If you want a service that monitors your home title for potential theft or fraud, Home Title Lock is an option. This service only focuses on home titles and deed fraud, rather than on other aspects of identity theft. This focused approach may appeal to you more than a full-fledged ID theft protection service.

Home Title Lock is definitely easy to use. It doesn’t contain complexities, and it doesn’t require much of your time to use it. So if you want a simple way to keep an eye on the deed to your home or property, a subscription to Home Title Lock is worth considering. Although we include Home Title Lock in our category of identity theft protection services, it doesn’t offer the same features as those services.

In my hands-on review of Home Title Lock, I put all the features of this service through the paces. My Home Title Lock review will measure whether this service lives up to the promises that it makes to subscribers. I will use the review to answer some of the most common questions people have about Home Title Lock, including:

- Is Home Title Lock worth the money?

- Is Home Title Lock an identity theft protection service?

- Is Home Title Lock a legitimate company?

- Can hackers steal your home title if you have Home Title Lock?

- Is Home Title Lock better than LifeLock?

If you are looking for identity theft protection, Home Title Lock is going to be too simplistic for you. This service only focuses on monitoring the title to your home or property, looking for signs of potential deed fraud or title theft. It does not monitor your credit report or look for oddities related to how your personally identifying information appears on the internet. It’s tough for me to make a full recommendation that you should subscribe to Home Title Lock because of its limitations. Even if you believe deed fraud could affect you, the steep price for Home Title Lock is tough to ignore. Many ID theft protection services monitor your home title and similar items to try to protect you from fraud and have similar prices point to Home Title Lock. I don’t believe Home Title Lock offers enough features for what it charges.

Summary of benefits: Home Title Lock

| No value | Home Title Lock |

| Website | https://hometitlelock.com/ | Free trial | 24/7 customer service | Identity theft insurance | Discount with annual billing | First-year subscription discount | Home title monitoring | Credit reports | Credit score |

|---|---|

| Best deal (per month) | $19.95 Get 10% off your first payment with an annual plan |

Home Title Lock: Hands-on review

Although Home Title Lock has a few similarities to identity theft protection services, it is far less extensive in the services it offers. Even though we categorize Home Title Lock under identity theft protection, it is important to note up front that they are different types of services.

If you want a service that monitors your identity and your credit reports, you do not want to subscribe to Home Title Lock. You will want to look at a more robust identity theft protection service.

With that information in hand, let’s focus on what Home Title Lock does. Home Title Lock monitors your home title for potential deed fraud.

You enter the address of your property – usually your home – into the Home Title Lock software at the time you subscribe. The service then begins monitoring that property for any oddities that could indicate fraud.

If Home Title Lock finds signs of fraud related to your home title, it will generate an alert via email. It also displays alerts on the website dashboard. You then need to decide whether you think the alert indicates someone stole the title to your home or property. If so, you can contact Home Title Lock for help with restoring ownership of your home title.

And that’s it. Home Title Lock does not provide any extra services. It does not monitor your identity for anything else. Considering you are paying nearly $20 per month for Home Title Lock, it’s difficult for me to recommend subscribing to this service. It just doesn’t have enough features to justify that kind of price tag.

For comparison, consider that you will pay roughly $25 per month for one of our top-rated identity theft protection services in Identity Guard. And for that price, it offers home title monitoring alongside the dozens of other items and features.

It’s tough to recommend Home Title Lock when you receive all the extra services of a true identity theft protection service – plus home title monitoring – for just a few dollars a month more with a service like Identity Guard.

To be fair, Home Title Lock excels at what it promises to do. If you only want home title monitoring and nothing else, Home Title Lock is definitely worth a look. Unfortunately, that simply isn’t enough for me to give it a high recommendation to a typical user.

Before breaking down exactly how Home Title Lock works, I want to discuss my review process. To create my hands-on review of Home Title Lock, I subscribed to the service myself, and I entered my actual information. When reviewing these types of services, I believe it’s important to use the service in a manner that is as close as possible to how you would use it.

I did not request to receive a free demonstration account, as this sometimes can create false narratives regarding the service. Using actual data tends to deliver the most realistic look at how the service performs.

I subscribed to the monthly price tier of Home Title Lock, paying $19.95 per month.

Home Title Lock features and insurance

Home Title Lock only has features aimed at protecting your home title from potential theft. This is not a traditional ID theft protection service, although its design and operation are somewhat similar to ID theft services.

Insurance and compensation

Home Title Lock does not offer any insurance to help you with costs related to trying to correct the information on your home title, should you suffer a theft or become the victim of deed fraud. For comparison, identity theft protection services often offer a $1 million insurance policy to help you with the costs of recovering your identity.

Despite not being eligible for an insurance payout, when you are a Home Title Lock subscriber, you do receive access to an expert who will work with you to try to restore your home title’s information.

Activity alerts

Home Title Lock displays any alerts related to your home title on the dashboard. You can see more detail by clicking My Alerts across the top of the page.

It took about 24 hours after I signed up for Home Title Lock to return alerts related to my property. It found five alerts, all of which were related to minor items that I expected it to find. It had alerts related to the sale of the property, to loans against the property, and similar items. None of the alerts on my property were related to potential deed fraud.

Within each alert, you can mark it as read or you can delete it. Until you choose to take an action with it, it will continue to show up on your list on the dashboard.

The My Alerts page has an Add a New Property button. Understand that if you choose to add a new property, you will need to pay for another subscription. So if you subscribe to the annual plan at $199 for your first property, you will receive a separate $199 charge for each property you subsequently add to the database.

This additional charge is not entirely clear when you are adding the property. Additionally, because the service saves your credit card information from your first property, you don’t have to enter your credit card again to add another property. This can cause some confusion about whether you are receiving a new charge for the additional property.

Most ID theft protection services allow you to track multiple items for one price, such as multiple credit cards or bank accounts. However, with Home Title Lock, each property requires a separate payment.

Dark web monitoring

Home Title Lock does not do dark web monitoring, as it is not a full-fledged ID theft protection service. It only monitors the status of your property title with your local government agencies.

Free report and monitoring

Where ID theft protection services often offer a free credit report for you, as well as credit score tracking, Home Title Lock focuses on your home title.

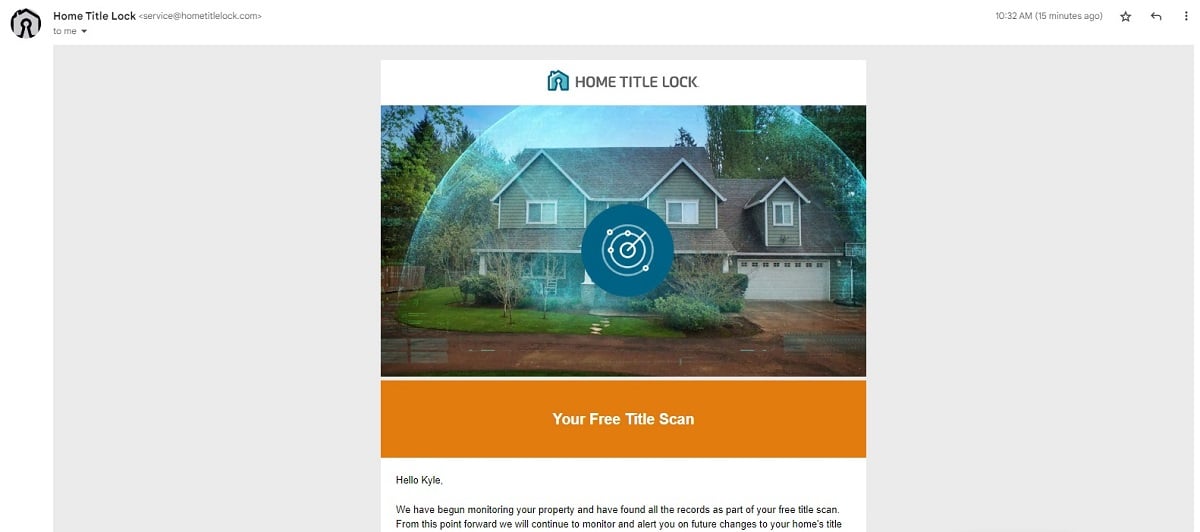

As part of your signup process, you receive Home Title Lock’s Comprehensive Title Report. Notification of it arrives via email about 24 hours after you sign up for the service. You then can access the information through the Home Title Lock dashboard.

To be fair, it isn’t really a “report” about your property. Instead, it is a list of the items found related to your property that generated the alerts I discussed earlier.

Home title monitoring

Your home’s title is part of the public record with your local government. Should a thief obtain some of your personal information, they might be able to file a new form with the local government and obtain control of your home title. The thief theoretically then could obtain loans against the home that could affect your credit score or that banks may expect you to repay.

Home Title Lock monitors your home title information and any loans listed with the property address you entered during signup. Should the service notice any oddities associated with the title to the property, it will generate an alert.

Home title restoration

Once you subscribe to Home Title Lock, you have access to a home title restoration expert if you believe a thief may have obtained your home title. Home Title Lock promises that this expert is based in the United States.

Home Title Lock recommends that you reach out to the service by phone as quickly as possible after discovering an alert that may indicate home title theft. The experts then can begin helping you attempt to recover control of your title.

In the Home Title Lock terms of service, the company does say that if the issue with your home title relates to a family relative making changes to the title, Home Title Lock probably cannot help.

It’s also important to note that Home Title Lock has no legal standing regarding your home title, so the company cannot take over the process for you. You, as the property’s legal owner, must take the steps yourself, although Home Title Lock can provide advice.

Additionally, there is no guarantee that the company can fix your problem. It can only help you take certain steps that have worked in the past to help people try to recover control of their home titles.

You could end up needing to hire an attorney or other professionals to work through the issues related to your home title. Home Title Lock does not provide insurance (like full-fledged identity theft protection services do), so any costs for attorneys are your responsibility. Ideally, though, Home Title Lock will be able to help you recover your home title without you needing to hire an attorney.

Finally, some alerts that Home Title Lock generates related to oddities with your home title could occur because of an improper filing from your local governmental entity. This situation would not mean your home title is in jeopardy, but Home Title Lock still may generate a false alert. You may have to contact your local government to rectify this situation.

2FA login

Home Title Lock does not offer two-factor authentication to protect your account if your password is compromised.

Signup

Home Title Lock provides a quick signup process. Although it does not have a free trial period option, you do receive a money-back guarantee during your first 14 days of subscribing.

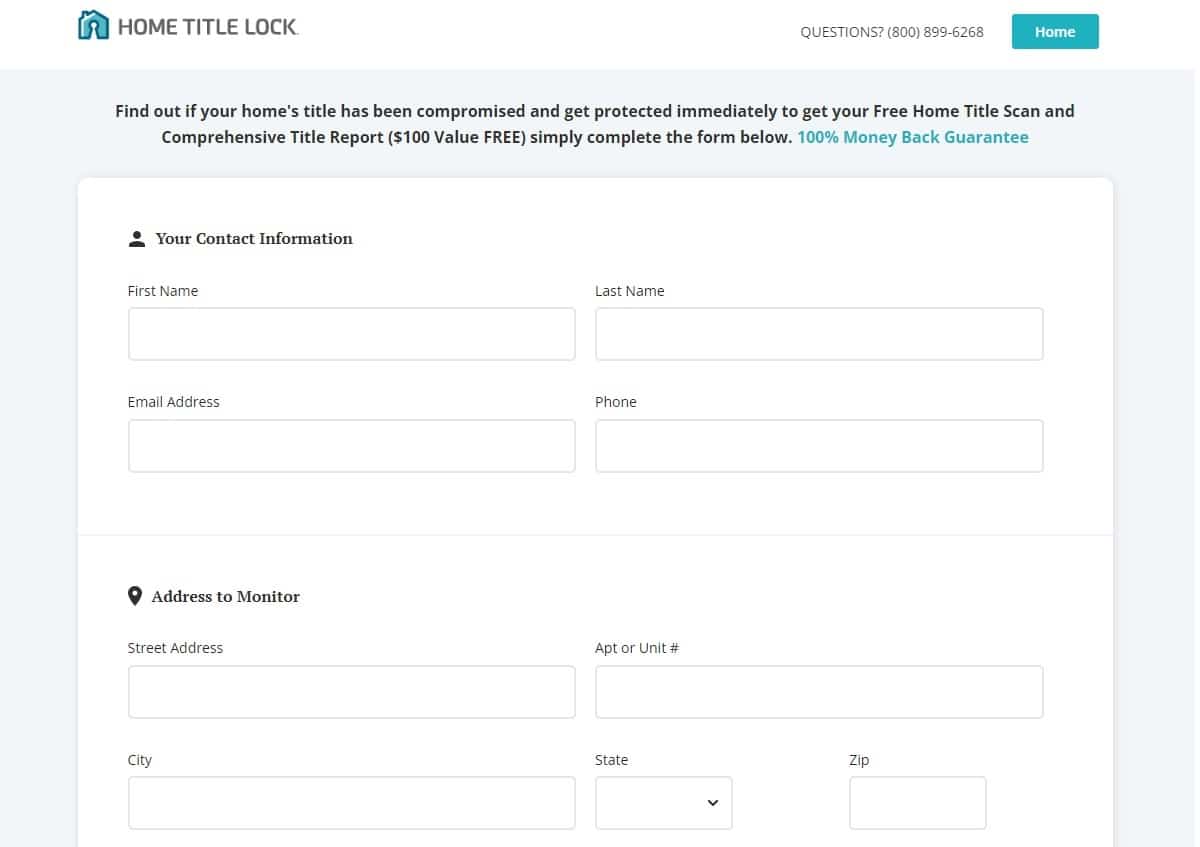

Click Sign Up in the upper left corner of the Home Title Lock home page. You then enter some personal information, including:

- Name

- Email address

- Phone number

- Address of property you want to monitor

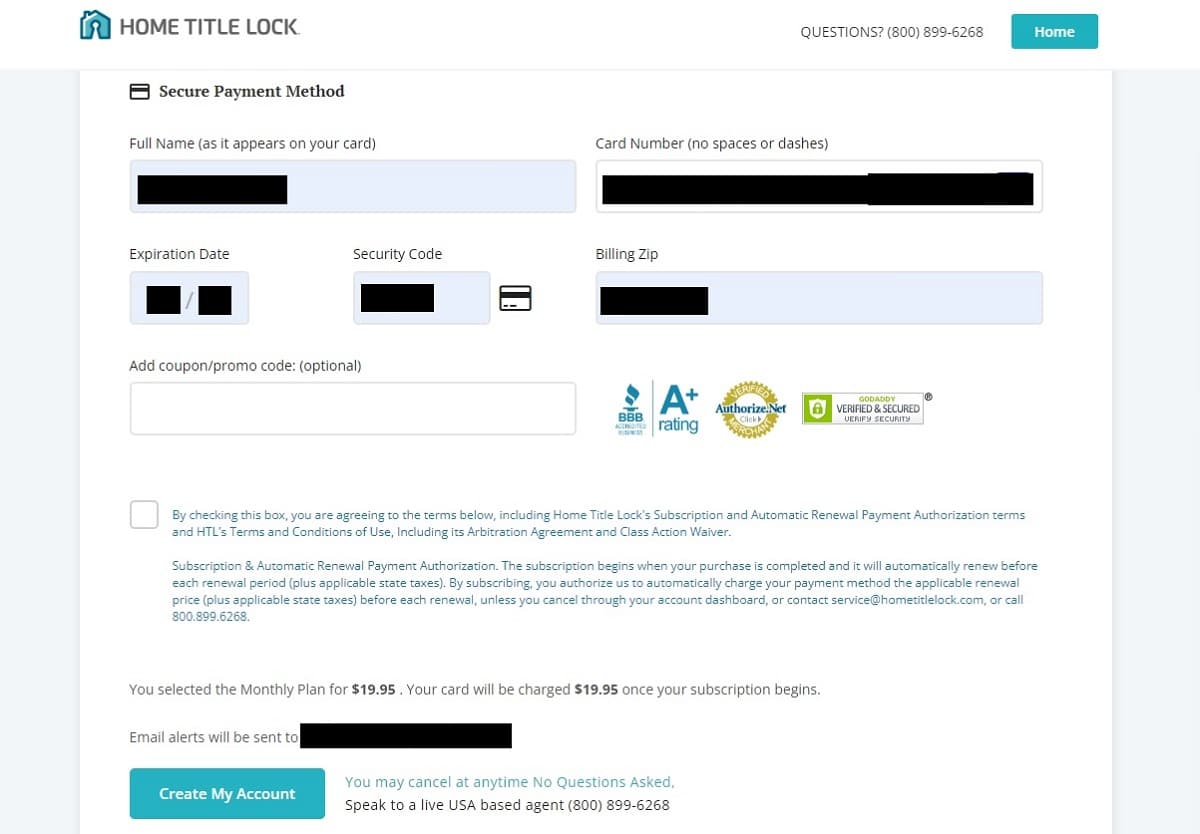

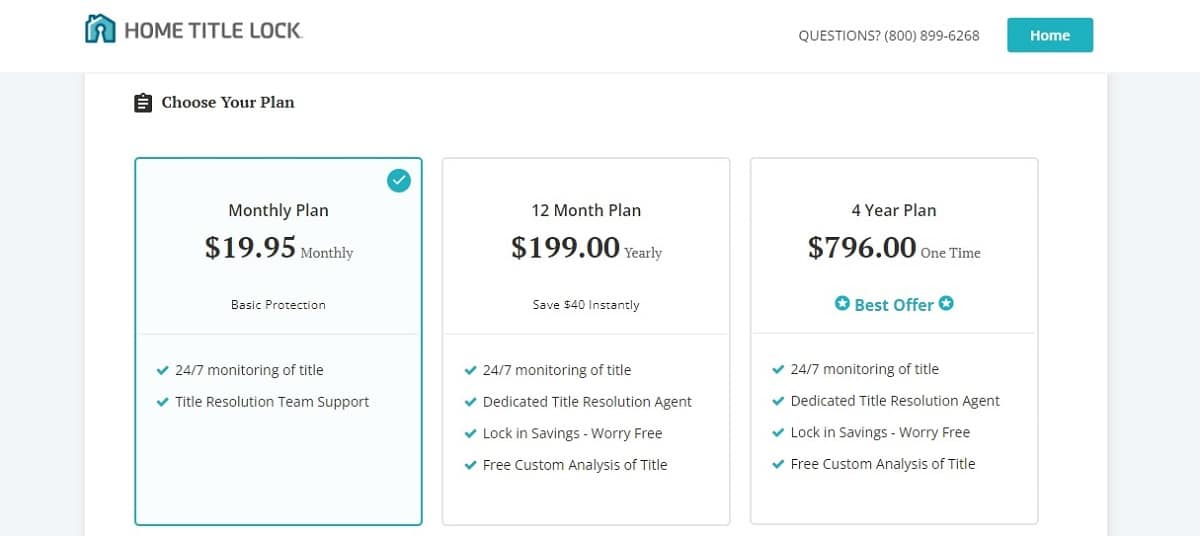

As you scroll down the page, you’ll see the three payment plans that Home Title Lock offers. Just click on the plan you want to use, and you’ll see a blue checkmark appear next to it. (We’ll discuss the pricing options later.)

Then enter the information for your payment method. I always recommend using a credit card for these types of services, just in case you have a dispute about payments at any time. Credit card companies will help with disputes more than your bank will if you sign up using a debit card.

You must click and activate the checkbox that indicates you are agreeing to the terms and conditions for the service. I would recommend reading the Home Title Lock Terms and Conditions of Use document and the Home Title Lock Privacy and Security Policy document. These documents will contain the latest information about exactly what legal obligations you are agreeing to with your subscription.

Toward the bottom of the page, you’ll see the payment amount you are agreeing to and the email address where you will receive any alerts. Verify this information is correct. Then click Create My Account, and Home Title Lock will create your account.

I do appreciate that Home Title Lock includes a phone number in multiple locations on the signup page, just in case you have questions. Home Title Lock’s signup process was one of the easiest I’ve found during my reviews of various theft protection services.

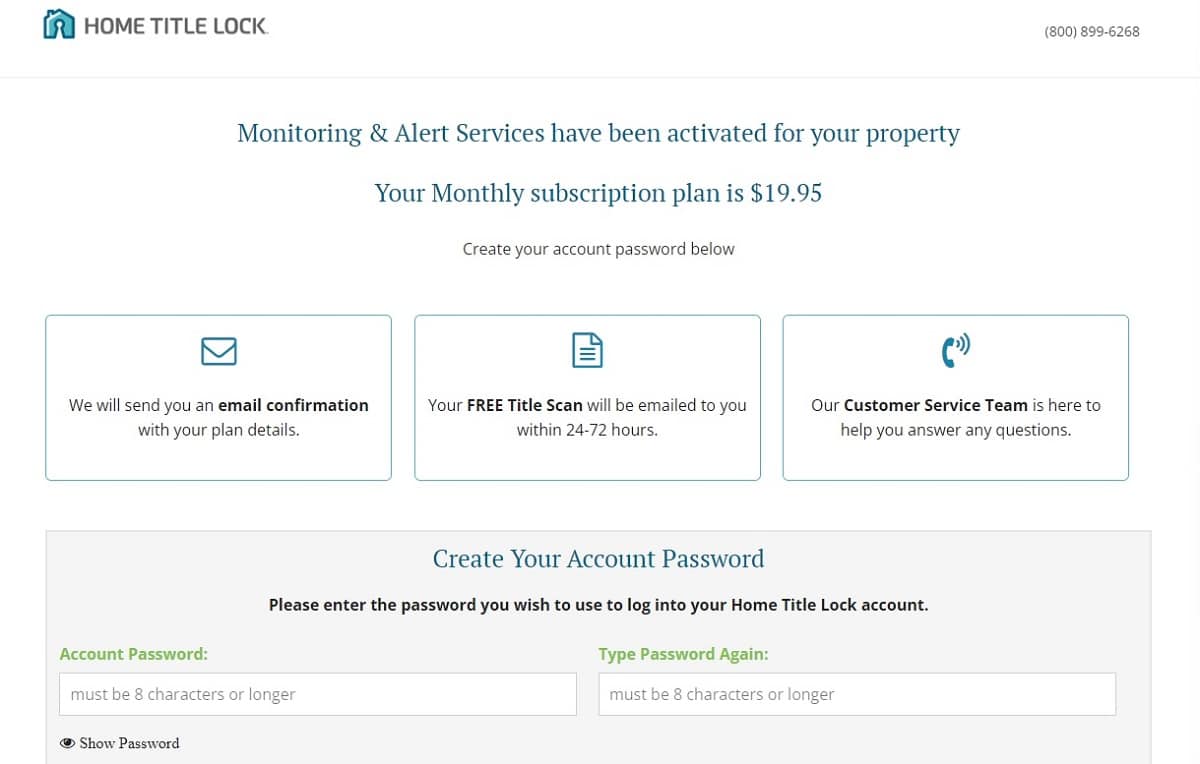

Setup

After you create your account in the previous step, Home Title Lock will open a new screen where you can create a password. The password must be at least eight characters.

Once you have a password selected, click Login to open the dashboard.

Underneath the Login button on this page, you’ll see a disclaimer about adding the Home Title Lock email address to your approved email addresses. Some email service providers may sort emails from Home Title Lock into your spam folder, so watch for this potential issue.

Login process

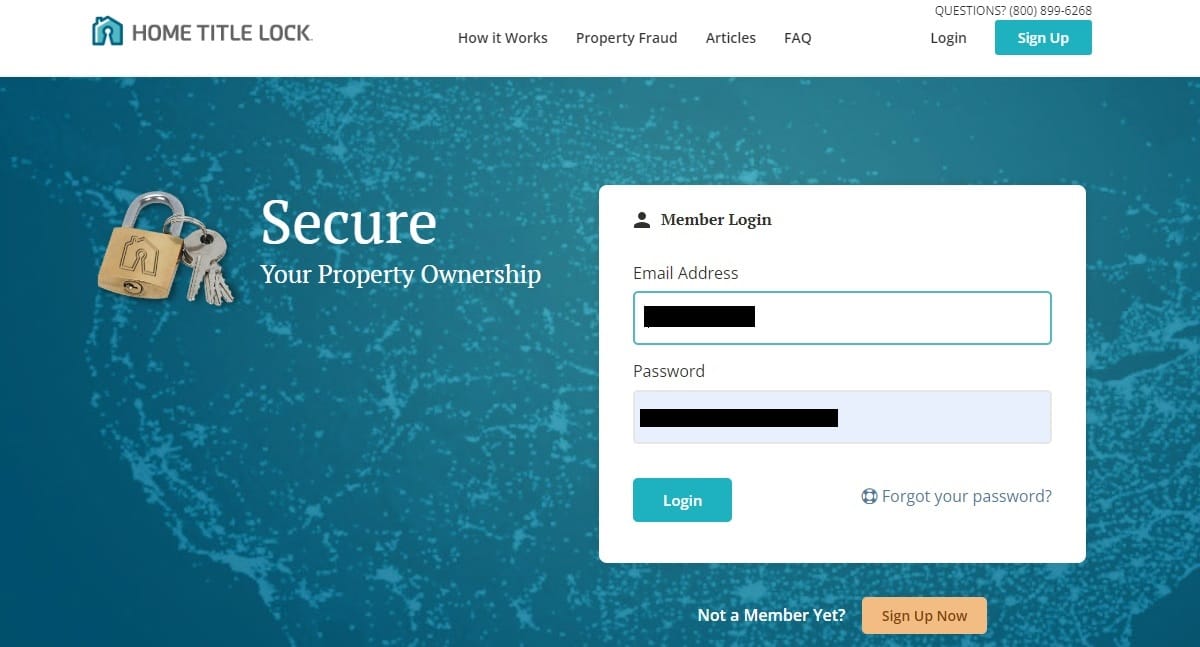

If you ever end up logged out of your Home Title Lock account, you can log in again by reopening the dashboard page. You also can go to the Home Title Lock home page and click Login in the upper right corner.

At the Login page, enter your email address and password. Then click the Login button.

Home Title Lock does not log you out of the service automatically after a certain amount of time of inactivity. It also does not log you out when you close the web browser. I didn’t log out after one session, closed my web browser, and I was still logged in two days later when I jumped directly to the dashboard in my browser.

If you forget to log out of the service after using it, and if someone else uses your computer later, it would be pretty easy for that person to access your account and to see your personal information stored in the account.

Certainly, Home Title Lock doesn’t collect as much of your sensitive personal information as an ID theft protection service would collect, so not having an auto logout process isn’t as dangerous as it could be for you and your personal information. But it is a little odd that Home Title Lock does not have an automatic logout feature after a period of inactivity.

Ease of use and design

Home Title Lock is extremely easy to use. Because the service only focuses on monitoring your home title, you don’t have to enter any extra information (beyond what you entered at the time of signup) to use your subscription. This differs significantly from full ID theft protection services, which require users to enter a lot of extra information after signing up to take advantage of all the service’s features.

Just click on any of the menus along the top of the Home Title Lock screen to access various features. There are only a few options, including:

- Account details

- View property information

- Add a property

- View unread alerts

- View all alerts

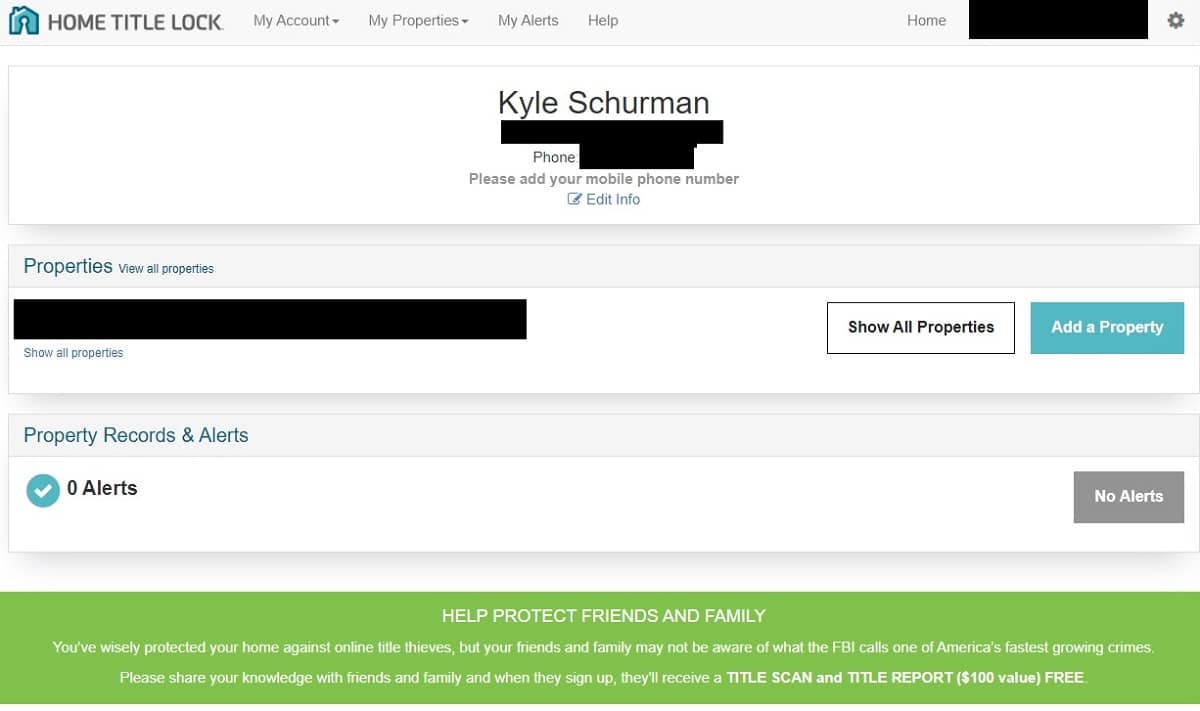

Dashboard

The dashboard for Home Title Lock has a nice design, showing you the most important information. It also has menus across the top of the dashboard, so you can find the features of the service that you need quickly.

The dashboard displays the primary property that the service is monitoring. It also lists any alerts associated with the property.

In the middle of the dashboard, you’ll see an advertisement encouraging you to get friends and family to sign up for the service. You will find a couple of different ads spread throughout the screens on Home Title Lock. Regularly displaying advertisements like this doesn’t give me the feeling that the service is as professional as it could be.

The lower section of the dashboard page contains articles related to protecting yourself against home title theft.

To return to the dashboard from any other window, click Home Title Lock in the upper left corner of any page.

Mobile app

Home Title Lock does not offer a mobile app.

Customer support

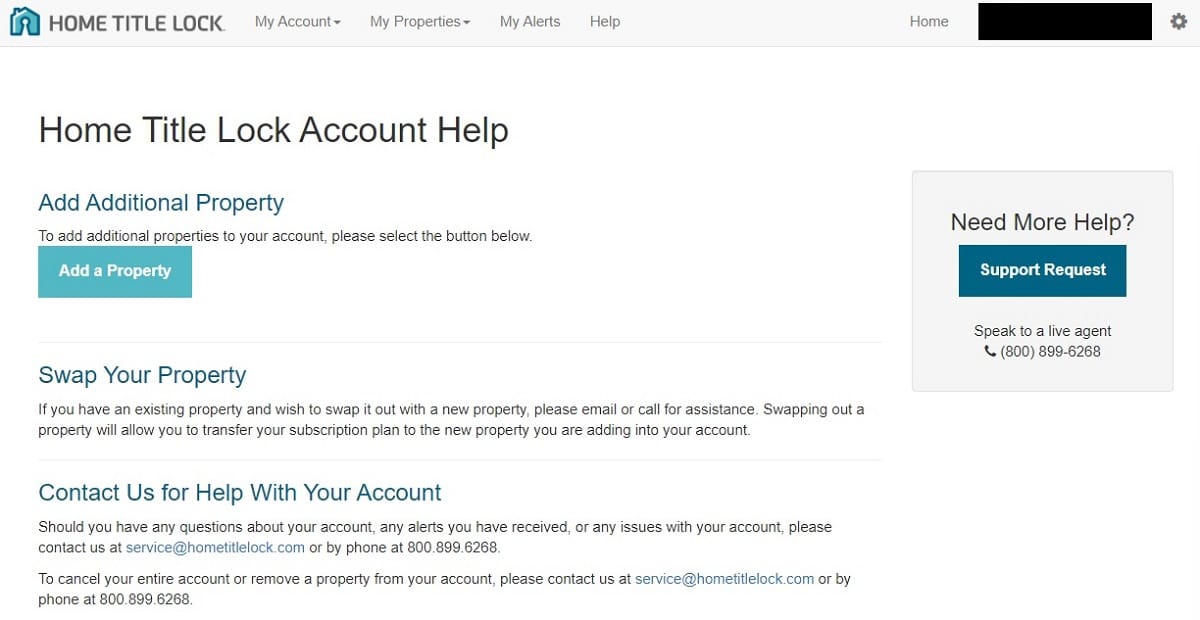

The easiest way to contact customer service for Home Title Lock is via telephone. Nearly every page of the Home Title Lock software displays the phone number somewhere.

Additionally, you can find contact information for Home Title Lock by clicking Help across the top of the dashboard. You can send an email to the address listed on the Help page. Click Support Request to fill out an online message form to send to the Home Title Lock customer service team for a response later.

I appreciate Home Title Lock’s customer service making it as easy as possible to find the contact information. This is not always the case with subscription services, especially identity theft protection services.

Unfortunately, Home Title Lock only offers limited customer service hours. You must call between 8 a.m. and 10 p.m. Eastern time Monday through Friday. Home Title Lock does not list its customer service hours anywhere on its website or within the software after you subscribe. I was able to track down the customer service hours while making test telephone calls to customer service to determine its level of responsiveness.

If you run into an issue while using the service, the Home Title Lock dashboard does not post self-help documents, which is unfortunate. Consequently, if you have a service problem, you’ll have a hard time fixing it without contacting customer service.

The dashboard does not offer a full list of informational articles nor an FAQ about the Home Title Lock service. To access those items, you need to return to the Home Title Lock home page.

Home Title Lock: Pricing

| No value | Home Title Lock |

| Website | https://hometitlelock.com/ | Subscription periods | Monthly or annually | Special offer | Price per month | $19.95 | Lowest annual price | $199 | 4-year pricing plan | $796 | Money-back guarantee | 14 days |

|---|---|

| Best deal (per month) | $19.95 Get 10% off your first payment with an annual plan |

Home Title Lock’s pricing plans are extremely basic. Each pricing tier covers one address for tracking. If you want to track a second address, you have to pay for a second subscription. It doesn’t matter how many people use the account, because Home Title Lock only charges by the number of properties.

You can pay by the month or for an entire year up front. You save about $40 over the course of the year if you choose to pay annually instead of month by month.

Home Title Lock also offers the option of paying for four years up front. You don’t save any money versus the annual payment plan, but you can lock in the price now, which guards against any price increases over the four-year period.

With Home Title Lock’s 14-day money-back guarantee, you can cancel the service within 14 days after signing up and receive a refund of your purchase with any of the pricing tiers.

Auto renewal options

When signing up for Home Title Lock, you must agree to the service’s automatic renewal process. Home Title Lock will automatically charge the payment method you used at signup at the time of renewal. You don’t have to do anything to renew your subscription, as the process is automatic.

If you want to cancel, you need to do so before the renewal date, or you will be charged.

If you cancel the service in the middle of a month as a subscriber to the annual or four-year plan, Home Title Lock promises to charge you for the remainder of that month and then refund the prorated amount for the remainder of your subscription term, which is actually a good deal. Some subscription services would stick you with the full charge for the remainder of your subscription term.

How do I cancel Home Title Lock?

You cannot cancel Home Title Lock online through your account. You must call the customer service phone number on the dashboard.

Fortunately, the cancellation process was stress free and fast. It was far easier than I expected, especially since Home Title Lock does not allow online cancellations. After calling and working through the selection menu, I was able to speak to a customer service rep within a couple minutes.

The customer service rep asked me why I wanted to cancel and offered me a free month to stick with the service. After I confirmed my desire to cancel, the rep pushed the cancellation through. The entire process took less than three minutes. I received an email confirmation within the hour.

Pros and cons of Home Title Lock

Pros:

- Signup process is easy

- 14-day money-back guarantee

- Saves money with an annual plan over a monthly plan

- Dashboard has a clean design

- Customer service phone number displayed on every page

- Provides alerts whenever monitoring of your home’s title shows an oddity

- Generates fewer marketing emails after you sign up for the service versus most ID theft protection services

Cons:

- Home Title Lock only focuses on home titles, not on other aspects of identity theft

- Price is pretty high for only monitoring your home title

- Requires at least 24 hours to begin seeing alerts related to your property

- No self-help documents

- No live chat with customer service

- Does not offer 24/7 customer service

- Advertisements on the dashboard

- Must purchase an extra subscription to add another property

- No insurance coverage to help with costs for restoring the home title

- Website marketing seems to focus on scare tactics

Our final verdict

I’ve written several reviews of ID theft protection services, and I feel like I have a pretty good handle on the market. So when I decided to write a hands-on review for Home Title Lock, I initially planned to approach it from the same perspective.

However, that plan didn’t last long. Home Title Lock is definitely not an identity theft protection service. It is a far simpler option, as it only monitors the title to your home or piece of property. This is far different from an identity theft protection service, which attempts to monitor all aspects of your financial life, looking for potential signs of fraud.

Even understanding that, perhaps my biggest disappointment is that Home Title Lock does not offer you any financial insurance if you happen to suffer a theft of your home’s deed. Having access to insurance is a key benefit of signing up for ID theft protection services, as the majority of them offer up to $1 million of insurance to help you pay for attempting to restore your identity.

If you believe that someone has stolen your home’s title, Home Title Lock will help you by assigning a U.S.-based home title restoration expert to your case. However, if you end up needing to hire an attorney or if you must miss work to try to deal with this situation, all the expenses are on you.

On the plus side, because Home Title Lock only deals with potential deed fraud or title theft, you don’t need to spend a lot of time using the service. You enter all the information Home Title Lock needs to monitor your home title during the quick signup process, and that’s all it takes. You then sit back and wait for Home Title Lock to generate any alerts for your account.

During my test, I found that Home Title Lock did a solid job with providing the features that it promised to provide. The service runs smoothly, and you don’t have to spend a lot of time manually working with it.

However, if you are looking for more features than the basics that Home Title Lock provides, you will need to look elsewhere. Home Title Lock does not have an option for adding other features related to identity theft protection.

The Home Title Lock interface is easy to use. I especially like how the service places the customer service phone number on nearly every screen. During my testing, I found the customer service team to be helpful and quick to respond to telephone calls. (It’s unfortunate that Home Title Lock doesn’t offer around-the-clock customer service via telephone or live chat, though.)

Home Title Lock does not try to confuse you with multiple pricing tiers. There’s only one tier, but you can choose to pay monthly or annually.

However, I found a few red flags with Home Title Lock’s interface that gave me pause about its level of professionalism.

- Although the customer service phone number is readily visible, the service does not list its customer service hours of operation anywhere within the software.

- Home Title Lock uses advertisements during signup and again on the dashboard, which is not something I want to see from a service that should be focused on protecting my information.

- You cannot cancel Home Title Lock through the software; you must call the customer service telephone number.

- Home Title Lock displays an Add a Property button on several of its pages, but it doesn’t clearly explain that adding a property allows the service to charge your credit card again for a new subscription.

- The Home Title Lock webpage uses quite a few “scare” tactics to try to convince you to sign up for the service. It seems to overemphasize the threat of deed fraud.

Bottom line: Home Title Lock does a good job at performing the service it promises to provide. However, when you are paying roughly $20 per month for a single service like this, it doesn’t feel like you are receiving a good value. You typically can receive full access to an identity theft protection service for just a few more dollars per month, and many of those ID theft companies also monitor the status of your home title for you. Additionally, ID theft protection services offer insurance to help you with expenses if you are a victim, but Home Title Lock does not. If you only want monitoring of the title for your home, and if you want an extremely easy product to use, Home Title Lock may serve you well. However, I believe there are better options out there.

Our testing methodology for theft protection services

When reviewing the best identity theft protection services and home title protection services, I believe strongly in actually using these services myself. I don’t feel like I can make recommendations about these services unless I use them in a manner that is similar to how you would use them.

I enter my own information into these services while testing them. I believe this is another very important aspect of creating a realistic situation during testing. Using data that the service provides to me could result in certain outcomes that may make the service appear to be operating more successfully than it actually does with a customer’s real data.

By using my own data and my own credit card, I also can give you first-hand advice about whether the service is easy to cancel, should you ever decide to try to cancel it yourself.

During my testing, I measure the responsiveness of the customer service team a few different times. Ultimately, I want to make sure that the service itself and the customer service team live up to the promises they make in marketing materials. Hopefully, my first-hand account of how the service works in a real-world setting can help you decide whether you want to subscribe.

FAQs

Is Home Title Lock worth the money?

Home Title Lock’s subscription prices are pretty high, considering that it only offers one service. Several identity theft protection services only cost a little more than Home Title Lock, and many of them offer home title protection and monitoring along with dozens of other services.

Is Home Title Lock an identity theft protection service?

Although an ID theft protection service may offer home title protection for you, just like Home Title Lock, the opposite is not true. Home Title Lock does not offer additional services and features aimed at protecting your identity and personal information.

Is Home Title Lock a legitimate company?

Yes, Home Title Lock is an actual company that offers the Home Title Lock subscription service. The service is legitimate, too. Whether the service that Home Title Lock provides is something that most people need is debatable, though, as a quick internet search shows multiple opinion articles questioning the legitimacy of the need for deed fraud protection.

Can hackers steal your home title if you have Home Title Lock?

Potentially, if a hacker has access to enough of your personal information, the hacker could take control of your home title. The hacker then may try to obtain loans against the value of the home, basically stealing the equity in your home. Having a Home Title Lock subscription warns you of a potential home title theft, but it cannot fully protect you from such an occurrence.

Is Home Title Lock better than LifeLock?

In my comparison article of Home Title Lock vs. LifeLock, I gave LifeLock the clear advantage, as it provides far more services than Home Title Lock. However, it’s worth noting that Home Title Lock is not an identity theft protection service like LifeLock, and it doesn’t try to match the services that LifeLock provides.

Should I get ID theft protection or home title protection?

I don’t feel comfortable giving you an iron-clad recommendation on whether you should subscribe to one of these services. Whether you can benefit from a subscription really depends on what kind of risk you have for theft of your identity or of your home title. Each person’s circumstances are different.

Before you decide whether to subscribe, it’s important to note that many people have a misconception about what these services do. They do not give you 100% protection against the theft of your identity or your home deed. And, if you do become a victim of fraud, they do not “flip a switch” and automatically put things back to normal. It can take several weeks or months to try to fix the situation.

Although ID theft protection services and home title theft protection services both monitor your information, looking for oddities that could indicate a possible theft of your personal information, they cannot take the steps to prevent fraud for you. Instead, you have to take the steps to try to protect your information after an alert about a potential theft.

Should you suffer some sort of theft of your identity or of your home title, these services will assign a specialist to your case. This person will try to help you restore things back to normal. However, you may need to do quite a bit of the legwork yourself to fix the issue.

Additionally, these services may sometimes generate false alarms regarding potential fraud. It can be extremely frustrating to have to regularly investigate false alarms.

If you don’t want to spend the money for subscribing to a protection service, you often can duplicate many of the features these services provide by simply keeping a close eye on your personal information, on your credit report, and on your home title. Some people feel comfortable monitoring these items themselves, while others prefer to pay a theft protection service to do the job.

Before subscribing to one of these services, closely read the marketing materials, so you understand what you are receiving. Read any official legal documents, such as terms of service documents, so you also understand the nuts and bolts of the way each service operates. Pay attention to the subscription pricing and to any refund or money-back guarantees, so no costs catch you off guard.

If after reading all the information about these services you believe you would like to subscribe to one, read our ID theft protection service reviews to learn about the strengths and weaknesses of the individual brands that provide these subscription packages.