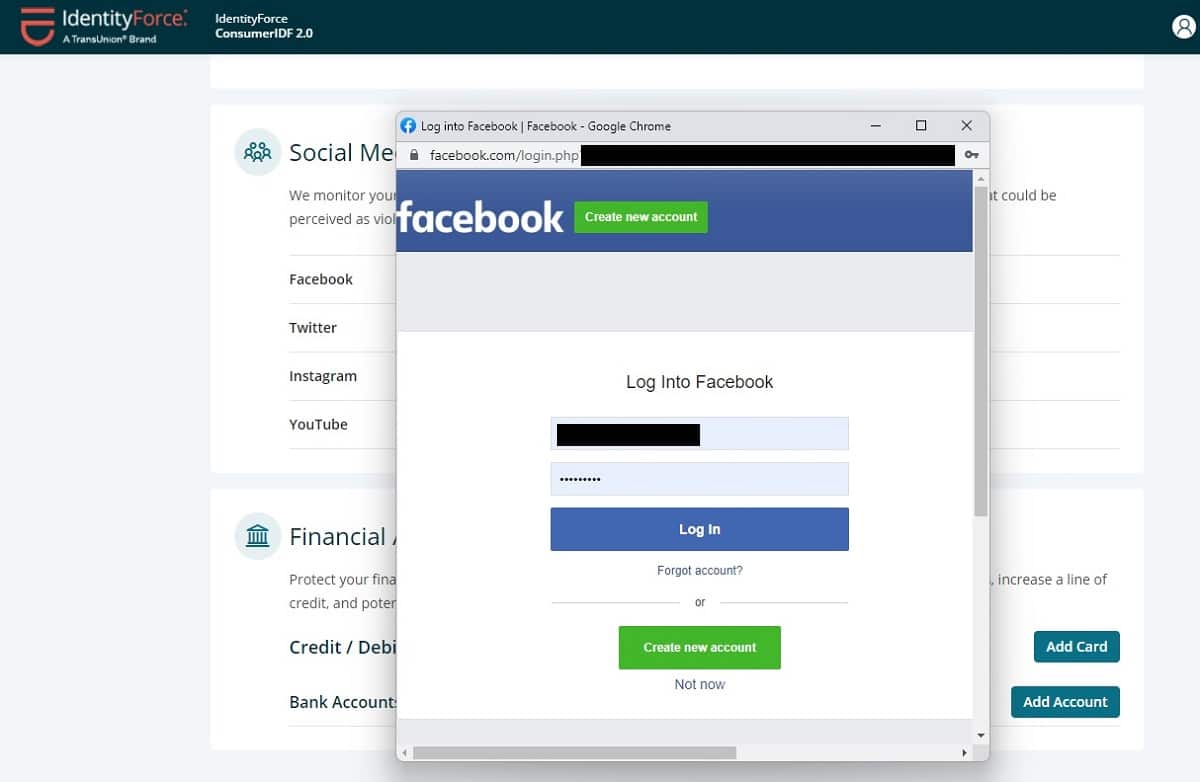

You can choose to have IdentityForce alert you any time you have a deposit or withdrawal from an investment account. If desired, you can have IdentityForce generate an alert each time you have a transaction in your bank account or on a credit card that exceeds a certain amount. Ideally, such alerts would help you spot fraud before you suffer a major loss. (You will need to give IdentityForce access to your login information for these accounts before it will begin monitoring them.)

Dark web monitoring

Various chat rooms, websites, and other areas on the internet buy and sell stolen personal data. These areas can be found on the dark web. Data like your Social Security Number, usernames, account numbers, passwords, and phone numbers can be bought and sold there. A hacker may be able to use a combination of this type of data to gain access to your accounts.

IdentityForce will monitor the dark web, looking for any mentions of your personal information. Some of the information IdentityForce may find could trigger an alert for you, because the service determines this information increases the chance of you suffering identity theft.

I received a dark web alert as soon as I signed up to begin using IdentityForce. Thankfully, it turned out to be a minor issue that I could fix quickly, but it was important to know about it.

Free credit report and monitoring

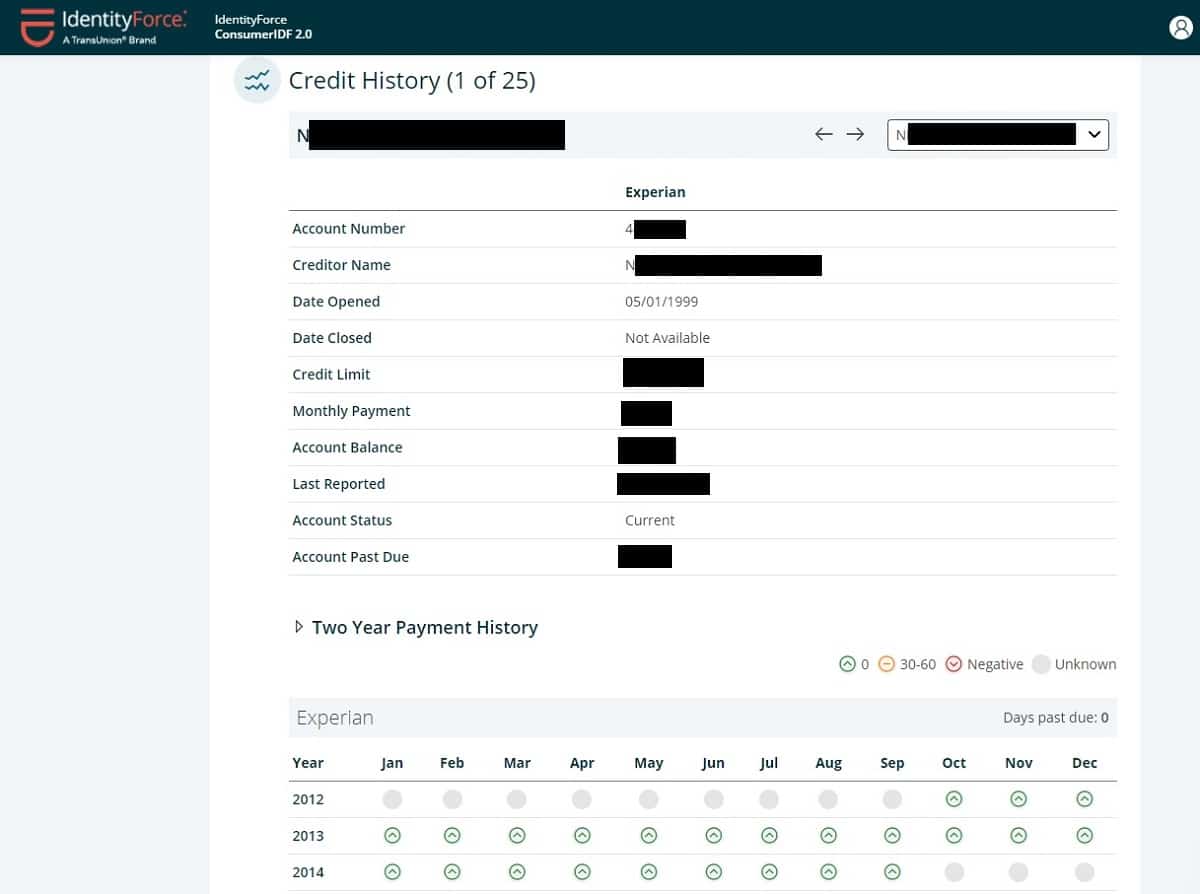

IdentityForce offers credit scores and credit reports as part of the subscription to the UltraSecure+Credit pricing tier. It also has a credit score simulator and tracker that you can use to keep a close eye on your credit. (These features are not available in the UltraSecure pricing tier.)

Even though TransUnion owns IdentityForce, you can receive credit scores from TransUnion, Experian, and Equifax.

The credit report screen takes the information from your credit report and lists it in an easy-to-understand format. It gives you information on your credit history and current credit situation, including current account balances, dates you opened a certain credit account, and a recent history of payments.

The IdentityForce credit report also provides a summary of all your credit accounts combined and a list of each credit account associated with your name. Look over this information carefully to spot potential signs of fraud, such as someone using one of your credit accounts without your knowledge.

An interesting feature that IdentityForce includes is its Credit Simulator feature. You can see how opening a new credit card, paying off a card, or declaring bankruptcy will affect your credit score. This simulator is not a guarantee of what will happen to your credit score if you take a particular action, but it gives you an idea of what likely will happen.

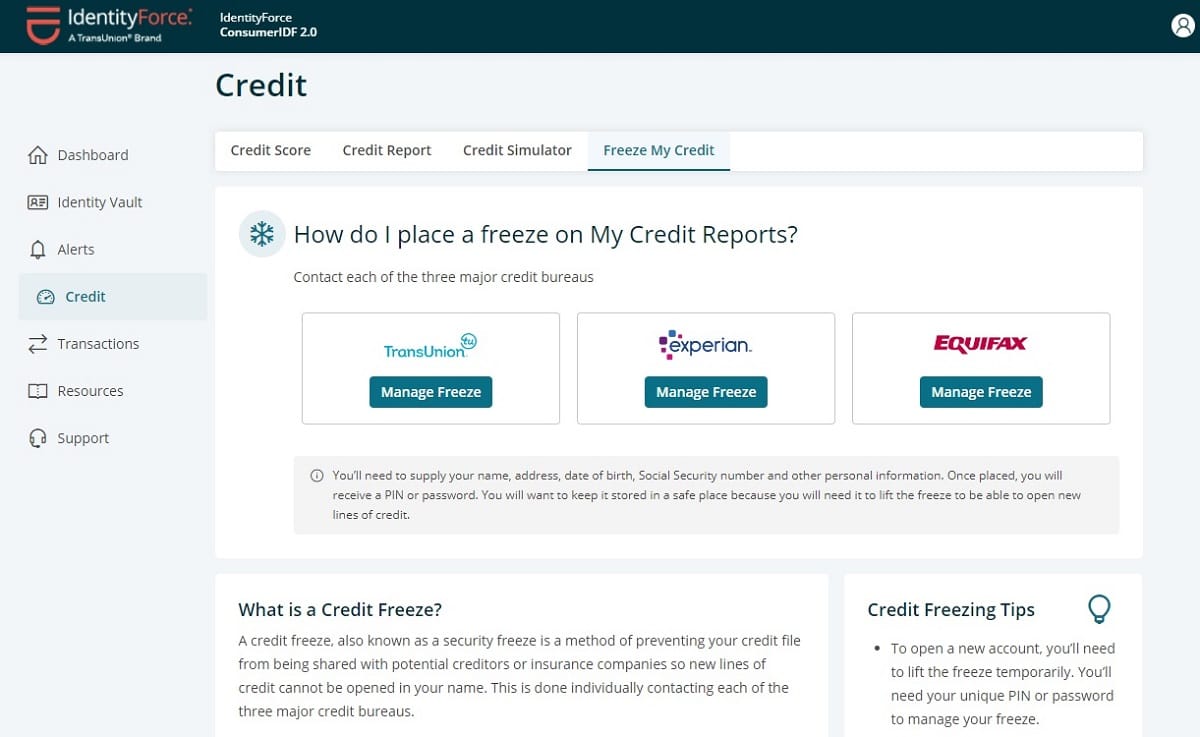

Freeze your credit report

You have the ability to freeze or lock your credit report through the IdentityForce dashboard for all three credit bureaus. This greatly simplifies this process versus contacting each of the three credit bureaus yourself.

Additionally, IdentityForce provides information and advice about the pros and cons of freezing your credit. Freezing your credit report is one of the best ways to prevent a financial loss from identity theft, and I appreciated the emphasis IdentityForce places on educating users about this option.

Address monitoring

If someone files a change of address form with the U.S. Postal Service related to your home address, IdentityForce will send you an alert. Some hackers may try to redirect your mail to attempt to steal your identity by receiving your bills and other personal mail.

Court records monitoring

IdentityForce will monitor court records and criminal proceedings throughout the United States, looking for any of your personal information. A criminal may try to use your stolen personal information during an arrest, so the criminal can hide his or her identity. IdentityForce would generate an alert if it finds this type of information.

Social media monitoring

When you give IdentityForce access to your social media accounts, the service will monitor them for odd activity that may indicate someone is attempting to take control of your social media presence. IdentityForce also may look for activity or posts on your accounts that could indicate cyberbullying that a hacker is trying to blame on you. IdentityForce monitors four types of social media accounts:

- YouTube Channel

ID restoration

Should you suffer identity theft while you are an IdentityForce subscriber, you gain access to assistance with trying to restore your identity. IdentityForce offers a U.S.-based customer service team of restoration professionals to help you with this process.

During my hands-on test, I (thankfully) did not suffer a breach of my identity, so I could not test the restoration services that IdentityForce offers.

You can call IdentityForce when you need help with identity restoration, and its customer service team is available 24 hours a day, excluding major holidays. You also can email IdentityForce for help.

IdentityForce places a contact button on its home page/dashboard, so you can find the contact information immediately when you need it, which is a nice feature.

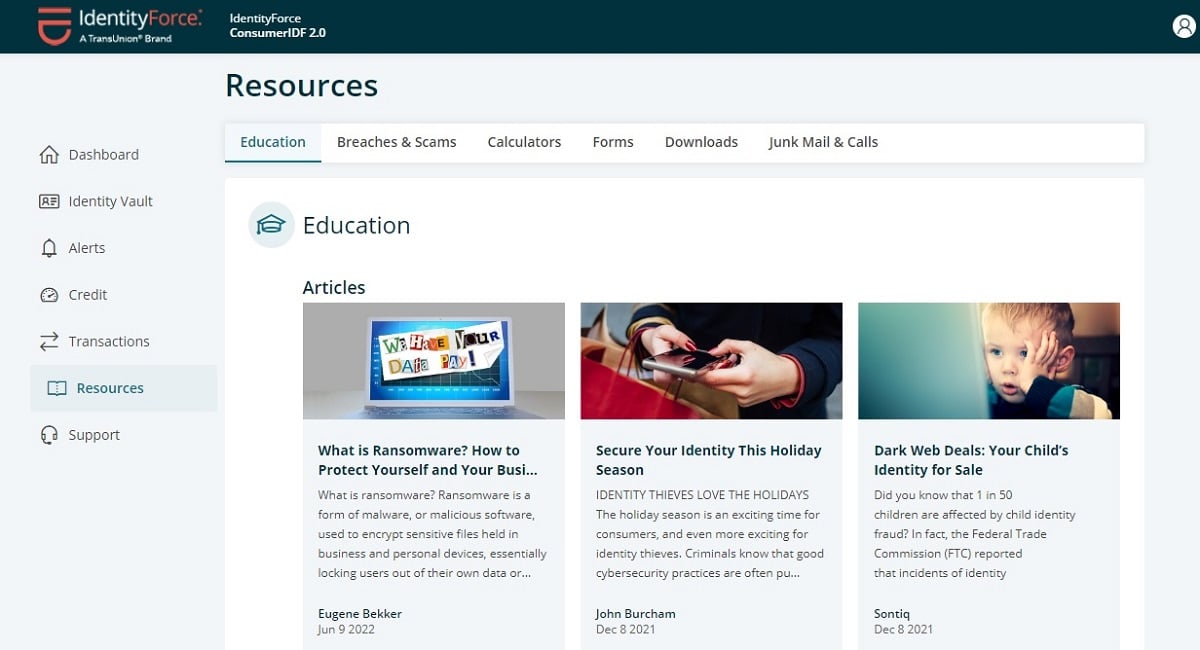

The self-help documentation that IdentityForce offers is extremely thorough. You can find quite a few answers to questions you may have in this area.

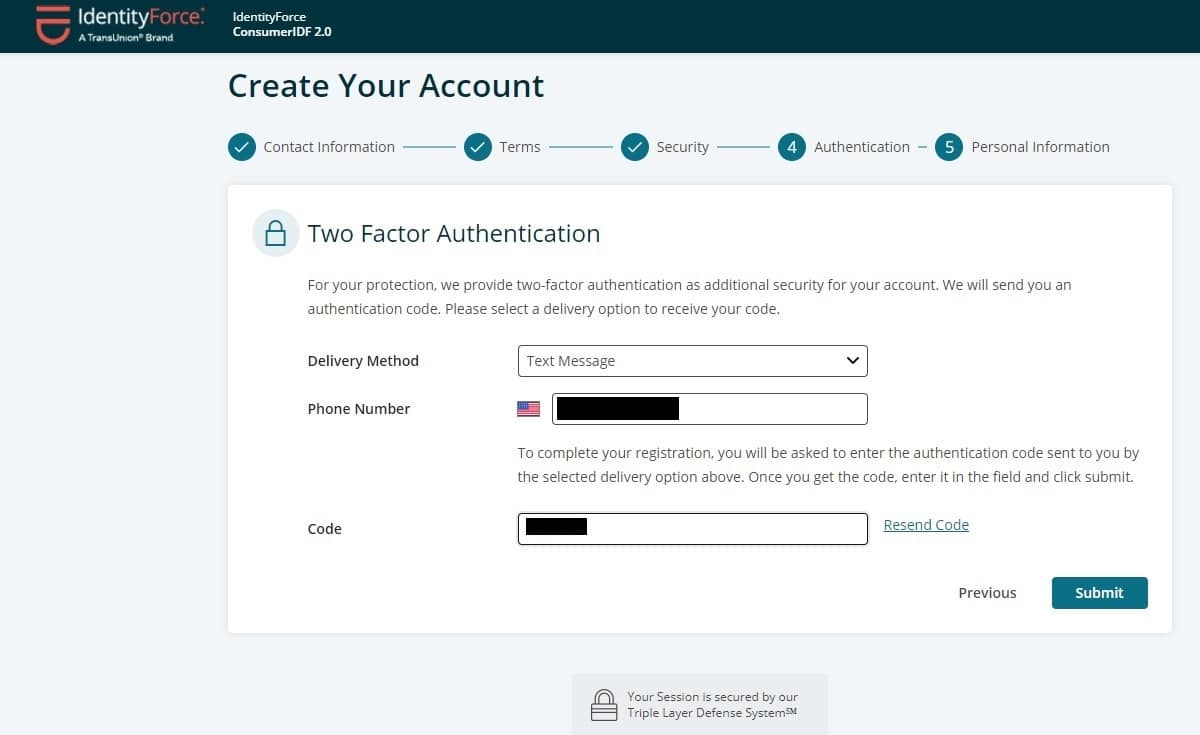

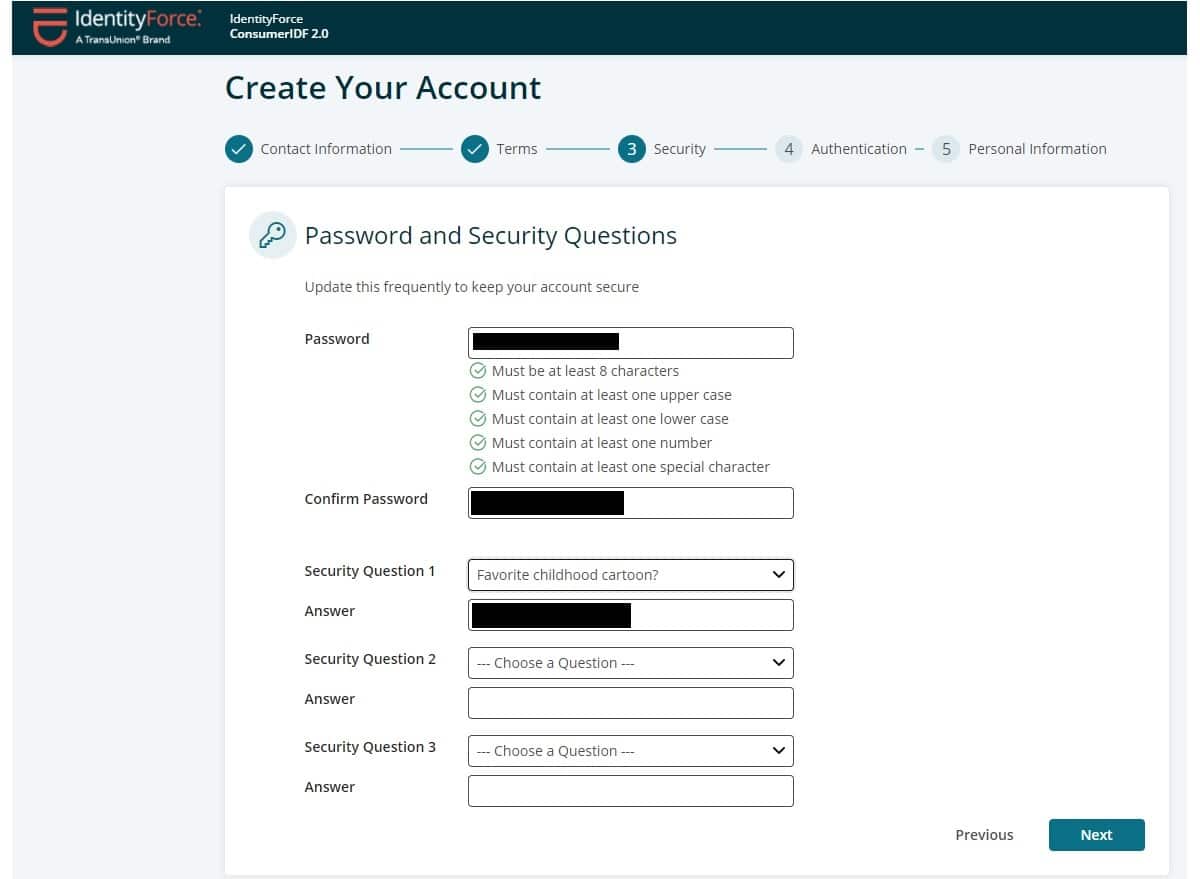

2FA login

When you sign up for IdentityForce, the service requires you to make use of two-factor authentication (2FA). You will need to enter your username and password when you sign in. IdentityForce then generates a secondary sign-in code that will come through text message, phone call, or email message. When you enter the secondary code, you can gain access to your IdentityForce account.

I appreciate that IdentityForce requires that you use 2FA, as this is the safest means of protecting your account’s data. If a hacker manages to steal your username and password, the hacker still could not break into your account without access to your smartphone or email account.

If given a choice, some people may choose to skip using 2FA because it takes a bit longer to log in to the account. Because IdentityForce requires you to use 2FA, rather than giving you a choice, it shows this organization is taking security seriously.

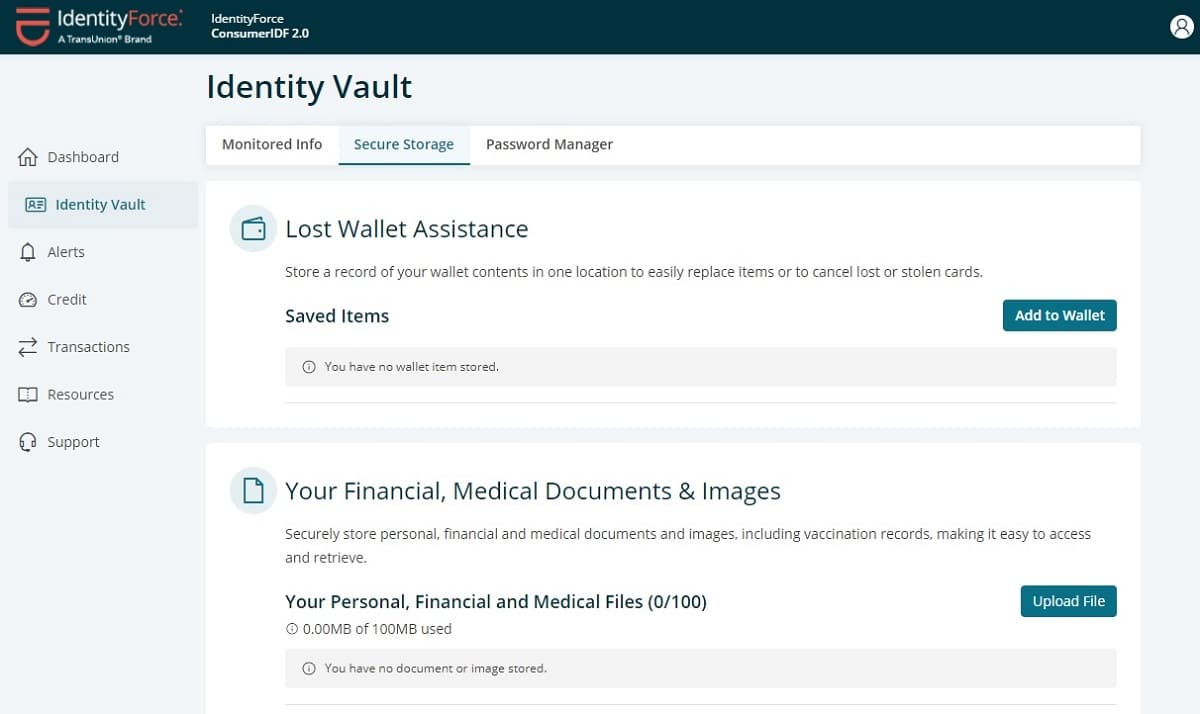

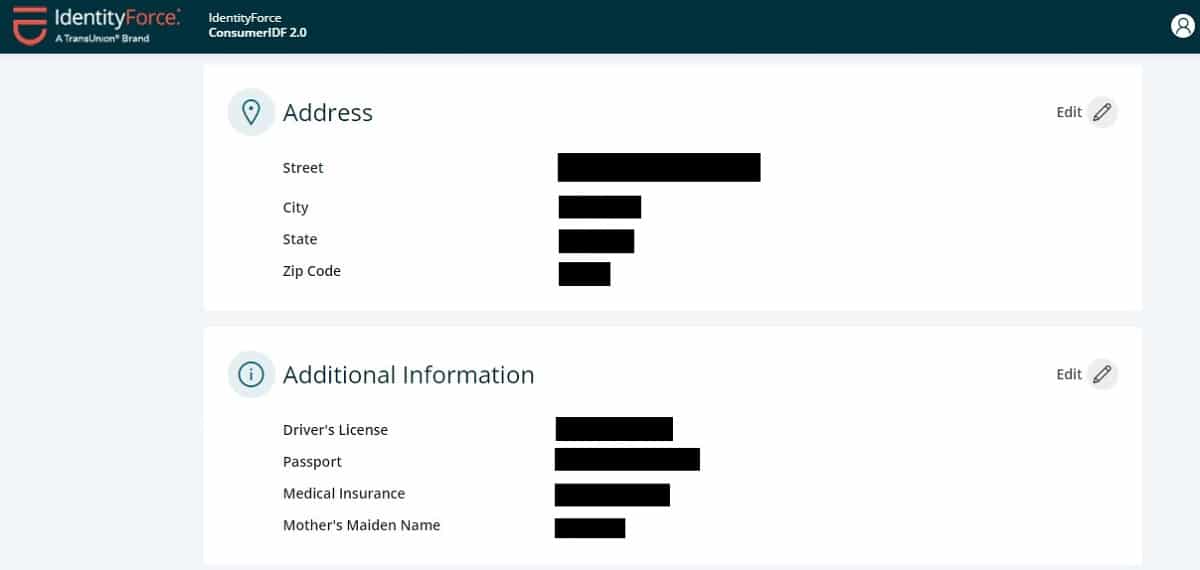

Lost wallet protection

You can store information about items you typically carry in your wallet inside your IdentityForce account. Should you ever lose your wallet, you then will have all this information in one location, allowing you to notify the providers of these items to cancel them and to obtain replacements. Some of the items you can store include:

- Credit card

- Debit card

- Driver’s license card

- Medical ID card

- Other ID card

- Social Security card

- Rewards card

- Membership card

- Passport

Important documents

Through the Identity Vault service within IdentityForce, you can upload digital copies of important documents to store them with your other personal information. You can store up to 100 MB of digital documents.

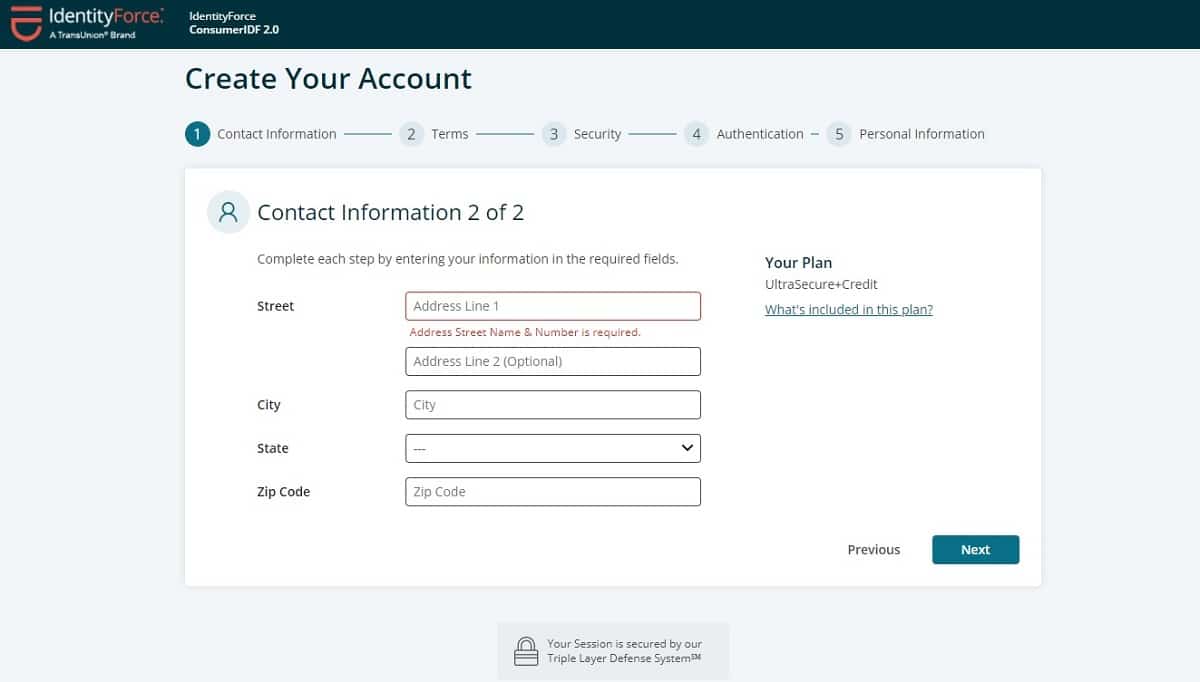

Signup and setup

It only takes a few minutes to sign up and begin using IdentityForce. You will need to submit some personal information, such as your Social Security Number, birthdate, name, and address to be able to verify your identity as you go through the signup process. Even if you are using the 30-day free trial, you will have to submit a credit card at the time of signup. If you do not cancel the service before the trial period ends, IdentityForce will charge your card.

IdentityForce will use your email address as your username. You will need to create a password for the service, and you will need to provide an option to make use of 2FA.

After the signup process, IdentityForce will pre-populate your dashboard with the information you already entered. You then can enter additional information to track specific items, such as your credit card accounts, banking accounts, investment accounts, social media accounts, and more.

You do not have to enter this information all at once. You can take your time entering the other information, but IdentityForce cannot start tracking your other accounts until you enter the information and give IdentityForce access to your accounts.

The next time you sign in to your IdentityForce account, you will need to enter your password. If you don’t want to enter the password every time, you can click on the Remember Me checkbox to have IdentityForce pre-populate the password box.

However, if there is even a slight chance that someone else could use your computer, using the Remember Me checkbox represents a security risk. After all, you are going to have a significant amount of personal information stored inside the IdentityForce dashboard that you probably will not want others to be able to see.

IdentityForce is a cloud-based service, meaning you will not download software to run on your computer. You will run the IdentityForce dashboard inside a web browser.

Ease of use and design

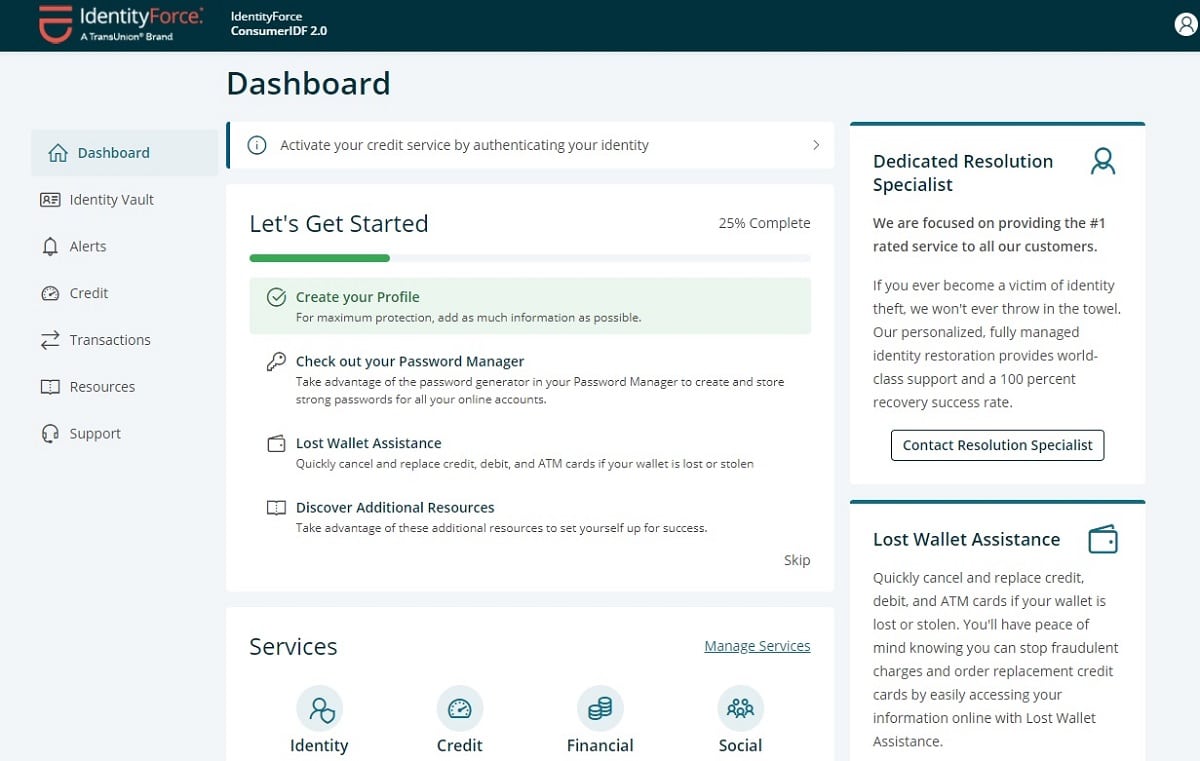

IdentityForce recently went through a redesign of its interface, and it is a significant upgrade from what appeared in the past. I really like the new design of the IdentityForce dashboard. It has a list of topics along the left side of the window, so you can jump to a topic quickly. Multiple sections are visible on the home page/dashboard, giving you faster access to commonly used features.

IdentityForce will remind you when you have certain pieces of information that you need to enter into the service. As you complete a section, it will turn green, making it easy to see what you have left to do.

When running IdentityForce over my internet connection, I felt like the service ran a little slower than I’d like to see. This is common with identity theft protection services, though, as they are deploying multiple security measures as the information travels from the ID theft protection server to your computer.

IdentityForce will automatically log you out of your account after about 20-30 minutes of inactivity. This is a security feature, so you don’t leave your account open on the screen where others could gain access to it. However, it can be frustrating to have to re-enter your password constantly. You may want to check the Remember Me checkbox to save time when you have to log in again.

IdentityForce dashboard

The recently redesigned IdentityForce dashboard is impressive. You can access any of the main features of the service along the left side of the screen. These features include:

- Dashboard

- Identity Vault

- Alerts

- Credit

- Transactions

- Resources

- Support

To access your account settings, click on your name in the upper right corner of the screen. If you ever are unsure whether your subscription tier contains a certain feature, you can see a list of features on the Manage Account screen.

IdentityForce mobile app

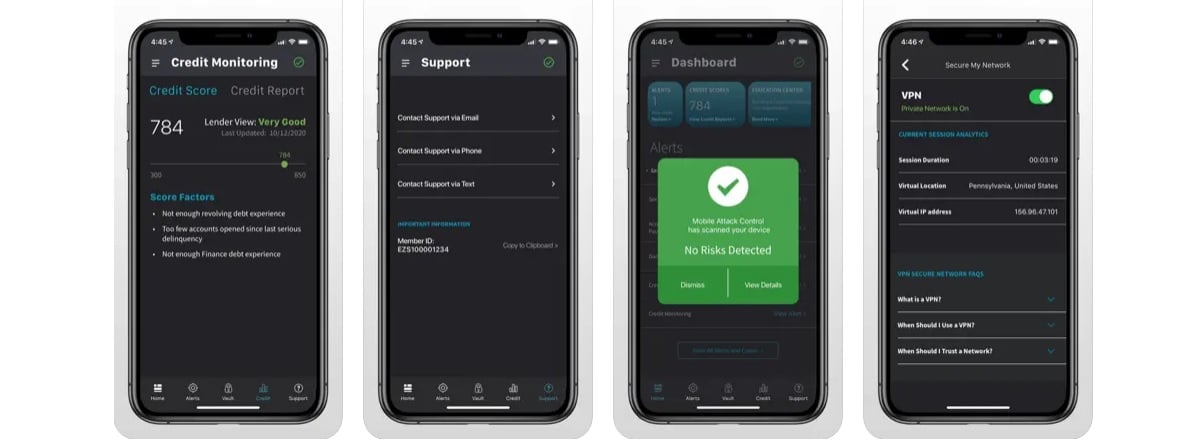

You can download IdentityForce’s mobile app for either Android or iPhone formats.

Beyond allowing you to monitor your personal information and credit information from anywhere, IdentityForce’s smartphone app also protects your smartphone’s data. The IdentityForce app will scan your phone for malware and spyware, and it can warn you about dangerous apps and websites. This is not a common feature for ID theft protection service mobile apps – but maybe more of them should take after IdentityTheft in this area.

As far as tracking and monitoring your personal information, the IdentityForce app only offers the most basic features. Don’t expect to be able to delve into your financial situation and into alerts and warnings as thoroughly as you can with the dashboard in a desktop browser.

Some online reviewers report having multiple glitches with the performance of the app in terms of delivering alerts. However, most of these problems are fixable by upgrading to the latest version of the app.

IdentityForce support

Accessing support with IdentityForce involves either clicking on the Support link along the left side of the screen or clicking the Contact Resolution Specialist button on the right side of the screen.

IdentityForce offers around-the-clock customer support via telephone (other than major holidays). This is an increase in customer service hours from the past. You also can email IdentityForce at any time to receive access to support personnel, or you can access IdentityForce’s live chat service.

When making phone calls during my tests of IdentityForce’s customer service features, I usually was able to speak with someone within a few minutes, which is good.

IdentityForce does create some marketing email messages for you after you sign up for the service, but these messages aren’t as overwhelming as some other ID theft protection services. Unfortunately, there isn’t much you can do about eliminating these messages.

IdentityForce: Pricing

| No value | Identity Force |

| Website | identityforce.com | Subscription periods | Monthly or annually | Special offer | 30-day free trial for new customers (UltraSecure tier) | Price per month | $17.99 (UltraSecure Individual tier) | Lowest annual price | $179.90 (UltraSecure tier) | 4-year pricing plan | $239.90 (UltraSecure+Credit Individual tier) | Lowest annual price (Family) | $249 (UltraSecure Family tier) | Highest annual price (Family) | $359 (UltraSecure+Credit Family tier) | Money-back guarantee |

|---|---|

| Best deal (per month) | Free trial Get a 14-day FREE trial! |

IdentityForce’s prices are very comparable to other identity theft protection services. Unlike some other packages, such as LifeLock, IdentityForce does not offer a significant first-year discount before ramping up the price in year two and beyond. You can select either a monthly payment method or an annual payment method with IdentityForce.

Auto renewal options

Like most ID theft protection services, IdentityForce follows an auto renewal policy. This means that the service will charge your payment method automatically at the time of renewal, whether that is monthly or annually. Once the charge goes through, you cannot cancel IdentityForce and expect to receive that payment back.

Auto renewal can be a significant annoyance for consumers. Unfortunately, if you want to make use of identity theft protection services, you will have to put up with auto renewals.

How do you cancel IdentityForce?

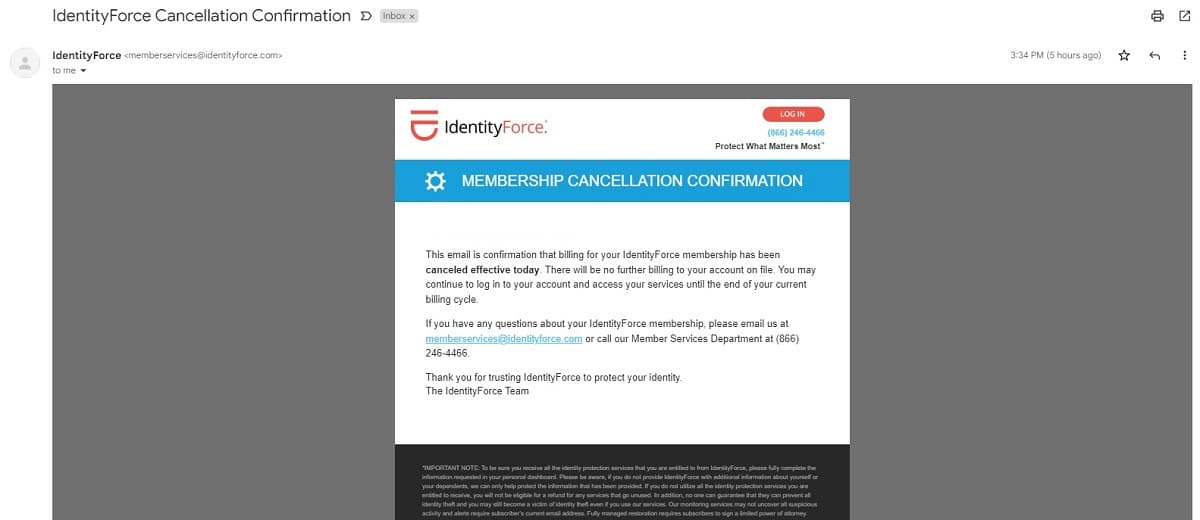

Canceling IdentityForce is a little challenging, just as it is with most ID theft protection services. You will have to dig through multiple screens in IdentityForce to find the cancellation information. (Fortunately for you, I already dug through the screens when I was ready to cancel the service after my testing period, so I will save you some time.)

To cancel IdentityForce, click on your name in the upper right corner of the dashboard. In the popup menu, click on Manage Account. Then click the Protection Plan tab along the top of the screen. You will see your current subscription plan (along with upgrade options).

Just click the Cancel button on this screen underneath your current subscription level, and then follow the instructions. When I canceled the service, it went smoothly. Hopefully, this will be the same experience you will have.

Expect IdentityForce to try to convince you to remain subscribed to the service, and it may even offer you a special discount to continue subscribing. You likely will continue to receive quite a few marketing emails for the remainder of your subscription term and beyond, asking you to reconsider.

You also can cancel via a phone call to customer service.

If you choose to cancel, remember that your subscription will remain active until the end of the current billing period, whether that is monthly or annually. You do not receive a refund from IdentityForce for the payment you made already.

I would recommend taking screenshots of the notification that your cancellation went through, and I would keep any email messages you receive about the cancellation. I did not have a problem with canceling the service. However, should IdentityForce continue charging you after you believe you canceled the service, you will want to have evidence that you should not receive additional charges.

I appreciate that IdentityForce promises to completely destroy all your personal data 30 days after your subscription expires, so you don’t have to worry about your personal information ending up in the wrong hands after you cancel.

I always recommend that you read through the most recent IdentityForce terms of use before you sign up for the service and give IdentityForce your credit card. You want to fully understand the cancellation policies and how the auto renewal charges work before you make a payment. This information is subject to change at any time, so always check the official terms for the latest policies.

I also would recommend making use of a credit card to pay for IdentityForce, rather than using a debit card or an automatic bank account withdrawal. If you have a dispute regarding charges with IdentityForce, your credit card company is going to have a better chance of helping you settle the charges favorably than your bank will have. (I did not have problems with odd charges when using IdentityForce, but a few online reviews of IdentityForce do mention this problem.)

IdentityForce pricing tiers

With IdentityForce, you can select among two pricing plans with two pricing tiers available under each of those plans. You can select either an individual pricing plan or a family pricing plan. The pricing tiers include:

- UltraSecure: The UltraSecure tier is the cheaper pricing tier with IdentityForce. It focuses on providing fraud alerts and on monitoring your personal information. It does not provide information on monitoring your credit.

- UltraSecure+Credit: This tier costs a few dollars more per month than UltraSecure, and it adds features to help you keep an eye on your credit. It gives you credit reports, credit scores, and credit monitoring from all three primary credit bureaus. It also offers an option to freeze your credit report.

The UltraSecure tier has a 30-day free trial period associated with it, but you cannot sign up for a free trial if you choose UltraSecure+Credit, which seems like an odd distinction for IdentityForce to make.

When subscribing, you have the option of paying month to month or annually. If you choose the annual payment plan, you will receive a discount equal to two months of the cost of the monthly plan over a 12-month period.

However, because IdentityForce does not offer refunds for unused portions of your subscription cost, if you choose the annual payment plan, you cannot receive a refund if you cancel a few months into the service. In other words, if you chose to pay annually to try to save some money versus paying each month, you will want to be certain that you plan to keep using the service for the full year.

Pros and cons of IdentityForce

Pros:

- For those seeking family coverage, the price is lower than average

- Provides credit monitoring and reports from all three bureaus

- Offers a Credit Simulator that lets you run various scenarios

- Offers up to $1 million insurance against the costs of recovering your identity

- Offers up to $1 million in reimbursement for stolen funds in some pricing tiers

- Excellent features related to monitoring and understanding your credit

- Has a well-designed dashboard

- Basic subscription tier offers a 30-day free trial period

- Lowest-priced tier offers outstanding ID monitoring features

- Mobile app also scans for malware and spyware on your smartphone

- Requires two-factor authentication

- Delivers on its ID monitoring promises

- Good collection of self-help and educational resources

Cons:

- No refund if you cancel before your subscription period expires

- Must agree to auto renewal process

- Some information about the service is difficult to track down

- The automatic log-out security feature is very aggressive

- When running in a browser, the service may have a lag as you click on buttons

- No credit reports or credit score available in lower-priced tier

- May not handle complex financial situations as well as others

- Some people report glitches in relation to receiving alerts in the mobile app

IdentityForce: Our final verdict

My hands-on review of IdentityForce shows an ID theft protection service that delivers on its promises of alerting you to any oddities with your personal information on the internet. Through these alerts, IdentityForce suggests changes you can make to your personal information, usernames, or passwords to try to avoid becoming a victim of identity theft.

For those who want identity theft protection services, IdentityForce will deliver the basics in an easy-to-use format. Its dashboard is well-designed and simplifies finding the exact feature you want.

One area where IdentityForce stands out from the crowd is through its outstanding credit monitoring services. If you want to learn more about your credit score and credit report, IdentityForce – in its higher-priced subscription tier – gives you access to all three credit bureaus. IdentityForce is a brand from TransUnion, one of the three credit bureaus, but it still gives you access to all three bureaus, which is a nice feature.

You will receive alerts about odd occurrences with your personal information in email, inside the dashboard, and in the mobile app. These alerts give you advice on how to proceed to protect yourself.

Should you suffer identity theft, IdentityForce matches the industry standard by offering $1 million of insurance to help you cover the costs of restoring your identity.

For its price point, IdentityForce provides more features than you will receive with more well-known (and more expensive) ID theft protection services. You may not be as familiar with the IdentityForce brand as with some others like LifeLock, but because IdentityForce has the backing of TransUnion, it is a trustworthy option.

Bottom line: I like the number of features you receive for the price with IdentityForce. Its newly designed dashboard is easy enough to use, and it delivers on its promises to give you alerts when it finds oddities in the way your personal information appears on the internet. The credit tracking and credit report features found with the upper pricing tier in IdentityForce are outstanding, and I like that you receive information from all three credit bureaus. IdentityForce’s biggest weakness is that it may not serve you as well if you have a complex financial situation. However, for the basics, it’s a very strong contender versus other identity theft protection services.

Our testing methodology for identity theft protection

When I am testing the best identity theft protection services, I know the importance of hands-on testing methods. Sure, I could simply read through the marketing materials from these companies and come up with a recommendation for you. However, marketing claims and real-world results often are quite different. I want to be able to give you the most accurate assessment of ID theft protection services, and hands-on testing is the best way to do this.

For starters, I want to use the ID theft protection service in a manner as similar to what you would do as possible. I enter my personal information and account information, seeking to generate alerts. When working through the features of these ID theft protection software packages, I also want to give you an idea of how easy they are to use and whether their features are actually useful for you.

I test customer service and technical service responses as well. When you need help from these ID theft protection services, you want to be confident that someone will pick up the phone on the other end and give you the answers you need.

As mentioned earlier, for my hands-on IdentityForce review, I paid for a subscription and entered my personal information. I did not use a demonstration account or a fake account that the company set up for me. This is the same type of account that you would be using.

FAQs

Is IdentityForce worth the money?

IdentityForce has one of the most reasonable price points among all the identity theft protection services. Additionally, it gives subscribers credit reports and credit scores from all three credit bureaus, which is a great feature. However, I cannot tell you whether it is worth the money for you. You will have to decide whether IdentityForce’s cost fits your budget and whether its features fit your personal situation.

Can I trust IdentityForce?

IdentityForce began operation in 2006, so it has a lengthy track record. Additionally, IdentityForce is a TransUnion brand, meaning users have the backing of one of the three primary US credit bureaus.

How easy is IdentityForce to use?

Signing up for IdentityForce only requires a few minutes. You don’t have to enter all your account information at the time of signup to begin using IdentityForce immediately. You can enter more information later, if desired. The service’s dashboard layout looks great after a redesign, and you can find the features you want to use quickly.

Is IdentityForce customer service any good?

IdentityForce recently began offering 24/7 customer service via telephone. You also can contact customer service via chat or email. During my testing of IdentityForce for this review, I found that the customer service team answered the phone within a few minutes almost every time.

Is IdentityForce better than LifeLock?

In my IdentityForce vs LifeLock review comparison, I selected IdentityForce as the better choice, primarily because of its lower price and strong feature set. IdentityForce offers more features than LifeLock at comparable price points. LifeLock does offer a very tempting first-year discount to new subscribers, but the significant price increase in year two and beyond gives IdentityForce the edge.

Should I get ID theft protection?

It is not possible for me to give you an iron-clad recommendation about subscribing to an identity theft protection service. This must be a decision each person makes individually, based on the situation you are facing.

Through obtaining credit reports and keeping a close eye on your various financial accounts, you often can duplicate the services that an ID theft protection service provides. Additionally, you can protect your identity by being careful about the types of information you share on the internet and by freezing your credit report during times when you know you will not be applying for loans.

Understandably, though, many people don’t have the time or desire to monitor their personal information regularly. Rather than trying to do the work themselves, they may feel more comfortable paying an ID theft protection service to take on this job for them. Additionally, these services offer reimbursement of expenses if you suffer a loss of your identity, which gives you peace of mind.

Certain types of people may receive a greater level of benefit than others from an identity theft protection service subscription. For example, if you suffered from identity theft in the past, you are more likely to become a victim again than the average person. Having an ID theft protection service on your side may help you catch an oddity earlier than you can do on your own.

Senior citizens and children don’t use credit as often as the average working adult. Consequently, older people and younger people (or, more likely, their parents) don’t check credit reports as often as working adults. The identity theft protection service can help people who don’t normally keep a close eye on their credit reports and credit score.

Understand that when you subscribe to an ID theft protection service, you will be opening yourself up to receiving frequent marketing emails. For some people, this is a highly annoying aspect of these services.

Additionally, you may receive false alerts from the service or alerts for items that are not actually serious threats to your personal information. Always read any alert you receive carefully, so you can be certain you understand it and you understand the steps you need to take.

I must mention that some people have the wrong idea about what identity theft protection services do. These services do not guarantee that you will never be the victim of identity theft. Instead, they search the internet for situations that show your personal information is in danger or has some oddities associated with it. You then need to take the steps to try to protect your information.

Along those same lines, should you suffer identity theft, the service does not restore your identity for you. The service will provide help with restoring your identity, but you will need to execute the plan, and you likely will need to hire attorneys or private investigators to help. (The ID theft protection service should reimburse you for expenses related to restoring your identity through its insurance policy.)

As another potential drawback, canceling the service can be a challenge. Nearly all ID theft protection services require you to agree to an auto renewal payment system at signup, so you will continue to receive charges until you take the steps to cancel. The identity theft protection service may make it challenging to cancel.

Ultimately, identity theft protection services are not perfect. These services are not cheap either, so you will want to carefully consider whether the cost fits in your monthly budget. However, because protecting your identity in a digital world is so important, they do provide a helpful service that is worth considering.

Perhaps the best advice I can give is to approach these services with a bit of skepticism. When you are reading marketing materials related to ID theft protection services, don’t assume they will live up to all their promises. Keep an open mind about how these services will help your particular situation and make sure you understand how they actually work. You then will be able to make a smarter choice about whether to subscribe.

All Identity Force reviews

All Star Identity Force reviews

All Identity Force positive reviews

All Identity Force critical reviews

All related Identity Force reviews

See all reviewsI inadvertently was signed up for identity force when I was trying to sign up for PAGE insurance. Once my credit card information was in on what appeared to be the PAGE website, all of a sudden I got an email from Identify Force saying I was signed up with them. I didn’t knowingly sign up for Identity Force. I’ve been trying to cancel for 6 months. I finally got it cancelled but they wont refund the money and are now blaming PAGE insurance for this. The lady on the phone said I should talk to them because it is their fault they provided Identity Force’s information. This makes no sense to me. Then I found out I hadn’t even signed up for PAGE insurance, I actually signed up for Identity Force only. So I had to sign up with PAGE separately. Now I get all these emails about how identity force has been checking my credit score/report and stuff like that, which I don’t want. When I tried to cancel the first few times it said something was wrong with my account. When I called, they couldn’t find me, yet I was being charged on my credit card every month. Identity Force was very defensive when I finally got to speak to someone about this. The way I was signed up for this was deceptive and sneaky. Identify Force is refusing to refund the $14/month for the past 6 months they have been charging me and have access to my personal information. This is not ok.

I have been with Identity Force for a year and it has been a problem the whole time. I do not hear from them when there are transactions done on my accts at the bank and I should. I have spoken to them about this several times and have gotten different responses . It might be time to look at Lifelock.

In the Identity Force review you make several incorrect references to Identity Guard. Please correct these typos as it makes the review very confusing. Best practice is to always QC your website text before you publish. 😉

I spent $359 to sign up for the UltraSecure+Credit Family Plan. Their marketing states this covers two adults and unlimited children 25 years and younger. When I went to add my children, I discovered they ONLY monitor the kid’s social security numbers and DO NOT provide any of the other services under this plan (credit cards, bank accounts, driver’s license, etc.). I’m so disappointed because I thought my entire family would receive the same coverage under the “Family Plan”. I confirmed this with their customer service rep over the phone when I tried to add my kids to the plan. People should understand IdentityForce advertising is misleading and your children will NOT receive all of the protection the plan was supposed to offer. At a minimum, they should have indicated that children get only minimal protection on the family plan (and not wait until parents get signed up and pay before they realize the minimal coverage for kids). Now my choice is to pay another $199/year for EACH of my three kids if I want them to have the same coverage my wife and I have. That would be $956 for a family of five. I feel like they pulled a bait and switch on me.

in the identity force review you had several references to identity guard. can you edit the review?