You may know the Experian brand name as one of the three US credit bureaus that collects your financial information and generates your credit report. But Experian is also in the identity theft protection market with Experian IdentityWorks.

So how does Experian IdentityWorks compare to the well-known LifeLock identity theft protection subscription service? I will break down the key features found in LifeLock and Experian comparison and help you decide which service better fits your needs. ID theft protection service software is a key focus here at Comparitech, and we strive to give you the most realistic look at these services.

LifeLock and Experian IdentityWorks have very similar service offerings. LifeLock works well for those who want the peace of mind of having maximum financial protection in case of becoming the victim of identity theft. Experian IdentityWorks, however, has a much lower price point. However, I will give LifeLock the edge here, as it delivers all the key items you need to protect your identity, making it a better value, even at a higher price.

Summary: LifeLock vs Experian

| No value | Experian IdentityWorks | LifeLock |

| Website | experianidworks.com | https://lifelock.com/ | Free trial | Average email response time | Identity theft insurance | Up to $1 million | Up to $1 million | Lock your credit | TransUnion only | Special offer | $8.99 | Highest price per month | $23.99 | Credit monitoring | Phone takeover monitoring | Crime in your name monitoring | Credit reports | Credit score |

|---|---|---|

| Best deal (per month) | $8.99 GET 25% off the first year |

LifeLock vs Experian: Features

I will compare some of the most important features found in both LifeLock and Experian’s ID theft protection services. Pay particular attention to the services that most closely meet your needs for identity protection.

Activity alerts

The primary focus of identity theft protection services is their ability to provide you with immediate alerts when something odd happens with your personal financial data. These alerts need to happen quickly, so you can decide what actions to take in a timely manner.

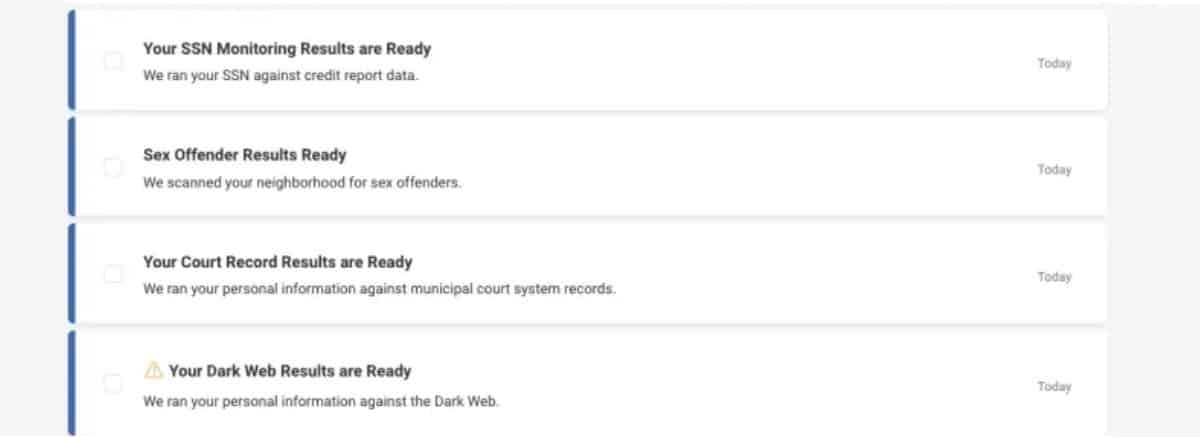

Both LifeLock and Experian IdentityWorks give you immediate alerts when they detect oddities with your credit reports or other personal information. Both services will monitor your bank accounts, financial accounts, credit card accounts, and Social Security Number for odd activity.

Both LifeLock and Experian offer monitoring of your personal profile at all three credit bureaus in their highest pricing tiers. However, Experian’s top tier is quite a bit cheaper than LifeLock’s top-priced tier after LifeLock’s first-year price discount expires.

Both services offer payday loan monitoring too, should someone attempt to open a payday loan using your personal information.

Dark web monitoring

Identity theft protection services use dark web monitoring to keep an eye on hacker forums and criminal marketplaces that may be trading and selling your personal information. When people suffer ID theft, their personal information often appears on these types of sites. Both Experian and LifeLock will monitor these areas of the internet for your name and information.

LifeLock sends you an alert when it discovers any of your information on the dark web, allowing you to change passwords or security questions to make the dark web information irrelevant. With Experian IdentityWorks, you can run your own dark web scan at any time through the service’s dashboard.

Free credit report and monitoring

One of the easiest ways to quickly spot potential problems with identity theft is through monitoring your credit reports. When this information shows odd activity, it can be an early clue that your personal financial information is not secure.

With both LifeLock and Experian, you will receive monitoring from one credit bureau at the lower price points. At the highest price point for both services, you receive credit monitoring from all three credit bureaus.

You also have the ability to request credit reports for free with either LifeLock or Experian IdentityWorks. At lower price points, the reports and scores will be free on an annual basis. At higher price points, credit reports and scores will be available as frequently as daily.

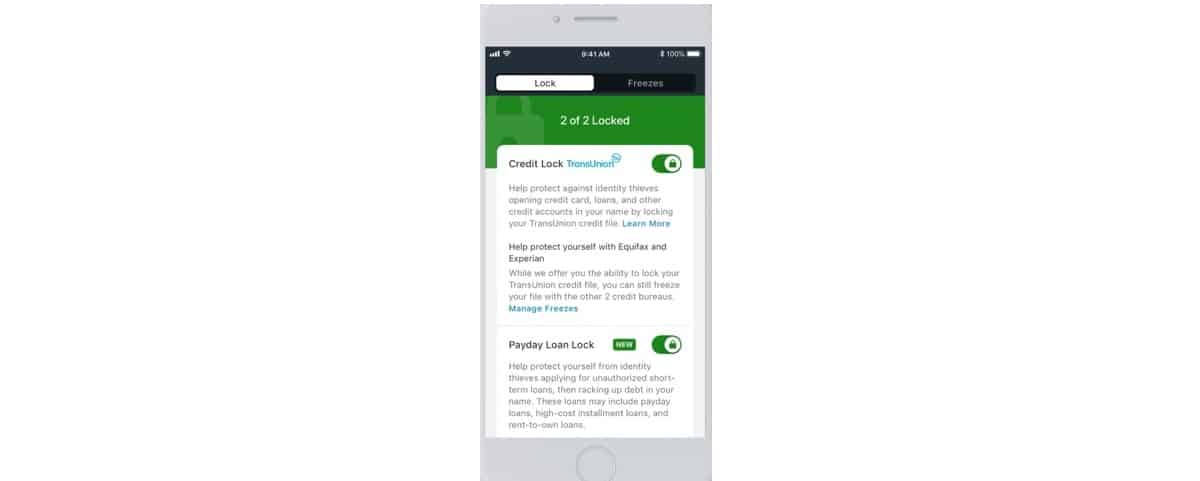

Should you need to freeze your credit profile, which prevents anyone (including you) from opening a new line of credit in your name until you unfreeze the profile, both services offer this capability. (Of course, you can freeze your credit profile on your own without subscribing to either of these services as well.)

Address monitoring

Should someone attempt to reroute your postal mail by changing your address with the U.S. Postal Service, both Experian IdentityWorks and LifeLock will monitor and alert you to any changes like this.

If you have an interest in monitoring any odd changes or activity involving your home title that’s part of the public record, LifeLock offers this service in its highest-pricing tier. Experian does not offer home title monitoring.

Public records monitoring

If someone commits a crime and gives law enforcement your stolen personal information to try to avoid prosecution, both Experian and LifeLock will give you an alert. Both services will monitor sex offender registries and court records for any mentions of your name or personal information.

Social media monitoring

Both LifeLock and Experian IdentityWorks will monitor social media services, looking for any evidence of someone opening an account in your name and using it for criminal purposes or to ruin your personal credibility.

Should something appear unusual with your social media accounts, both services can alert you to these kinds of issues, especially if someone suddenly begins posting threatening messages in your name.

ID restoration

For many people, receiving help with ID restoration after an identity theft occurs is the main reason they choose to subscribe to an ID theft protection service. If these services cannot help you restore your identity, they are not really worth the monthly subscription cost.

Should you suffer identity theft, both LifeLock and Experian will assign you a U.S.-based fraud resolution specialist to help you take the necessary steps to recover your identity and to reset the areas where fraud occurred in your financial profile.

Experian IdentityWorks does not have 24/7 live customer service options available, while LifeLock does. However, if you suffer a case of ID theft, you will be able to receive help whenever you need it with Experian.

It is a little challenging to search the Experian IdentityWorks website to find the customer service phone numbers, but they are available. With both services, you can gain access to customer service through email or live chat as well. Both services have online documentation available to answer your simpler questions.

Along with supplying an identity theft restoration specialist, both services can point you toward lawyers who can help you with recovering your identity.

Both services also offer a lost wallet service, which tracks all of your credit card numbers, debit card number, driver’s license number, and other identifying cards that you may be carrying. Should you lose your wallet, both Experian and LifeLock can retrieve the information about the items in your wallet, so you can begin canceling your cards.

Insurance and compensation

Depending on the pricing tier you select, you will have up to $1 million in insurance coverage with both Experian and LifeLock. These insurance payments can help you with the costs required to attempt to recover your identity, such as legal costs.

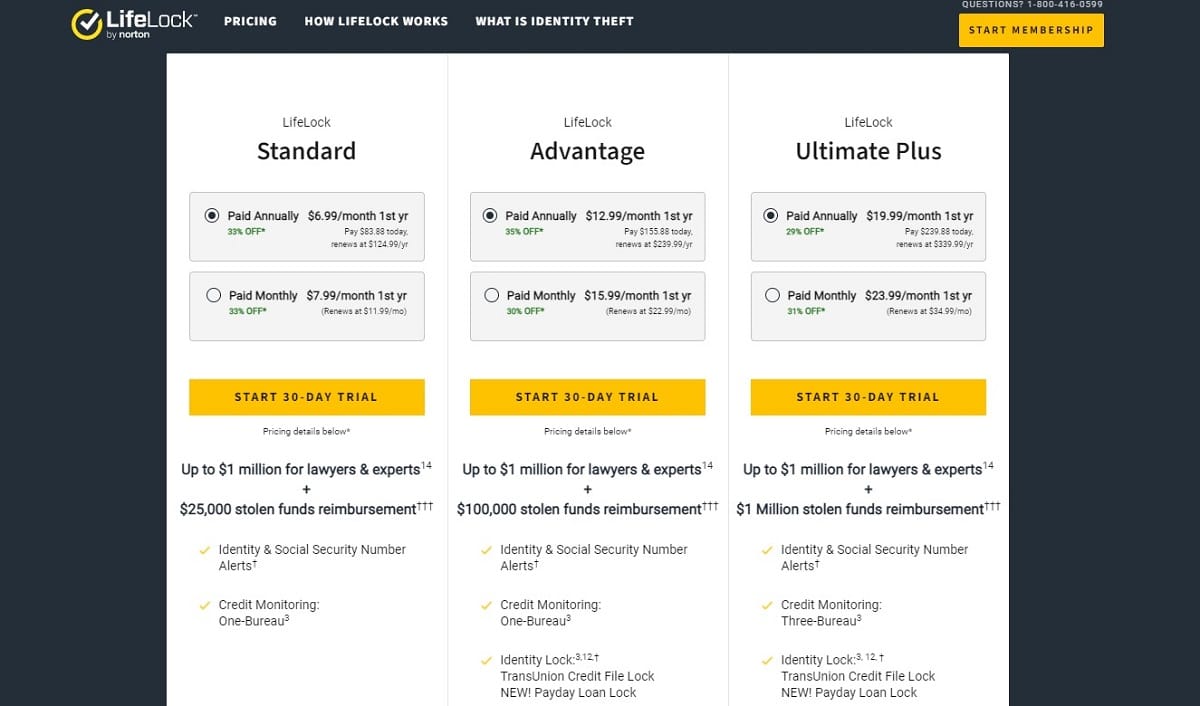

LifeLock offers up to $1 million in insurance for all of its pricing tiers. It then also offers an amount to reimburse you for any stolen funds you have related to the identity theft. This amount ranges from up to $25,000 to up to $1 million, depending on the price tier you chose..

Experian IdentityWorks also offers up to $1 million in insurance coverage, but only at its highest-priced tier. It offers up to $500,000 of coverage in its lower-priced tier. Although, like LifeLock, it offers both insurance and stolen funds reimbursement, it combines the two into a single $500,000 or $1 million amount.

If you have significant amounts of money in your financial accounts, LifeLock will give you a better deal in this area at its highest-priced tier. However, Experian IdentityWorks has the far better offering for reimbursement in its lowest-priced tier.

2FA login

You can enable two-factor authentication (2FA) with your LifeLock identity theft protection accounts. However, you do have to turn on 2FA with LifeLock. It does not force you to use 2FA automatically. Experian IdentityWorks does not offer 2FA.

LifeLock vs Experian IdentityWorks: Pricing

| No value | Experian IdentityWorks | LifeLock |

| Website | experianidworks.com | https://lifelock.com/ | Subscription periods | Monthly | Monthly or annually | Special offer | 30-day free trial | First-year discount for new customers | Price per month | $9.99 (Plus tier) | $8.99 (Standard Individual tier) | Lowest annual price | $299.88 | $89.99 (Standard Individual tier) | 4-year pricing plan | $199.99 (Premium tier) | $239.88 (Ultimate Plus Individual tier) | Lowest annual price (Family) | $419.88 | $221.87 (Standard Family with Kids tier) | Highest annual price (Family) | $299.99 (Premium Family tier) | $467.88 (Ultimate Plus Family with Kids tier) | Money-back guarantee | 60 days for annual subscription or 14 days for monthly subscription |

|---|---|---|

| Best deal (per month) | $8.99 GET 25% off the first year |

LifeLock has nine different pricing tiers, while Experian IdentityWorks offers six pricing tiers. Both services offer pricing tiers for families and individuals.

Experian has a lower price point at every comparable tier than LifeLock offers. I must mention that LifeLock’s first-year pricing discount is significant enough that it will be cheaper than what Experian offers for the first year. However, from the second year and beyond, LifeLock’s prices will increase significantly, creating a higher cost than what Experian offers. (We list LifeLock’s second year and beyond prices here, not its first-year discounted prices.)

Although it may be tempting to pick LifeLock based on its lower first-year prices, I generally would not recommend this. The majority of people want an identity theft restoration service that they can trust for many years into the future, not just for one year. So you really should compare the prices you will pay after the first-year discount on LifeLock ends.

Auto renewal options

When you sign up for the majority of identity theft protection subscription services, including Experian and LifeLock, you must provide a credit card immediately. By signing up, you also are agreeing to abide by the auto renewal membership for both services.

With auto renewal, either Experian IdentityWorks or LifeLock will automatically charge you for the next billing period using your payment method on file. Your charges will continue until you take the step to cancel the service.

Cancellation options

I must mention here one of the biggest drawbacks to these types of services: It is extremely difficult to cancel the services once you sign up for them. Do not expect to be able to make a quick phone call to cancel the service or to be able to cancel over email.

Chances are high that you will have to speak to several people when you attempt to cancel, all of whom will try to convince you to keep the service. LifeLock does have 24/7 customer service, so you have the option of trying to cancel anytime you want. With Experian, general customer service is available seven days a week during normal business hours.

With both services, you may be eligible to receive a refund of a portion of the service you paid for already but will not be using. However, you are not guaranteed to receive a refund.

Do not sign up for either service without carefully reading the LifeLock terms of service or the Experian IdentityWorks terms of service to learn more about their billing, cancellation, and auto renewal policies. Information I am sharing with you about these policies is subject to change at any time, so it is important to read the terms of service for the latest information.

Experian IdentityWorks pricing tiers

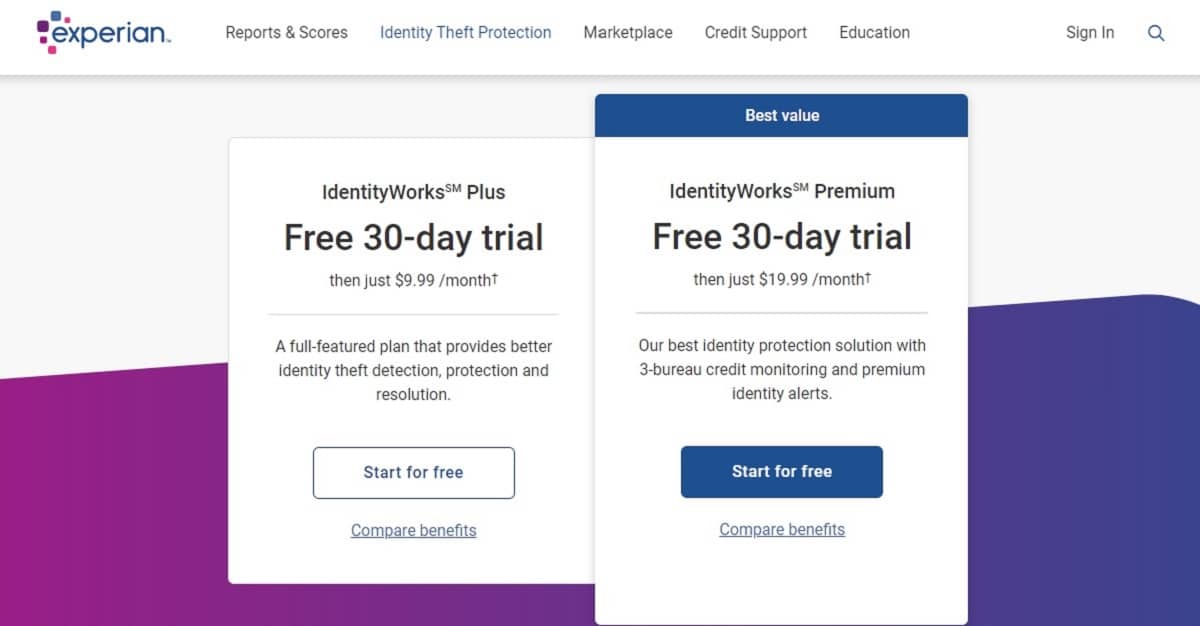

IdentityWorks offers three pricing plans, each of which is available in two tiers. The three pricing plans are for an individual adult, for an individual adult with up to 10 children, and for two adults with up to 10 children. You then can select either the Plus tier or the Premium tier within those plans.

Rather than giving you a specific money-back guarantee like LifeLock does, Experian offers a free trial period up front. Each tier has a 30-day free trial period available, but you will have to provide a credit card as soon as you sign up for the trial. You also will have to agree to the auto renewal service before you can start your free trial. If you do not cancel within the 30-day period, you will pay for the next month automatically. The two tiers are:

- Plus: This is a basic tier that offers up to $500,000 in identity theft insurance. It only monitors your financial identity at one credit reporting bureau – Experian (as you might expect). It monitors your Social Security Number and provides access to a fraud resolution specialist if you suffer identity theft. However, it does not monitor activity with your financial accounts.

- Premium: The Premium tier includes everything in the Plus tier, but it offers up to $1 million in identity theft insurance. It includes financial account monitoring, payday loan monitoring, social media monitoring, and crime in your name monitoring. It delivers credit monitoring from all three credit bureaus as well.

LifeLock pricing tiers

Because LifeLock offers more pricing options than Experian, it may be easier to find a specific plan and tier that perfectly fits your needs and budget. Among the three pricing plans are a plan for an individual, a plan for two adults, and a plan for two adults and up to five children. Within each of those plans, you have access to three pricing tiers, including:

- Standard: LifeLock offers its Standard tier for only the most basic user needs. Like Experian’s Plus tier, the LifeLock Standard tier does not offer monitoring of your financial accounts. It only provides activity alerts for your Social Security Number and for potential risks to your identity. You receive credit monitoring for only one credit bureau – TransUnion.

- Advantage: The Advantage tier with LifeLock has everything in the Standard tier, but it adds monitoring for your financial accounts, alerts for crimes in your name, and phone takeover monitoring. It continues to offer credit reports and monitoring from one bureau.

- Ultimate Plus: LifeLock uses its Ultimate Plus tier as its premium offering for those seeking the highest level of ID theft protection. Customers receive everything in the Advantage tier, as well as credit reports and monitoring from all three credit bureaus. LifeLock adds social media monitoring, investment account monitoring, and home title monitoring in this tier.

Setup and ease of use

Signing up for either Experian IdentityWorks or LifeLock is extremely easy. Both services make it far easier to sign up and pay for their plans versus trying to cancel the plans later. (This is common for nearly all ID theft protection services, not just LifeLock and Experian.)

You will need to provide some personal information, including some sort of identification (such as a driver’s license) and a credit card or debit card to sign up for either service.

Each service gives you a dashboard from which you can monitor your identity and can make changes to the settings on your account. Both have quite a bit of useful information on the dashboards, simplifying the process of finding exactly what you need. I slightly preferred the organization on the dashboard for Experian IdentityWorks, but both services are excellent in this area.

Experian’s dashboard offers a bit more information on deciphering your credit report and on learning more about how your credit score works. This is understandable, as Experian serves as one of the three primary US credit bureaus.

Both LifeLock and Experian offer mobile apps for either iOS or Android, so you can view any alerts about your identity at any time. LifeLock’s app offers more features for managing your account than Experian’s app does.

Pros and cons of Experian IdentityWorks

Pros:

- Experian offers a 30-day free trial period

- Delivers detailed information on your credit report and score

- Easy to freeze and unfreeze your credit report

- Its price points routinely are below LifeLock

- You can receive a discount by paying annually instead of monthly

- Family tiers offer monitoring of information for up to 10 children

- Delivers credit monitoring at all three bureaus in the Premium tier

- Experian is a significant brand name in the credit world

- Offers funds theft reimbursement and ID theft restoration insurance

Cons:

- Does not offer 24/7 customer service

- Mobile app is lacking in detail for managing your account

- Features of the Plus tier are extremely basic

- Does not offer financial account monitoring in lowest-priced tier

Pros and cons of LifeLock

Pros:

- Separates funds theft reimbursement and ID theft insurance

- Mobile app gives you the ability to monitor your account settings

- Includes nine different pricing options

- Provides a money-back guarantee (with limitations)

- Customer service personnel are available 24/7

- Has a healthy pricing discount for new users for the first year

- Recently added social media and payday loans monitoring features

- Monitors all three credit bureaus at the highest pricing tier

- Meshes well with other services from Norton (LifeLock’s owner)

Cons:

- Price increases after the first year are significant, leaving it costing more than Experian

- Customer service reviews for Norton and LifeLock are poor

- Only offers reports and monitoring at one credit bureau in two lower-priced tiers

- Lowest-priced tier is extremely basic with no financial account monitoring

The winner: LifeLock

Both Experian IdentityWorks and LifeLock offer similar services and features, making it tough to declare a winner in this comparison. However, I will give LifeLock the slight nod, as it delivers a higher level of services, even though it costs a bit more.

In terms of the services offered with each plan, the fact that Experian is a major credit bureau gives it a full set of capabilities in the identity theft protection space. LifeLock has been in business for a long time (since 2005), so it also has a trusted name in this space as well.

The actual services that LifeLock and Experian offer are nearly identical. Both offer a very basic tier that has a low price but that doesn’t offer many features. Both also offer almost identical features in their highest-priced tiers.

However, LifeLock’s features are just a little bit more useful and better, meaning it can overcome the higher price it carries.

Understand that at first glance LifeLock actually appears to have better prices than Experian. However, you have to pay attention to the significant price increase you will pay after the first-year subscription discount with LifeLock comes to an end. In the second year and beyond, LifeLock’s prices are more expensive than Experian.

I believe most people who are purchasing an identity theft protection service will want to maintain the same service for many years into the future, I can’t make a recommendation in the LifeLock vs Experian comparison based on LifeLock’s first-year discounted prices.

For those who want to subscribe to an ID theft protection service to ensure they can receive the largest possible insurance payment in case they suffer a loss after an identity theft occurrence, LifeLock holds the clear advantage here. It offers more money to reimburse you for losses and to help you pay fees associated with recovering your identity than Experian does.

Understand that if you do need to receive a payment because of a loss related to the theft of your identity, it is not always easy to receive the payment that you believe you should have. You will have to produce supporting documents that prove the exact amount of your loss and that will satisfy either LifeLock or Experian before they will release any insurance payments to you.

As one final advantage for LifeLock, its mobile app delivers a better set of features than Experian’s mobile app. This makes it far easier to control your LifeLock account while you are on the go.

For these reasons, I rank LifeLock as being a slightly better choice for the average person seeking ID theft protection services. But there are situations where Experian IdentityWorks fits better, especially if you have a significant concern over saving money on the subscription fee, making it a smarter choice for some people.

Our testing methodology for identity theft protection

The best identity theft protection services all will alert you to any odd situations involving your credit reports and identity. When I am running these services through the paces to try to narrow down how the services stack up against each other and in how quickly and accurately they generate alerts, I always try to approach my tests and usage in a way that mimics what an average user would do.

I believe it is important to try to make sure that these ID theft protection services live up to the promises they make to consumers. It is vitally important that these services deliver the help you need should you ever suffer a loss of your identity, but they also need to give you day-to-day information and alerts in a simple manner. Bottom line: These services need to give consumers everything they promise.

It can be tough to drill down to the exact benefits and protections that services like this provide, because they all rely heavily on marketing jargon and product descriptions that aren’t always entirely clear. For consumers who don’t deal with ID theft protection services on a regular basis, sifting the marketing hype from the reality can be a major challenge.

As I go through the testing phase for these services, I want to make use of data that tries to trigger the ID theft protection service’s alerts. I certainly am not going to be able to deliver a trigger for every potential scenario, but I attempt to find ways to match what the average consumer would experience.

Customer service responsiveness is highly important too. These services can – and do – make multiple references to 24/7 customer service and quick responsiveness in their marketing. However, if customer service is not available or is giving you the runaround when you are facing a difficult situation, the customer service promises are worthless.

When you are considering purchasing a subscription for identity theft protection services, it is important that you understand the features they offer. But you also need some insight on whether the services live up to the marketing promises they make, and I hope that my testing methods can give you some answers that are helpful to you.

LifeLock vs Experian FAQs

How does identity theft protection work?

ID theft protection services attempt to help you avoid losing control of your financial identity, which could lead to a monetary loss for you. When someone steals your identity, this thief could gain access to your financial accounts or could open loans in your name.

Identity theft protection attempts to give you warnings about situations that seem odd regarding the usage of your personal information. Because so much of our personal information is available digitally, it is easier than ever for someone to steal your personal identifying information. ID theft protection services are able to use these same digital means to monitor your information for oddities.

Should you suffer identity theft, the biggest advantage of protection services is that they offer services and experts who know the processes and steps you should follow to try to recover control of your identity. Without the help of an expert, it can be challenging to know exactly where to start. These services also should give you financial help with trying to recover any funds you lost to the identity thief and with the costs of recovering your identity.

Even though these services sound like a great idea, they are far from perfect. By the time the ID protection service notices oddities regarding your personal identification, it may be too late. You may already have significant financial loss that can take months or years to recover. These services may also generate false positive alerts about potential loss of your personal data that leave you wasting time dealing with alerts that are not accurate.

Can LifeLock help me after someone stole my identity?

Receiving help with recovering your identity after you suffer a breach is one of the main selling points for LifeLock. Should you suffer a loss of your identity, LifeLock will assign recovery professionals to your account, working to help you return your life to the normalcy you are seeking. LifeLock will assign people based in the United States to help you with your attempts to recover your identity. Should you have a loss of funds related to the identity theft, or should you need to spend money to try to recover your identity, LifeLock offers a reimbursement of these funds.

Can Experian help me after someone stole my identity?

Experian IdentityWorks will provide significant help in trying to restore your identity and your credit profile back to where it was before you suffered the fraud. Experian will assign a specialist to your case when you suffer identity theft, working toward fixing errors in your credit profile and returning your situation back to where it was previously. Experian also gives you money to help you with the costs of restoring your identity and with any financial loss you may have related to the identity theft.

Does LifeLock compensate me for stolen funds?

Yes, LifeLock does offer reimbursement for any stolen funds directly related to the theft of your personal information. You can qualify for an amount between up to $25,000 and up to $1 million, depending on which pricing tier you are using. You must provide proof of these financial losses.

Does Experian IdentityWorks compensate me for stolen funds?

Experian will give you reimbursement for any direct financial losses you have related to the identity loss. Depending on the pricing tier you subscribe to, you could be eligible for an amount between up to $500,000 and up to $1 million. However, any reimbursement for legal fees and similar funds that you need to spend to try to recover your identity also are part of this amount.

How can I protect my identity from being stolen?

If you are using personal information on the internet – and nearly all of us do – you run the risk of having your identity stolen. Although signing up for an identity theft protection service can help you catch oddities regarding the use of your personal identifying information on the internet, these services cannot guarantee complete protection of your identity. By the time an ID protection service discovers a potential problem, for example, it may be too late.

Ultimately, the best way to try to avoid having your identity stolen is to be very careful about the type of personal information that you share online. Make use of 2FA with all of your online accounts, and create complex, long passwords that make use of a mixture of random uppercase letters, lowercase letters, symbols, and numbers. Be very careful about clicking on links that arrive in emails or text messages, as these could lead to fake websites that trick you into revealing your personal information.

Should I change my phone number after identity theft?

If someone steals your personal information and your identity, your old phone number could continue to have an association with your account information. Someone may be able to reuse this old phone number and gain access to any new account information you created. By changing your phone number after someone steals your identity, you have a better chance of avoiding another theft of your identity.

How does identity theft happen?

Identity theft can happen in a number of ways. Perhaps you entered your information on a fraudulent website that you thought was real. Maybe a hacker was able to steal millions of personal identification records of customers during a breach at a large corporation. Maybe someone intercepted your postal mail and found account numbers belonging to you.

The thief then uses this information for financial gain. They might open lines of credit, make purchases, and apply for services that require a credit check in your name.

What are some simple steps I can take to protect my identity for free?

If you don’t want to spend money on an identity theft protection service just yet, you can take a few steps to try to keep your personal information from falling into the wrong hands.

- Freeze your credit at the three credit bureaus, preventing anyone from applying for new lines of credit in your name.

- Review your credit report regularly, looking for oddities.

- Review your financial account statements regularly.

- Destroy any junk mail you receive, especially credit card offers.

- Use complex, unique passwords on your accounts.

- Enable 2FA for gaining access to your accounts.

- Install antivirus software on your computers, tablets, and smartphones.

- Carefully choose where and how you share personally identifying information online.

Should I get ID theft protection?

This is not a question I can answer with a blanket statement. Identity theft protection services work well for some people, but they represent an unnecessary cost for other people.

The majority of tasks that ID theft protection services do for their subscribers are possible for people to do on their own for free. You could take the time to monitor your financial accounts and transaction statements closely for any potential signs of fraud. You could look at your credit reports on a regular basis to search for oddities.

Understandably, though, some people simply are not comfortable performing these tasks themselves. People who often receive a greater benefit from subscribing to an ID theft protection service tend to include:

- Those with past identity theft problems: When your personal information suffered from fraud in the past, you are more susceptible to this type of fraud again in the future. The ID theft protection service may give you an alert about odd occurrences with your personal information that could lead to discovering a problem early enough to do something about it.

- Those who have little experience with monitoring their accounts: If you do not have an ability to understand how to monitor your own credit reports for potential signs of fraud, you may prefer paying an ID theft protection service to take care of this for you.

- Those who don’t have the time or desire to watch their own information: Monitoring your own personal information and credit reports can be a time consuming process. You may prefer having a professional company invest the time to watch your accounts for odd occurrences.

- Those who rarely use credit or obtain loans: If you have little reason to check your credit report on a regular basis or if you don’t see your credit score that often, having a service monitor your credit reports and your personal information can be helpful. For example, if you do not use credit cards or take out consumer loans, you may have no reason to keep an eye on your credit. Similarly, children don’t have any reason to monitor their credit reports, yet they can be victims of identity theft.

You may want to subscribe to an identity theft protection service because you like the idea of having an insurance policy to help you with the costs associated with restoring your credit and to reimburse you for funds lost out of your accounts to identity thieves. Understand, however, that actually convincing the identity theft protection service to pay the reimbursement amount you believe you deserve to have can be challenging. You may need to provide certain information to the service that you simply cannot access because of the theft of your identity.

Dealing with this Catch-22 situation can be extremely frustrating. Unfortunately, obtaining these reimbursement funds is not as easy as it may sound in the marketing materials for ID theft protection services.

If you are someone who becomes frustrated easily with receiving significant marketing materials and “offers” for additional services after you sign up for a subscription service, understand that identity theft protection services also generate quite a bit of marketing emails and unsolicited communications with their customers.

Finally, canceling these services can be a significant challenge. Nearly all ID theft protection services make use of auto renewal payment plans, meaning they automatically charge you at the start of each billing period. Because they have your payment information on file, they do not give up this revenue stream without a fight by allowing you to cancel easily. You may have a difficult time speaking with someone who can actually cancel your service, and it may take multiple phone calls to complete the cancellation.

I recommend that anyone who wants to subscribe to an identity theft protection service should use a credit card to sign up for the service, rather than a debit card or a direct withdrawal from a bank account. If the company is not allowing you to cancel or is continuing to charge you after you believe you canceled the service, your credit card company often can help you put an end to the charges more successfully than your bank can.

The features that ID theft protection services promise to give you sound great in the marketing materials. However, the services don’t always live up to these lofty goals once they have your credit card in hand and are automatically charging it each billing period. Pay attention to any potential downsides to these services before deciding whether you want to subscribe.