At Comparitech, we spend a lot of time researching and writing about online streaming and virtual private networks, or VPNs. From average VPN download speeds to logging policies, we not only try to look at how VPNs are working from a consumer-facing standpoint but also how they’re being influenced by major international trends.

The World Cup provides a great opportunity to investigate meaningful shifts in online streaming and VPN use as sports fans around the world look for easy, convenient, and free options to watch association football.

Based on Comparitech’s research into VPN website traffic and sales data provided to us by ExpressVPN, NordVPN, and IPVanish, plus Google Trends data, we found:

- More consumers are looking for how to watch the World Cup live online over 2014

- More users are looking for and turning to VPNs to bypass geographic content restrictions

- When free live streams go down in a country, users are far more likely to try to turn to VPN services

- Following major sporting events like the World Cup, VPN interest rises, as noted by data from ExpressVPN, NordVPN, and Comparitech’s own website traffic data and VPN referrals

- ExpressVPN experienced their biggest sales day ever due to World Cup streaming

- English-speaking residents in countries where online live streams are either cheap or free are less likely to try to look for alternatives, however…

- Many consumers currently living or traveling in foreign countries may be looking to use VPNs to access live streams in their native language

The growth in VPN service sales directly related to the World Cup is of particular interest.

According to Harold Li, vice president of ExpressVPN, “The spike in traffic we’re seeing from the World Cup is a great example of the broader trend of people shifting from traditional TV options to online streaming and turning to VPNs to ensure they can reliably access those streams. This is particularly true of those who have grown up in the digital era and expect to be able to access the content they want, where and when they want, on any device – VPNs help unlock that access.”

Below, we’ve explored some more of our research findings in more detail. Comparitech’s research goals focused on English-language searches available through Google Trends as well as VPN sales and website traffic data made available to us from VPN services and from our own site metrics.

Increase in month-over-month VPN sales

The Google Trends data is revealing, but there are a few additional facts to highlight before we dig into those. First, we saw an increase in English-speaking consumers looking to access free World Cup streams online between 2014 and 2018. Secondly, more of those users than ever are looking to use VPNs to bypass geographic content restrictions, which may indicate a growing awareness of VPNs as a bypass method and more online broadcasters restricting their streams to local viewers.

This coincides with another growing trend we found: Increased month-over-month and year-over-year sales for VPN services as well as a much higher number of sales over some other international sporting events.

ExpressVPN, NordVPN, and IPVanish shared sales data with us following the World Cup’s main events.

VPN sales and site traffic increases

According to ExpressVPN, traffic to its website jumped 30.6 percent, while VPN sales increased 35.1 percent during the period of June 14 to July 11, when compared to the similar period between May and June.

ExpressVPN also noted that the first week of the World Cup saw extremely high traffic and sales over a similar period the month before. Between June 14 and June 20, ExpressVPN’s site traffic rose 77.6 percent, while their VPN sales increased 70 percent.

Most notably, ExpressVPN states its site traffic was statistically similar during the first week of the World Cup as it was during the 2018 Winter Olympics—only 0.2 percent more—but that VPN sales were up 63.6 percent. This may reflect a larger interest in the World Cup over the Winter Olympics this year, but it could also relate to other factors, such as more free streams available online for the World Cup that can be unblocked with VPNs compared to those available for the Winter Olympics.

The 2018 World Cup also bested the 2016 Summer Olympics, according to ExpressVPN’s traffic and sales data. Traffic for its site was up 47.6 percent for the 2018 World Cup compared to the 2016 Summer Olympics, while VPN sales were up 29.1 percent. ExpressVPN notes the 2016 Olympics week one sales increase over the previous month that year was 49 percent, meaning the 2018 World Cup saw a noticeably higher bump in sales for a similar time period.

However, NordVPN’s data showed it doubled sales during the 2016 Summer Olympics, which they did not do for the 2018 World Cup.

ExpressVPN explained that this year’s World Cup resulted in its highest sales day ever as a company. On June 15th, the same day Spain and Portugal battled it out in one of the most memorable match-ups this year, ExpressVPN broke its previous sales records.

NordVPN saw a 31.9 percent increase in new buyers during the first week of the World Cup. The company explained that June 24 was its biggest sales day during the event, which coincides with the beginning of the knockout stage of the group matches.

Compared to the Champions Leagues final, NordVPN explained World Cup sales jumped over 20 percent. Per its sales data, NordVPN points out a growing trend among users looking to bypass content restrictions to access sporting event live streams online.

“With each large sporting event, more and more people try the VPN technology they might have never used before,” said Ruby Gonzalez, Head of Communication at NordVPN. “We started getting questions about how NordVPN can help expand the options for watching World Cup games weeks in advance. We are happy about the increase in our customers due to the World Cup, and once the soccer fever is over, we hope that many will stick to VPN. People quickly learn how useful and easy it actually is.”

IPVanish, a US-based VPN service, also experienced a sales increase due to the World Cup. The company’s World Cup sales bump was a more modest 10-15 percent, but still attributable to the international football tournament. Jeremy Palmer, VP of Marketing, said, “We tend to see an increase in traffic and sales during sporting events, but we work hard to diversify our traffic and focus primarily on the privacy and security aspects of our service, compared to geo-unblocking. The overall impact of big events is generally short-lived.”

VPN sales by language and region

ExpressVPN also shared some language and region sales data with us. According to the VPN service, Polish-language speakers drove the most significant uplift during the event, with a 138 percent increase month-over-month, seconded by Korean-language speakers with 109 percent, Spanish-language speakers with 97 percent, and German-language speakers with 84 percent.

The biggest regional sales increases for ExpressVPN during the World Cup came from Luxembourg, which recorded a 289 percent increase month-over-month, followed by Greece (161 percent), New Zealand (151 percent) and Colombia (145 percent). ExpressVPN filtered out countries with smaller sales numbers.

This aligns with at least some of our research, particularly for “World Cup VPNs” Google searches, which saw a large increase from New Zealand between 2014 and 2018.

Beyond those services that shared data with us, other VPN services published their own data to reflect World Cup-related growth. A July 4 press release from PureVPN reports a 400 percent increase for that company during the first few weeks of the sporting event. Meanwhile, a June 29 press release from ZenMate notes that service saw its sales double and its site traffic increase 51 percent.

Comparitech VPN sales referral data

Comparitech provides reviews and comparisons of security and privacy tools including VPNs. This provides an insight to industry-wide trends in VPN sales across multiple service providers.

Referrals to a cross-section of VPN services through the Comparitech site increased 51 percent for the first week of the World Cup versus the same period in May ( June 14 – 20 v. May 14 – 20).

Comparitech’s peak VPN referral days were:

- June 16 (Croatia v. Nigeria, France v. Australia) – sales up 108 percent v. the average day in May

- June 17 (Brazil v. Switzerland, Germany v. Mexico) – sales up 96 percent v. the average day in May

- July 7 (Sweden v. England, Russia v. Croatia) – sales up 95 percent v. the average day in May

- July 15 (Final, France v. Croatia) – sales were up 93 percent v. the average day in May

The day of the World Cup Final also translated to Comparitech’s most site traffic during the event.

Overall, referrals for this year’s World Cup also surpassed our referrals for the Winter Olympics from earlier this year.

2018 World Cup: A year for online viewing

As high-speed internet access and travel both increase across the world, more English-speaking sports fans are turning to the convenience of online live streaming. Online sports streaming is already well established in many countries, such as the United States, United Kingdom, Canada, and Germany, where high-speed internet access has helped fuel consumer demand for more cord-cutting streaming options.

The US, in particular, is currently a hotbed for online streaming as internet TV “skinny bundle” services have proliferated greatly in just the past few years. US sports fans can now access services like Sling TV, YouTube TV, Hulu with Live TV, PlayStation Vue, DirecTV Now, and more through apps on most of their devices. Additionally, a large number of cable companies are now offering online viewing options through dedicated apps so users aren’t tied to a TV if they don’t want to be.

Given association football is the most popular sport in the world with around 4 billion fans, it should come as no surprise that most countries obtain streaming rights through either public or private broadcasters, and most association football fans will seek out any medium they can to watch the sport.

Our Google Trends research, however, covered three areas:

- How have English-speaking World Cup fans changed their web searching habits from 2014 to 2018?

- How many English-speaking World Cup fans are looking to bypass geographic content blocking via VPNs compared to previous World Cups?

- Do changes in English-speaking users searching for online streams and VPN options correlate with changes in VPN sales and website traffic? (Verified in the first section of our study)

We specifically looked for measurable increases across these three research questions but were particularly interested in whether or not consumer interest in online viewing and VPN use for the World Cup went in either direction. Both growth and decline in these areas can provide a glimpse into a variety of consumer behaviors, business initiatives, and government policies.

How do World Cup fans search for live streams?

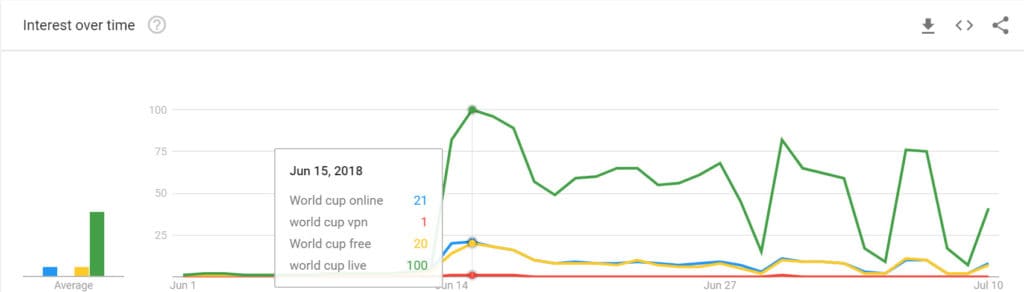

This year, one of the key search terms most associated with World Cup streaming online that garnered a large amount of volume, according to Google Trends, was “World Cup live”. That search averaged more than three times the volume of the next closest search term, “world cup online”.

“World cup live” is a fairly generic search term, however. Many of those using that term may not have been seeking to watch the 2018 World Cup online, but instead where to best watch the game live from any source, including analog and digital over-the-air TV or traditional cable options. Some of those searching for “World cup live” may even have been looking simply for a schedule for the matches, or even where to watch at a local pub.

We chose instead to focus more attention on those who were using the search terms “World Cup online”, “World Cup free”, and “World Cup VPN”. These are more targeted keywords, which is also why they produce far less volume compared to broader, generic searches.

We should also note some significant limitations to this approach. Google Trends does not give specific numbers for these searches. Instead, it provides data based on comparative volumes. The service also adjusts volumes, so regions that naturally have an overwhelmingly large number of native searches (such as US and UK) are not the only ones appearing in its results. A small country with far fewer internet users searching in English (such as Uganda or St. Helena), but with a larger comparative volume of individual users searching for a term, will appear alongside another country with a technically larger number of individuals searching for the same term.

Additionally, our focus was only English-language searches. For example, a large volume of individuals may search for “World Cup online” in a German equivalent, but Comparitech’s research only reflects how English speakers are using Google’s search around the world. This means we’re specifically looking at English-speaking travelers, expatriates, and native populations where English is either spoken as a first language or used commonly for those who go online. We cannot tell exactly who is performing the searches based on Google Trends data.

Google Trends data reveals some interesting changes between 2014 and 2018 when it comes to various search terms associated with the World Cup.

“World Cup online” 2014 v. 2018

According to our research into Trends data, we saw notable decreases in the volume of searches for “World Cup online” across many countries where data was available for both years.

Click here for full-screen view

In 2014, between June 1 (a few weeks before the World Cup kicked off) and July 13 (the day of the World Cup final that year), the largest English-language search volume for how to watch the games online came from Jamaica. While Jamaica failed to qualify for the World Cup that year, a lack of decent coverage by the broadcasting rights holder in 2014 may have accounted for some of that volume.

That year, the broadcasting rights holder in Jamaica, CVM Television, only broadcasted over-the-air and was dealing with significant signal issues leading up to the games. Many fans may have turned to alternative online streaming options due to difficulties receiving terrestrial coverage. Approximately 53 percent of Jamaicans had internet access in 2014, so many did have the option to take their viewing online.

Outside of Jamaica, a high volume of searches in 2014 for “World Cup online” came from

- Qatar

- UAE

- Trinidad and Tobago

- Nepal

- Singapore

- Laos

- Bahrain

- Bangladesh

- Malaysia

- Kuwait

- Lebanon

- Oman

- Pakistan

- Malta

- Vietnam

Interestingly, the trend here reveals that the highest English-language search volumes by nation for the specified term came from the Middle East, East Asia, and Southeast Asia. Central and South American, European, and African nations notably fall far behind in search volume for those looking for “World Cup online”.

Some reasons we can surmise for why those countries fell behind can include, but are not limited to: A lack of high-speed internet access (Central and South America as well as Africa) and a larger share of users viewing from traditional cable and satellite TV. As our research focused on English-language searches, it’s also possible that there were fewer expatriates, English-language travelers connecting in from those regions, or fewer internet users native to those countries who prefer to use English while online.

A notable change in 2018 saw the volume of searches for “World Cup online” decrease in most countries where data was available for both 2014 or 2018. Around 80 countries had at least some data available for both years. Of those, over 40 saw measurable decreases in search volume for the aforementioned search term. Only 20 countries reflected measurable growth in volume. The remainder had no measurable changes in search volume.

It is difficult to speculate why so many countries saw increases and decreases in the search volume of individuals looking for World Cup streaming online in English. Whether or not one’s country is involved in the World Cup could potentially account for these decreases in interest across the globe. If that is the case, we should expect to see huge increases in interest for this search term in 2026, when the World Cup will have more slots for teams than ever and will be hosted by three nations at the same time (United States, Canada, and Mexico).

However, it’s important to note again that Google Trends is comparative. The increases in interest experienced by other nations may have simply resulted in a comparative drop in other nations based on the way Google Trends works. Nevertheless, a closer analysis of the broadcasting situation and increase in high-speed internet access in each country could lend at least some insight regarding those trends.

Interest may also have dropped in several nations due to increased visibility and marketing inside those countries for streaming locations. This is possibly the case in the US, where online streaming options for the World Cup increased between 2014 and 2018 thanks to the proliferation of cord-cutting streaming services like Sling TV and others.

In the US, FOX Sports held the broadcasting rights for the 2018 World Cup. US consumers had among the most choices anywhere in the world for where to access their online streams, including traditional cable subscriptions with online viewing options like Comcast’s Xfinity.

Those services invest heavily in advertising, so fewer World Cup fans turned to Google searches to find where to watch online. A drop in searches would be expected in that situation, but more research would be needed to verify a causal relationship. That said, the US team’s failure to qualify may also account for this dip in interest from US football fans.

Outside the US, the rise of cord-cutting options and better advertising of those options would reasonably make a dent in search metrics. For Jamaica, this may have been the case, as the primary rights holder this year, Television Jamaica, offered a free live stream that was heavily advertised both online and in media outlets.

“World Cup free” and “World Cup VPNs”

FIFA’s international broadcast rights are complicated, to say the least, but reflect one of the current difficulties that exist for content rights holders. While in some countries sports fans watched the World Cup for free — live streaming online now more than ever — through public broadcasters, many World Cup fans had to pay varying amounts for access.

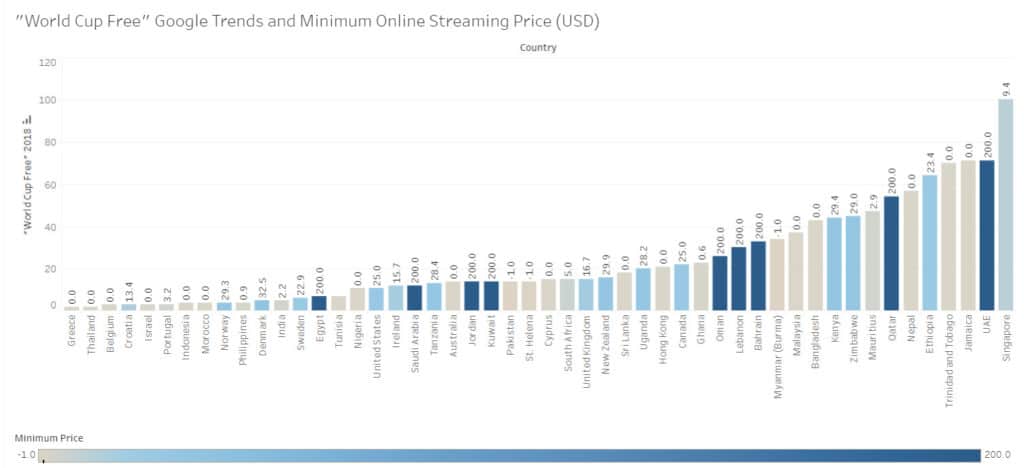

Intuition might suggest those who live in countries where payment is necessary to access the World Cup would overwhelmingly search online for free streams and ways to bypass geographic content blocks. However, of the top 50 countries (by English-language search volume) registering on Google Trends in 2018 for “World Cup free”, most already offer the matches online for free through public broadcasters:

We believe what this suggests is that the search volume primarily comprises individuals looking to access World Cup broadcasts in another language. Our reasoning for this relates specifically to the comparative growth in individuals looking to access VPNs to bypass content blocks in other countries, even when searching from countries where the games were already available for free online but exclusively in one language.

Take, for example, the comparison of those searching for “World Cup VPN” versus the minimum cost to view games in that country (per month):

Note: In the two charts above, a -1.0 for price data indicates that there were no online streaming options available in that country that we could locate.

As with the “World Cup free” graph above, when we compare those searching for “World Cup VPN” against the minimum price for streaming, we still see much of the higher search volumes populated by countries where online streaming access is already free.

When compared to searches for VPNs, however, it does appear that a higher volume of searches for VPN access comes from countries where the minimum cost for access is above zero. The same goes for countries like Nepal, where access is free but the broadcaster no longer streams the World Cup online.

What the above data does not tell us, unfortunately, is how this relates to the relative cost of living in each country and the purchasing power parity across countries for similar TV services in local currencies.

Overall, the volume of consumers searching for both “World Cup free” and “World Cup online” increased between 2014 and 2018.

Click here for full-screen view

Click here for full-screen view

Conclusions and limitations

We purposefully avoided drawing too many conclusions about the Google Trends data we obtained. Specifically, we recognize a large number of variables could influence changes in search habits, some of which we already noted.

Additionally, as mentioned earlier, Google Trends can track search terms in other languages, but our research focused solely on English-language searches. This limitation may account for why we weren’t able to see any correlation in our Trends data to ExpressVPN’s sales data from non-English speaking countries.

One expected finding was that there are more online streaming options in 2018 than in 2014. The data, both sales, traffic, and Google Trends search volume data, all seem to show a growing interest in live online sports streaming. They also show that in countries where costs may be burdensome, or where online streaming access has not kept up with the availability of high-speed internet, users may be more inclined to seek out free streams and bypass geographic blocks to access them.

However, our data does appear to show that many travelers and expatriates currently residing outside of their home country are quite likely searching for sports streams with commentary in their own language. Also worth noting, many of those countries that generated high levels of search interest in VPNs also have large foreign-born populations. With Uganda, Nepal, and St. Helena serving as outliers*, the next 5 nations in our Google Trends 2018 search data for “World Cup VPN” have noticeably high foreign-born populations and travelers.

Those include:

- Singapore – 42.9 percent

- Hong Kong – 38.9 percent

- UAE – 83.7 percent

- New Zealand – 25 percent

- Qatar – 73.8 percent

The bottom of the list for that search term is populated mostly by countries with low immigrant populations or where VPNs were ultimately unnecessary due to easily accessible and low-cost or free options online. (Additional population data available via Wikipedia.)

Finally, we recognized a few limitations when gathering data on local minimum prices for online streaming access in various countries. Many African countries had access to online streams via KWESÉ TV, for example, but many are countries where KWESÉ TV is available are also locations that have limited high-speed internet access.

Additionally, few Middle Eastern countries had local public or private broadcasters with rights to the World Cup. Instead, most World Cup fans throughout the Middle East required access to a rather pricey beIN satellite TV subscription to access the games. While other pricing data we obtained and graphed is listed in a per-month equivalent, the lowest-cost option in many Middle Eastern nations was a one-time payment of $200 to beIN that granted viewing access to only the 2018 World Cup games.

This caused many Middle Eastern countries to appear far more expensive, by comparison, but also reflects the reality that accessing live streams in the Middle East was indeed more expensive in general.

We believe more can be uncovered just through the data we’ve currently gathered. We encourage others who may be interested to investigate further, particularly when it comes to more specific changes in individual countries’ World Cup streaming availability for consumers.

Methodology

Several points of data were gathered for this analysis. We looked at:

- Google Trends data for different time periods in 2014 and 2018

- Pricing data of different streaming service costs, TV license fees, and taxes for over 100 different countries across the world

- World Cup broadcasting rights for 2014 and 2018

- Online streaming availability for over 100 countries around the world

To obtain much of the data, we utilized publicly available information from Google Trends, filtering by date from the start of June to the end of the World Cup. For 2018, our data ended before the final match occurred. For 2014, our trends data included all of June, up to July 13th, the day of the final match for the World Cup in 2014.

Pricing data for various streaming services, TV license fees, and national TV taxes was acquired on a country-by-country basis through web searches. For that, we also utilized FIFA’s published broadcasting rights for 2018. For 2014, we utilized the organization’s published information for broadcast rights from that year. Information for both years is also available on Wikipedia.

During our research, we noticed that volumes for different English-language search terms, such as “World Cup online” or “World Cup free”, changed on a daily basis. As such, all of our data for search terms in 2018 were recorded for the same time period: June 1 through July 12. Given the World Cup final was on July 15, it’s quite likely that Trends volume data reflects different countries in different comparative positions. However, it’s unlikely the overall trends and important conclusions, particularly when compared to 2014, look different even with the additional data.

Tableau Public version 2018.1.2 and Datawrapper were used to graph data.

*Comparitech identified a reason for Nepal’s increase in searches for World Cup streaming options earlier in our study. The primary free broadcaster in Nepal stopped broadcasting their live stream online, likely leading to more Nepal fans seeking alternative online streaming options. As for St. Helena, its primary issue this year was a lack of broadcasters with rights to stream on the island, even as high-speed internet access has increased on the island since 2014. Uganda’s reason for jumping so high in the search data is currently unknown, although it may relate to recent interest in VPNs due to that country’s social media tax.