When you visit your local Costco big-box store, you’re probably looking for a deal on your favorite items. However, as Costco members know, this warehouse membership store offers quite a few perks for its members beyond bulk food and other household goods at low prices. One of those perks involves offering identity theft protection services.

The Costco Complete ID service has a very low price point compared to other ID protection services. So how does the Complete ID vs LifeLock comparison look? I will help you understand the key factors for both of these identity theft protection services, so you can make the most informed decision.

Don’t want to read the full comparison? LifeLock is the winner. LifeLock’s overall feature set and well-known brand name gives it the edge here, even though it is a close comparison. Costco Complete ID is basically the same identity theft protection service as Experian IdentityWorks, except Complete ID is only available to Costco members. For those who have a Costco membership, the cost of this service is so low that it may fit in your budget far better than the more expensive LifeLock. If so, Complete ID is a nice choice. However, for the most extensive list of features, LifeLock wins this comparison.

Summary of benefits: Complete ID vs LifeLock

| No value | Complete ID | LifeLock |

| Website | completeid.com | https://lifelock.com/ |

|---|---|---|

| Free trial | ||

| Average email response time | ||

| Identity theft insurance | Up to $1 million | Up to $1 million |

| Stolen funds reimbursement | Up to $1 million | Up to $1 million |

| Special offer | NA | $8.99 |

| Highest price per month | $23.99 | |

| Credit monitoring | ||

| Phone takeover monitoring | ||

| Crime in your name monitoring | ||

| Credit reports | ||

| Credit score | ||

| Best deal (per month) | $8.99 $8.99 per person per month | $8.99 GET 25% off the first year |

Complete ID vs LifeLock features

To make it easier for you to compare Complete ID and LifeLock, I will break down the main features each service offers and how they compare to each other.

Activity alerts

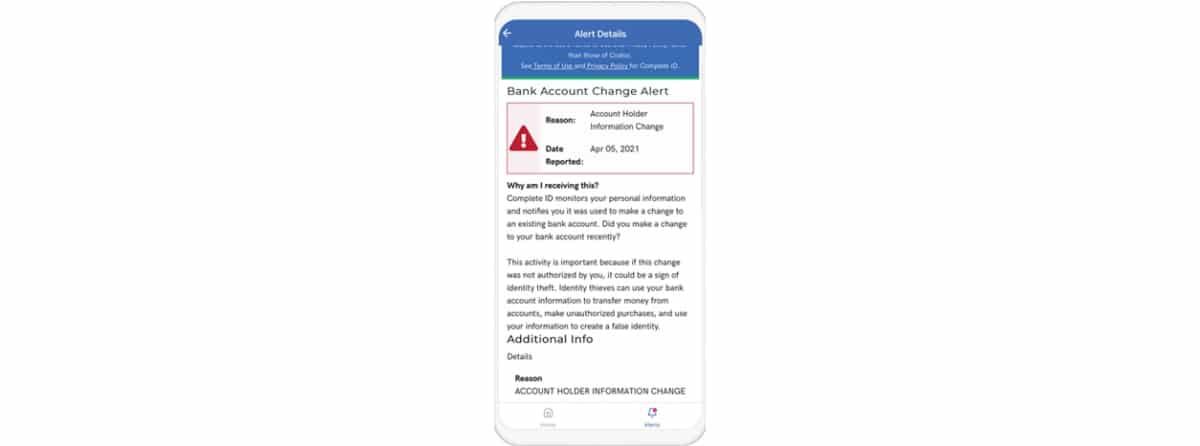

To be effective, the services must generate alerts in a timely manner. Delayed notification of problems could leave your identity in danger of being stolen before you have a chance to take steps to protect it.

LifeLock and Complete ID do a good job of giving you alerts quickly after discovering a potential problem. Both services will monitor activity regarding your financial accounts, Social Security Number, and credit card accounts, but you will need to make use of LifeLock’s mid-priced tier for protection of your banking accounts and its highest-priced tier to add protection for investment accounts. Complete ID covers bank and investment accounts in its lone pricing tier.

Both services monitor your personal information at all three credit bureaus (Experian, TransUnion, and Equifax). With LifeLock, you have to subscribe to its highest-priced tier to receive monitoring at all three credit bureaus, though.

Dark web monitoring

When your personal information appears on the dark web, the chances of you suffering identity theft increase significantly. The dark web includes criminal marketplace websites known to sell personal information, as well as forums that hackers frequently use.

Both Complete ID and LifeLock will monitor information that flows through the dark web, searching for anything that is part of your personal information. Should either service find something odd, you will receive an alert.

Free credit report and monitoring

You can receive both free credit scores and free credit reports with LifeLock and Complete ID. Both services give you a free annual credit report from all three credit bureaus, as well as more frequent access to your credit scores and credit reports from a single credit bureau. (Again, you need to subscribe to the highest-priced tier of LifeLock to receive features that match what Complete ID offers.)

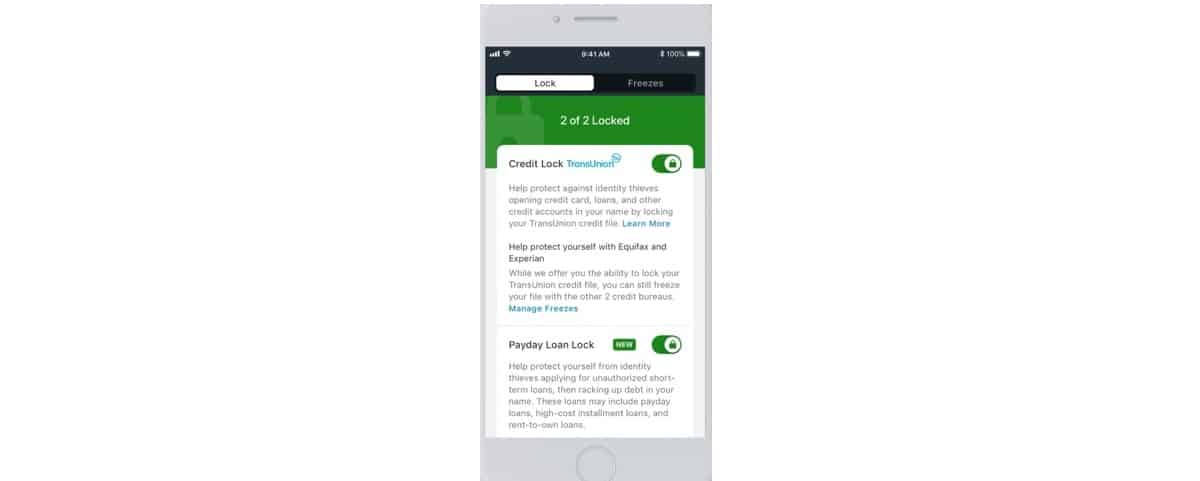

Complete ID can help you freeze your credit at Experian but not TransUnion or Equifax. You can easily freeze your credit at TransUnion when you subscribe to either of LifeLock’s two highest-pricing tiers, but not Equifax or Experian. If you want to freeze your credit at credit bureaus not mentioned in your plan, you will need to contact those bureaus on your own.

Address monitoring

Both LifeLock and Costco Complete ID will monitor U.S. Postal Service records to determine whether anyone requested a change in your address for your postal mail. If someone fraudulently is able to intercept your mail, this person could use the information in your mail to potentially steal your identity.

Public records monitoring

If someone who has access to your personal identification information suffers an arrest at the hands of law enforcement, this person may try to fool police by giving officers your name and information. Giving a fake name with stolen information is a way someone with a past criminal record can try to avoid additional charges.

Both LifeLock and Complete ID will keep an eye on criminal proceedings that are part of the public record, including sex offender registries, to see if your name fraudulently appears on any of these records.

Social media monitoring

LifeLock will monitor your social media accounts for any fraudulent activity. With Complete ID, you will receive social media monitoring for your children when you choose a family protection tier.

ID restoration

As a subscriber to LifeLock or Complete ID, should you ever suffer identity theft, these services promise to help you work toward regaining control of your personal information. This is the most important feature that these services offer, because most of us would have little idea where to start with trying to restore our identity without some guidance.

For starters, once you report an identity theft, both LifeLock and Complete ID will assign a restoration specialist to your case. This is a person based in the United States. Other customer service people who can help with your case will be available 24/7 with both services. Should you need the help of a local lawyer to file documentation designed to recover your identity, both services can direct you toward someone who can help.

As an offshoot of helping you recover from identity theft, both LifeLock and Costco Complete ID offer a lost wallet recovery service. Should you ever lose your physical wallet containing your credit cards, driver’s license, debit card, and more, both services can help you take the steps needed to cancel your cards and to work toward retrieving new documents.

Insurance and compensation

The process of recovering your identity can be pricey, as you may need to hire a lawyer, open new accounts, and fill out a lot of forms. Both LifeLock and Complete ID give you ID theft insurance to help you pay for the services you need.

With either service, you can receive up to $1 million in theft insurance. You will have to show documentation of your expenses to receive any reimbursement.

Should you suffer any loss of money from your financial accounts related to the identity theft, both services will potentially reimburse you for these losses. With LifeLock, the reimbursement will be between up to $25,000 and up to $1 million, depending on the subscription tier you are using.

With Complete ID, the reimbursement is part of the up to $1 million in theft insurance mentioned earlier. Complete ID combines both types of reimbursement into one fund. For those who may have financial accounts with large balances, the larger amount of potential reimbursement with LifeLock may be advantageous.

2FA login

Both Complete ID and LifeLock let you set up two-factor authentication (2FA) to gain access to your account. This provides an added layer of protection. However, these services do not automatically activate 2FA, as you will have to do this yourself through the settings.

Complete ID vs LifeLock pricing

| No value | Complete ID | LifeLock |

| Website | completeid.com | https://lifelock.com/ |

|---|---|---|

| Subscription periods | Monthly | Monthly or annually |

| Special offer | Must be a Costco member | First-year discount for new customers |

| Price per month | $8.99 (for Costco Executive members) | $8.99 (Standard Individual tier) |

| Lowest annual price | $107.88 (for Costco Executive members) | $89.99 (Standard Individual tier) |

| 4-year pricing plan | $167.88 (for Costco Gold Star members) | $239.88 (Ultimate Plus Individual tier) |

| Lowest annual price (Family) | $227.88 (for Costco Executive members) | $221.87 (Standard Family with Kids tier) |

| Highest annual price (Family) | $359.88 (for Costco Gold Star members) | $467.88 (Ultimate Plus Family with Kids tier) |

| Money-back guarantee | 60 days for annual subscription or 14 days for monthly subscription | |

| Best deal (per month) | $8.99 $8.99 per person per month | $8.99 GET 25% off the first year |

It can be a little tougher to find a perfect service and price point with Complete ID, as it only offers one pricing plan, whereas LifeLock offers three plans. However, because Complete ID is so much less expensive than LifeLock, not having multiple pricing options may not be a big deal for most people.

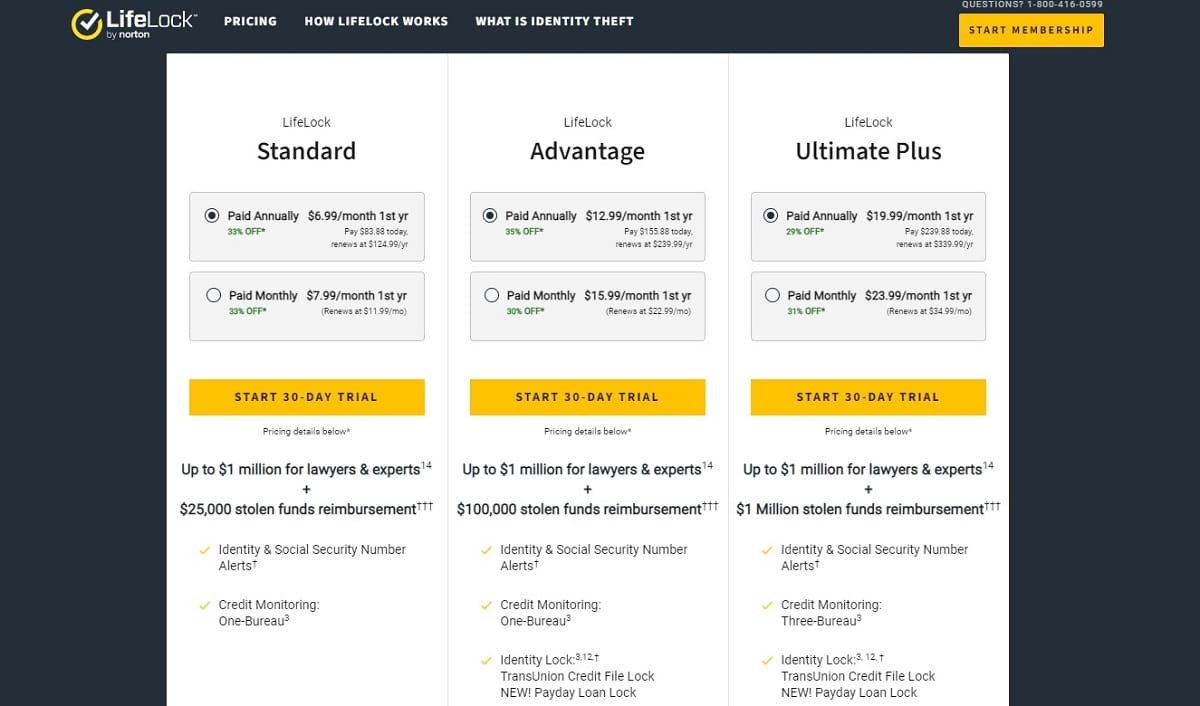

The price difference in favor of Complete ID is far more noticeable in the family tier versus the individual tier. I also must note that LifeLock offers a significant first-year pricing discount to new customers that makes LifeLock look like quite the bargain.

It’s important to mention that Complete ID is not available to anyone who does not hold a Costco membership. The Costco membership costs $60 per year for the Gold Star level and $120 per year for the Executive level, so you will have additional costs beyond the cost for Complete ID.

Auto renewal options

As with nearly any identity theft protection service, both LifeLock and Complete ID require that you agree to their auto renewal policies to sign up for the service. This means that the service will automatically charge you when the billing period comes to an end, because you will have a credit card or bank account on file. The charges continue until you decide to cancel.

Some people sign up for subscription services like this and then forget about the service, ringing up new charges every month. You will want to make sure you keep an eye on either Complete ID or LifeLock’s charges, so you aren’t paying for a subscription you aren’t using.

Cancellation options

One of the most frustrating aspects of identity theft protection services across the board is the difficulty subscribers have when they attempt to cancel the service. These entities have your credit card information in hand, and they are not going to just allow you to cancel without trying to convince you to change your mind.

You should not expect to be able to make a two- or three-minute phone call and cancel either LifeLock or Complete ID. It will be a bigger challenge, and you may have to speak to multiple people to be able to actually cancel the service. You also may find yourself in a situation where you believe you canceled the service, but the charge continues to show up on your credit card statement.

Do not sign up for either service or provide your credit card information until you read through the LifeLock terms of service or the Complete ID terms of service to learn more about all their policies related to billing and cancellation. You will need to visit the terms of service webpages for each service to receive the latest information, as this information may change at any time.

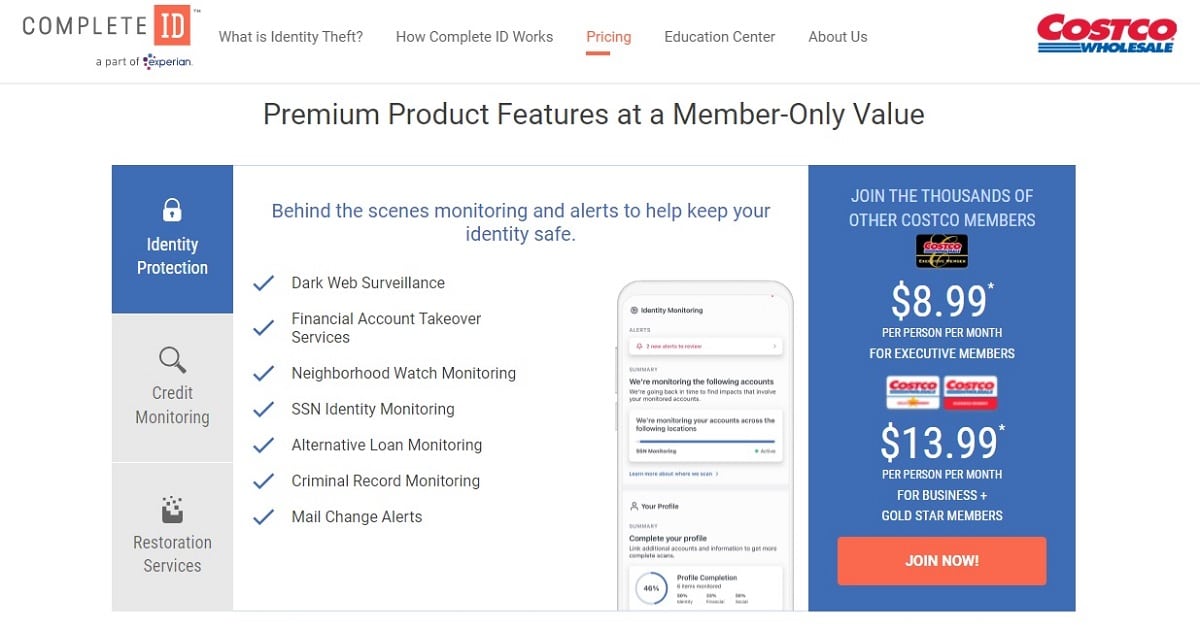

Complete ID pricing tiers

Complete ID provides four pricing plans consisting of one adult, one adult with up to five children, two adults, and two adults with up to five children. But because there is only one service tier for Complete ID, it’s easy to figure out which tier you should select.

You will have two different pricing options for Complete ID, but these pricing options both offer the exact same features. The difference in price relates to the level of membership you have with Costco.

If you have the lower-priced Gold Star membership at Costco, you’ll pay $5 more per month for Complete ID than if you have an Executive membership. This difference comes to $60 per year, which happens to be the difference in cost between the Gold Star ($60 annually) and the Executive ($120 annually) membership levels.

So if you plan to add Complete ID to your Costco membership, from a financial standpoint, you might as well upgrade to the Executive membership level. The extra $60 per year you will pay to have an Executive membership will be offset by the $60 you’ll save on your Complete ID bill with the Executive level Costco membership.

Complete ID does not offer customers a discount for paying annually versus monthly, because it does not offer an annual membership. It would be nice if you could save some money by paying annually with this service, but it already represents a significant bargain compared to LifeLock.

Even if you cancel your Costco membership, you can maintain your Complete ID membership as long as you keep participating in the auto renewal program. If you want to cancel both your Costco membership and your Complete ID membership at the same time, you will have to separately cancel the two memberships.

LifeLock pricing tiers

LifeLock’s pricing tiers are quite a bit more complex than what you find with Complete ID, as you can select among nine different subscription options. LifeLock offers three pricing plans, consisting of a single adult, two adults, or two adults with up to five children. Customers then will have the chance to pick among three service tiers within each plan. The service tiers available from LifeLock include:

- Standard: LifeLock’s Standard tier includes very limited features. You will only receive monitoring for your Social Security Number and for a few other risks to your personal information. In the Standard tier, LifeLock only monitors your identifying information at one credit bureau.

- Advantage: With the Advantage tier, you will add monitoring for your financial accounts to what you receive in the Standard tier. LifeLock also begins monitoring for any crimes committed using your name in this tier.

- Ultimate Plus: In the LifeLock vs Complete ID comparison, the Complete ID service’s features align most closely with this Ultimate Plus tier. With Ultimate Plus, LifeLock provides customers with everything in the Advantage tier, along with monitoring for your social media accounts, investment accounts, and home title. You also begin receiving credit reports and monitoring from each of the three credit bureaus in Ultimate Plus.

Setup and ease of use

Both LifeLock and Complete ID are easy to use, giving customers a dashboard that allows them to see any alerts and to manage the settings for the subscription.

You can sign up for either service in just a few minutes. With LifeLock and Complete ID, you will need to provide an identification card, like a driver’s license, and a credit card at the time of signup. With Complete ID, you also will need to provide your Costco membership number.

Complete ID and LifeLock offer mobile apps for both iOS and Android devices. The LifeLock app offers more options for managing your account than the Complete ID app.

Pros and cons of Costco Complete ID

Pros:

- Gives you a significant discount versus other ID theft services

- Only has one service plan, which simplifies the signup process

- You can freeze or unfreeze your Experian credit profile quickly

- Complete ID has the backing of Experian

- Offers outstanding features that compare favorably to other services

- Has up to $1 million in ID theft insurance and stolen funds reimbursement

- Offers credit monitoring for all three credit bureaus

- Gives maximum savings to Costco Executive membership users

Cons:

- Only has a month-to-month service offering

- Mobile app could use more options for account management

- You must purchase a Costco membership to use Complete ID

- Doesn’t offer as many pricing tier options as LifeLock

Pros and cons of LifeLock

Pros:

- Gives new users a significant price break in the first year

- Offers customer service features 24/7

- Provides up to $1 million in theft ID insurance

- Customers can select among nine different pricing options

- Has a strong mobile app for monitoring account settings

- Works in conjunction with other services from LifeLock’s owner, Norton

- Highest-priced tier gives you credit monitoring from all three credit bureaus

- LifeLock has a highly trusted brand name among ID theft protection services

Cons:

- You will receive a significant price increase in the second year and beyond

- Does not compete favorably with Complete ID’s prices

- LifeLock’s lowest-priced tier is extremely basic

- Norton and LifeLock do not receive good customer service ratings

The winner: LifeLock

Because Complete ID and LifeLock offer a similar set of features, it was challenging to pick a winner. However, I will go with LifeLock in this comparison, as its feature set and its higher levels of insurance protection give it the edge. I must mention that for people who already have a Costco membership, the low price of Complete ID may give it the edge in your particular situation. LifeLock is a more expensive option. However, if you want the best features and if you can fit LifeLock’s cost into your budget, it will give most people the better results.

LifeLock’s primary areas of advantage in this comparison involve its significant first-year pricing discount, its ability to work seamlessly with other Norton products, the ability to subscribe to it without needing a Costco membership, its better feature set, and its greater level of reimbursement for funds lost to theft. If these areas are especially important to you, you may not mind paying more for the LifeLock subscription.

Methodology: How we test identity theft protection

When testing the best identity theft protection services, I always start with wanting to make sure these services are living up to the promises they make to their customers. I want to make sure that an average user is able to receive the value and level of service expected when they subscribe to these services.

The identity theft protection services should provide accurate alerts in a timely manner too. The sooner you can receive information about any strange occurrences with your personal information, the sooner you can attempt to fix any problems before you lose your identity.

When testing these services, I attempt to enter data that should trigger alerts, so I can measure the responsiveness of the service. It is impossible to trigger certain alerts, of course, but I attempt to make sure the services can handle at least the basic needs for average users.

Ease of use is important too. Even though I work with these ID theft protection services every day, I understand that the majority of the customers for these services do not. They want to be able to check on the status of their personal information as quickly as possible and then move on to the rest of the day. If a service is too difficult to navigate, it will not be useful for the average person.

Finally, customer service responsiveness is highly important. If you ever have a problem with your personal information, you need customer service to respond to you quickly and answer your questions correctly. Without great customer service, these services are not giving you good value.

Ultimately, I try to sort through the differences between marketing hype and the actual performance that these services deliver. Scanning the websites of ID theft protection services and reading the marketing materials will give you one point of view. I want to try to help you sort the hype from the truth when it comes to what identity protection services deliver to their customers.

Complete ID vs LifeLock FAQs

How does identity theft protection work?

Through an identity theft protection service, the hope is that you can spot potential red flags regarding your personal identifying information that could indicate someone is trying to use it to steal your identity. If someone is able to take control of your identity, this person potentially could steal money from your bank accounts, open loans in your name, and cause many other significant problems for your life.

The ID theft protection service will monitor your credit report and areas of the internet where your personal information may appear. If the service notices something that is unusual, it should generate an alert for you. You then would be able to determine whether you need to adjust passwords, change security questions, freeze credit, obtain new credit cards, or close accounts.

Understand that simply subscribing to an identity theft protection service does not guarantee that your identity will remain safe. By the time the ID protection service discovers a problem, it may be too late to prevent significant problems and financial loss.

Should you suffer a financial loss related to the theft of your identity while you are subscribing to an ID theft protection service, you may be able to receive reimbursement for your losses. Many of these services also provide reimbursement payments for any money you must spend to try to regain control of your identity. The amount you could receive in reimbursement will depend on the service you are using and the subscription tier in use, but many services offer a maximum reimbursement of $1 million.

Can LifeLock help me after someone stole my identity?

LifeLock does offer help to subscribers who lose their identities. At the time you report a loss of your personally identifying information, LifeLock will give you access to identity restoration specialists based in the United States, making it easier to connect with them during normal working hours, although LifeLock always has customer service available 24/7. Through its ID theft insurance, you can receive payments for the costs associated with attempting to restore your identity.

Can Complete ID help me after someone stole my identity?

Complete ID will perform a series of tasks for you if you are a subscriber and someone steals your identity. Specialists working for Experian, which operates Complete ID for Costco, will alert your financial institutions about the fraud, including credit card companies and banks. Experian will assign restoration specialists to your case to help you figure out how to restore your identity. You will have access to an insurance policy that helps cover the cost of recovering your stolen identity.

Does LifeLock compensate me for stolen funds?

As long as you can provide proof of your direct financial losses, LifeLock will reimburse you for them. Depending on the subscription tier you are using, LifeLock will reimburse you in a range of up to $25,000 to up to $1 million.

Does Complete ID compensate me for stolen funds?

Experian, which operates Complete ID for Costco, will compensate you for stolen funds related to the identity theft situation, as long as you can prove the losses. The reimbursement of your funds will be subject to the same $1 million limit as the restoration insurance fund mentioned earlier, as all of this reimbursement money comes from the same fund.

How can I protect my identity from being stolen?

The best way to reduce the chances of having your identity stolen – whether you subscribe to an ID theft protection service or not – is to be very careful about the type of personal information you share on the internet.

- Do not use simple passwords or the same password at multiple websites, because if a hacker steals this password, he or she could access several websites with it.

- Do not click on random links that show up in email messages or text messages unless you are absolutely certain about the origin of the message.

- Some fake websites, made to mimic the real thing, can steal your personal information if you enter it willingly into these fake sites.

- Enable 2FA on all your accounts that allow it.

- Destroy mail when you finish with it, especially credit card applications and bills that list your address and account numbers.

- Check your bank and credit card statements for any odd charges that could indicate someone is probing your account to see if they can gain access to it.

Should I change my phone number after identity theft?

It is a good idea to change your phone number after you suffer identity theft. Your old phone number may have an association with your hacked accounts. When you open new accounts, if you keep the same phone number associated with these accounts, it potentially gives the hacker a data point into trying to hack your new accounts. A new phone number is just another step in distancing yourself from your hacked information.

Does credit monitoring hurt your credit?

When either you or an identity theft protection service monitors your credit, it does not affect your credit score in a negative way. Accessing credit reports regularly should not affect your score either.

How long does it take to restore your identity?

After an identity theft, it can take several weeks or months to restore your identity. Some complex cases may take a year or longer, while cases where you catch the potential identity theft early may only take a few weeks to straighten out.

If you have an identity theft restoration specialist helping you, the process should happen quicker. These specialists can do some of the tasks for you and can point you in the right direction for performing other tasks. If you don’t subscribe to an identity theft protection service, you can hire a lawyer to represent you in the process of restoring your identity, and the lawyer can perform some of the same tasks as the specialist.

It is possible to try to do all the steps yourself, but it can be very time consuming. You will need to make a lot of phone calls and to file quite a few documents. Many of these phone calls must happen during normal business hours, which could interfere with your ability to work at your place of employment. Understand that you likely will have to hire a lawyer at some point to help with legal documents anyway, so there will be some cost associated with restoring your identity, even when trying to do the work yourself.

Should I get ID theft protection?

It is impossible for me to provide an answer that would fit every potential situation for everyone. Some people likely will benefit from subscribing to an identification theft protection service, while other people will not receive much value from these services.

If you are willing to check your bank and credit card account statements regularly, and if you keep a close eye on your credit report for any odd entries, you may be able to spot any unusual occurrences on your own. The identity theft protection service basically does this same thing for you, flagging strange occurrences so you can check them out further.

Additionally, if you are careful about the type of personal information you share online, you can greatly reduce the chances of having your personal information fall into the wrong hands. (The chances of you suffering identity theft are never going to be zero, regardless of whether you subscribe to an ID theft protection service, but you can reduce the chances by being careful about where you share your information.).

However, some people simply are not comfortable trying to keep track of this information on their own, which is easy to understand. Subscribing to an identity theft protection service may give you peace of mind that professionals are watching your information, making it worth the monthly cost.

A few types of people tend to receive a greater benefit from ID theft protection services than others. If you suffered identity theft in the past, you may be more susceptible than the average person to having your identity stolen again. Having an ID theft protection service watching your credit information may help you catch new problems before you end up losing your identity again.

Additionally, people who rarely make use of credit or who have no reason to apply for loans, such as children or people who pay for everything with cash, would have very little chance of catching strange occurrences with their credit information before someone takes advantage of it. An ID theft protection service would give you a more timely alert than you might receive through your own actions.

A key advantage of subscribing to an identity theft protection service is the insurance policy you receive. This policy should pay you if you have to spend your own money to attempt to restore your identity or if you have a direct loss in your financial accounts because of the identity theft situation. If you don’t subscribe to a service, you would not have this type of financial protection in place.

I must mention that it is not always easy to obtain the payments that you believe you should have. You must show proof of your losses and of your costs for attempting to restore your identity. While you are trying to restore your identity, it can sometimes be difficult to obtain the information you need to receive your insurance payment.

Beyond the monthly cost and the requirement to participate in an auto renewal program, ID theft protection services do have a few other drawbacks. You will receive quite a bit of marketing material from these services, attempting to convince you to purchase add-ons or to upgrade to a more expensive service level. (This is less of a problem with Complete ID than with some other services because it does not have multiple pricing tiers.)

Should you ever decide that you want to cancel your subscription, this can be quite an ordeal. You probably will have to speak to multiple people before you can cancel, as the subscription service will attempt to talk you out of canceling. Occasionally, you may believe that you canceled the service, only to see a new charge show up on your credit card the following month. Receiving the runaround when trying to cancel can be very frustrating.

If you choose to sign up for an identity theft protection service or any similar kind of auto renewal subscription service, I always recommend using a credit card to make the payment, rather than using your debit card or using a bank account withdrawal. Should you have a dispute with the ID theft protection service regarding the cancellation of the service, your credit card company will have a better chance of helping you cancel the charge than your bank will.

As a final bit of advice, I would recommend having a healthy skepticism about the marketing promises these types of services make. They do live up to many of their promises, but they also make quite a few aspects of the service seem better and easier to use than they actually are. Don’t just focus on the positives that these services offer. Make sure you understand some of the negative aspects too before you sign up for a service.

See also: