It’s that time of year again. Most taxpayers should have their W-2s in hand, while business owners and self-employed taxpayers should have all of their 1099s and other tax documents ready for the 2019 tax filing season. However, as that April 15 tax deadline rolls in, US taxpayers may want to be careful when picking up the phone. For the past several years, IRS scams have increased in number, with many using scare tactics to separate Americans from their hard-earned dollars.

What are IRS scam calls?

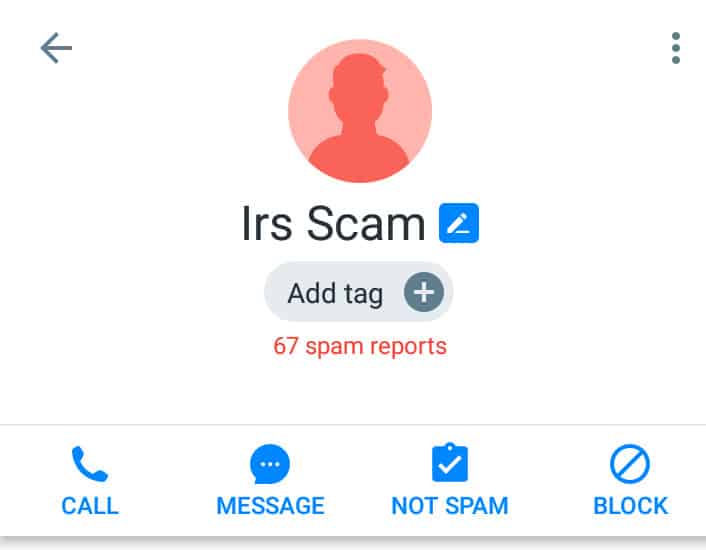

IRS scam calls can come in many forms. Most, however, will attempt to scare you into thinking that you have certain tax liabilities that you don’t actually have. As a US taxpayer with a phone number that’s been stolen in quite a few dozen data breaches, I’m no stranger to these calls, either. Thankfully, my Truecaller app quickly identifies these numbers as spam. But before I had a spam call filter, I found myself feeling the pinch of fear that these calls can induce.

In fact, around tax time last year, I received multiple calls from one number identified by the Truecaller community as an IRS scam:

Thanks to my spam filter, I’ve never picked up this number, and anyone who receives any number identified by their spam filtering apps (such as Truecaller or Robokiller), should also avoid picking up these calls.

The anatomy of an IRS scam call

For those interested in what happens when you do pick up one of these calls, I decided to give a reported fake IRS number a return call:

As you can hear, the individual on the other end of the line identifies himself as an agent with the US Treasury Department. He then proceeds to ask for rather standard information (name, mailing address, etc.), in order to appear official.

The personal information I gave the scammer was completely made up. I gave the IRS scammer a fake name and a fake mailing address. The scammer appears to do a web search for the name I gave him, which led him to ask me about my current address information. Since my address didn’t match what he found (likely through publically available online databases), I told him I recently moved and changed addresses.

The scammer makes every effort to appear official and to try to persuade me that I have a tax liability. He uses “scare” words and phrases, such as “lawsuit”, “crime” and “hiding money from the government”.

In this instance, he became suspicious before I managed to get to the finish line of the scam, which typically involves demanding repayment of the unpaid taxes. However, there are a few things consumers should watch out for here:

- The scam number is not an official government number

- While there are certainly many individuals working for the IRS who are not native born to the US, the heavy accent is suspicious, especially considering the name the agent provided for himself

- He made no effort to verify whether I had received any form of documentation in the mail

Had I managed to get him to stay on the line, he likely would have requested me to give him credit card information or to pay through other means, such as through purchasing gift cards and providing the gift card information or even paying through PayPal.

The IRS never conducts business over the phone in this manner, and almost never makes phone contact regarding overdue tax liabilities.

With IRS scams of this nature, the scammer will try to get you to stay on the line as long as possible in order to verify that you’ve sent the money. At that point, you’ll be disconnected.

If you end up on the receiving end of an IRS scam call, you may also hear other scare words and phrases, such as “asset forfeiture”, or even “criminal offense” and “jail”. The IRS does not conduct business in this manner, either, especially not over the phone.

Why IRS calls are always scams

Are IRS calls always scams? For the vast majority of consumers, yes. Simply put, the IRS never initiates communication for tax-related issues with a phone call. The IRS will always send a letter in the mail first, and any follow-up communication will only happen after other efforts to communicate have failed. Additionally, the agency will likely send multiple letters in the mail before moving to another form of communication. Phone calls from the IRS are exceedingly rare.

If you get a phone call from the IRS and it’s not a 1-800 number, it’s quite possibly likely a scam. That said, the IRS does have local numbers in different locations, and these numbers can be spoofed. This is especially the case if the number carries the same area code and local exchange as yours. In this instance, it’s likely using neighbor spoofing as its scam method.

The IRS itself confirms that this is the case. According to the IRS, the agency does not:

- Call to demand immediate payment using a specific payment method such as a prepaid debit card, gift card or wire transfer. Generally, the IRS will first mail you a bill if you owe any taxes.

- Threaten to bring in local police or other law-enforcement groups to have you arrested for not paying.

- Demand payment without giving you the opportunity to question or appeal the amount they say you owe.

- Ask for credit or debit card numbers over the phone.

Note that some of these IRS phone scams can be fairly sophisticated. The scammers may have fake identification numbers, names, and other information intended to convince you that they’re a real agent. However, if you receive an IRS call that is requesting you pay money for any tax purposes, it’s a scam. Note that the IRS also will not communicate through text messages or emails.

For more information on IRS tax scams, read here.

Additionally, the IRS offers a list of its official numbers on its website and states it’s best to call the agency if you think you owe taxes.

What to do if you receive an IRS tax scam phone call

Unless you’re using a spam blocking app on your mobile device, you probably won’t know a call is a scam until you pick up.

Your best defense against these types of calls is to use a spam call blocking and filtering app. The best apps in this category include:

- Truecaller (Free, iOS and Android)

- Hiya (Free, iOS and Android)

- Robokiller ($3.99/month or $29.99/year, iOS and Android, but does not work with MVNO mobile carriers such as Xfinity Mobile, Cricket Wireless, or Net10)

However, spam callers are now using number spoofing methods that bypass even the best spam filters. In particular, “neighbor spoofing” now accounts for the vast majority of spam calls, where the area code and local exchange number match that of your number. Some of these calls use spoofing technology to hide the real number, and may also be IRS tax scams.

If you receive an IRS tax scam call, do the following:

- Do not respond to any inquiries. Hang up the phone

- Look up the number on a website, such as Spy Dialer, to determine if there have been complaints about it from others

- Report the incident online to the Treasury Inspector General for Tax Administration (TIGTA) (or by phone: 1.800.366.4484)

- File a complaint with the FTC through the FTC Complaint Assistant. In the system, click “Other” and then “Imposter Scams”. For IRS scams, type the words “IRS Telephone Scam” in the notes section

- Report the number to a community-based scam site, such as the Spy Dialer or the White Pages (look up the number, then click on “Report It”)

If you believe you’ve fallen victim to an IRS scam, report the incident to your bank and credit card company immediately. Additionally, report the incident to the FTC.