Elder fraud, which is also known as elder financial exploitation or elder financial abuse, is the abuse of financial control or misappropriation of financial resources, resulting in harm to an elderly victim, in a relationship where the perpetrator is in a position of trust.

A Comparitech study found that while more than 200,000 elder fraud scams are reported to US authorities each year, resulting in an estimated $1.17 billion in damages, this is likely only part of the story. Based on our study findings, we estimated that the real number of annual elder fraud cases in the US was closer to 5 million, equating to roughly $27.4 billion in damages.

In this post, we explain more about what elder fraud is, why the elderly are targeted in scams, and what you can do to prevent elder fraud.

See also: Cybercrime statistics

What is elder fraud?

Elder fraud is a specific type of fraud that targets seniors. Perpetrators may be someone known to the elderly victim such as a family member or friend, or they could be a complete stranger. In the latter case, the fraudster will often make contact with their victim online or over the phone.

One common way that seniors are targeted over the internet is through email. General phishing techniques are used against a large number of email addresses with messages aimed at seniors. This content often falls into the following categories:

- Medical or health (including discount prescriptions and health coverage)

- Financial support (for example, home equity or retirement savings)

- Friendship or camaraderie

Other schemes are more targeted and may involve emails or phone calls that are very personal and specific in nature. Targeted attacks often use information gleaned in general phishing attacks to help dupe the victim into going along with the scam.

Elder fraud can result in devastating losses for victims. A US Consumer Financial Protection Bureau analysis found that victims suffered an average loss of $34,200.

It’s worth noting that during the height of the COVID-19 pandemic, many types of elder fraud were on the rise. And this is a trend we may continue to see. For example, bogus COVID-19-related products (such as vaccines and air filters) and services (for example, testing and contact tracing) have been used to swindle people out of money or to obtain personal information. Social Security Administration (SSA), insurance, charity, and other financial scams related to COVID-19 have been doing the rounds, with many targeting the elderly.

Why are elders targeted?

Seniors are disproportionately targeted as victims for fraud. Our study estimated that in 2018, 1 in 10 seniors in the US fell victim to elder fraud. We also found that 38 percent of all fraud cases target the elderly. So why is the rate so high? There are a few main reasons:

- Common problems: It’s easier to phish information from people if you know what their problems are. Seniors tend to share common concerns, such as medication costs, proper health care coverage, financial security as retirement funds run out, and providing for loved ones left behind. From a criminal’s standpoint, it makes sense to craft phishing emails on a small number of topics that a large percentage of recipients will be interested in.

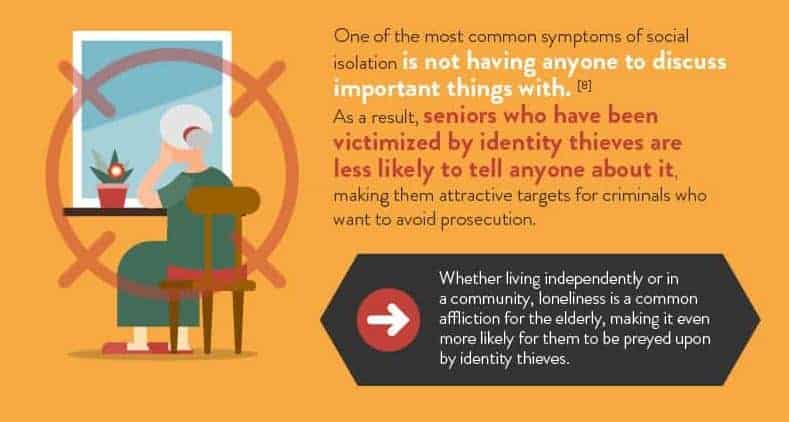

- Isolation: Many cases of elder fraud wouldn’t have occurred at all if the victim had spoken to a friend, family member, or carer about what was happening. The problem is that many seniors are isolated and don’t have anyone to run things by.

- Trusting: Most people over 30 today have memories of a world without the internet, and seniors would have spent most of their lives without using email. That can lead to confusion over how reliable email is, and how much trust to assign it.

- Poor decision-making: It’s not uncommon to experience some level of diminished mental capacity as we age. That can tax our decision-making abilities and lead to poor choices.

Common types of online elder fraud

It’s both surprising and sad that a good chunk of elder fraud is committed by family members or caregivers. A report by the Office of Financial Protection for Older Americans found that in 36 percent of cases, the victim knew the perpetrator, be it a family member, fiduciary, caregiver, friend, or acquaintance.

The same study found that just over half of elder fraud cases are perpetrated by strangers. Many of these schemes are carried out online where email, social media, and other communication methods provide a way in for scammers.

Here are some common examples of online elder fraud:

- Investment schemes

- Insurance scams

- Grandparent scams

- Lottery scams

- Charity schemes

- Health scams

- Identity theft

- IRS schemes

- Reverse mortgage systems

- Widow schemes

- Romance scams

- Tech support schemes

Let’s look at these in more detail.

1. Investment schemes

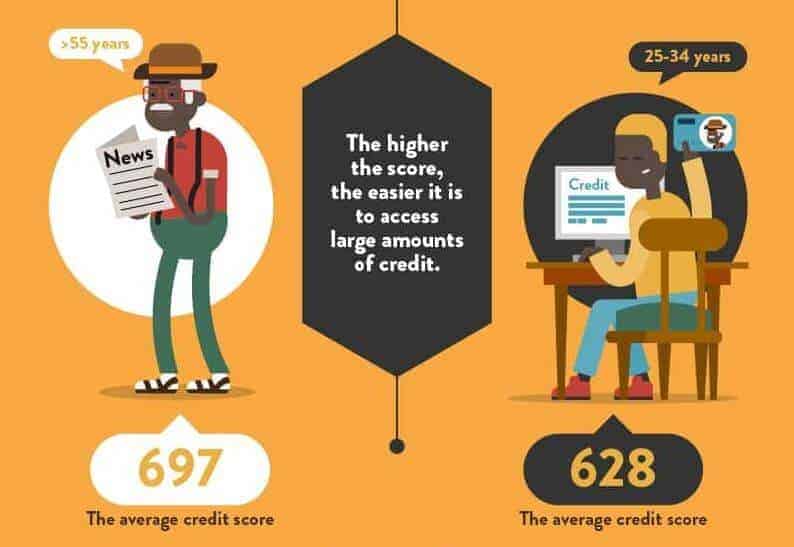

Monetary scams aimed at elders are attractive to criminals for two major (very different) reasons. On the one hand, many seniors are living on fixed and inadequate incomes and could use more money to live on. On the other, many elderly people have sizable cash nest eggs (on average more than six times as much as younger people). Plus, with large amounts of equity in their homes, they have access to lots of money.

Fraudulent investment schemes seek to bilk money out of people with the promise of some greater reward down the road. While it can be grisly to consider at the time, it’s always important to think of how much time is left for an investment to mature. By and large, older people would be looking at short-term investments, so this is where many fraudsters will focus their efforts.

2. Insurance scams

Insurance scams play another angle as there is no promise of the victim pulling money out of the insurance policy. Instead, fraudsters tug at the heartstrings and persuade seniors to invest money that will benefit those left behind.

In some cases, the insurance agent is legitimately licensed, but is still trying to commit fraud against the elderly. For example, David Pickett, a US-based insurance agent, has been arrested three times for fraud.

3. Grandparent scams

Although they sound far-fetched, grandparent scams are unfortunately surprisingly prevalent. In this scheme, a fraudster calls a senior on the phone and claims to be their grandchild in need of help.

The caller who is posing as the grandchild typically asks for money to be sent quickly to help them out of some emergency. They often tell the senior not to tell anyone about the situation as the grandchild would get in trouble.

While it sounds unlikely that someone would believe a stranger is their relative, there is usually some well thought out excuse as to why they sound different. Plus, the senior may be hard of hearing or simply feel panicked enough that they don’t become suspicious. A criminal convicted of carrying out these scams claimed that around one in 50 people fell for his scheme.

In one recent case, a woman was scammed out of more than $20,000. She thought she was sending bond money to get her grandson out of jail.

In this instance, the caller was someone posing as a law enforcement officer, so it was even easier to persuade the woman to send money. In other cases, the caller may pretend to be some other person in a position of authority. For example, they may claim to be a lawyer acting on behalf of the grandchild or a member of staff in a medical center where the grandchild is supposedly receiving treatment.

4. Lottery scams

Lottery scams are targeted at people of all ages and older people are no exception. The basic framework of a lottery or sweepstakes scam is to tell the victim they’ve won a large prize of some kind, but some smaller amount of money has to be paid in order to claim the prize.

The money to be paid is usually attributed to non-existent things like “international transfer fees” or something equally silly. It is safe to say that if you’ve never entered a lottery, you can’t win it, so claims like this out of the blue are a red flag. Legitimate lotteries are tightly regulated to ensure there is no fraud. It is extremely unlikely that a real lottery organization would contact the winner by email to begin with.

5. Charity schemes

Charity scams typically involve a fraudster impersonating a representative from a real charity or fabricating a fake charity in order to scam victims out of money. Contact might occur via phone, email, text, or mail, or it might even be in person.

These schemes tend to be more common (and successful) during or following major events, such as natural disasters, health crises, or global political movements. People tend to be more giving during these times and more likely to hand over money.

Some fake charities are difficult to spot as the scammers will create a professional-looking website to back their scheme. That said, in many countries, you can find out if a charity is legitimate by checking online. Here are some useful resources:

- US: IRS Tax Exempt Organization Search tool

- UK: Charity register

- Canada: List of charities

- Australia: ACNC Charity Register

If you do find that a charity is legitimate and you wish to donate, it’s best to do so via the charity’s official website, instead of through a questionable representative.

6. Health scams

It’s no secret that thirty-somethings don’t tend to need a lot of prescriptions. As we age, that changes, and by the time we reach our elder years, most people routinely take prescriptions of some sort. Depending on the type of drug and the available health care benefits, medication bills can add up. This creates a rich environment for scammers to prey on.

The National Association of Boards of Pharmacy (NABP) found that 96 percent of the online pharmacies it reviewed appeared to be operating against the law or against standard practices.

One example is CanadaDrugs.com which was allegedly selling unapproved and counterfeit medication. This domain has since been seized, but the below screenshot was captured before the site was taken down.

Government and industry organizations alike warn against purchasing drugs online for a variety of reasons, most of which boil down to a lack of accountability. There is no reasonable way to ensure that:

- You will receive the drugs

- The contents are as labeled

- The medication is of the correct dosage

- The drugs are not expired

Wondering if a pharmacy email is legitimate? While there are some legal online pharmacies, almost none of them would bother to send unsolicited emails. This is partly because they would get lost amongst the onslaught of spam promoting illegal pharmacies. If you’re going to order drugs online, the following guidelines are recommended:

- Only use websites that belong to a verifiable “brick and mortar” pharmacy with a street address.

- Don’t purchase drugs from a pharmacy that will sell you prescription drugs without a prescription.

- Don’t purchase drugs from a pharmacy that will issue you a prescription based solely on a questionnaire on the site.

The NABP is spearheading a movement called Safe Pharmacy to help customers identify legitimate pharmacy sites.

Only legitimate pharmacies should be able to purchase “dot pharmacy” domains, meaning sites with that extension are safe to visit.

7. Identity theft

Identity theft is a strange-sounding term, but it is accurate. Identities are very valuable because they can be used to apply for credit cards, open bank accounts, and a wide variety of other things. Stealing an identity simply means pretending to be another person to fraudulently obtain money or other items. The FTC reports that 19 percent of all identity theft complaints affect seniors.

We’ve created an infographic which shows many of the reasons seniors are disproportionately targeted for identity theft. Some of those are that seniors typically have:

- Higher savings

- Better credit scores

- More assets

- Higher net worth

Identity thieves are generally criminals of opportunity. Taking some basic measures can greatly increase your protection against becoming a victim. We’ve provided some easy-to-follow steps here.

There are a large number of identity theft prevention services in the US, which you may want to use as an added precaution.

8. IRS schemes

A very large, ongoing scam that targets seniors is the IRS scam. It has been going on for years and specifically tries to identify seniors as victims. The caller pretends to be from the IRS and states that you have a tax debt that must be immediately paid in order to avoid arrest. In reality, the scammer is after money or personal and banking information.

9. Reverse mortgage systems

Reverse mortgage systems are not inherently fraudulent but they are almost never a good idea. A reverse mortgage is a type of loan whereby older homeowners can borrow from their home’s equity. These loans are typically very expensive and it’s possible that the principal plus the interest over time can end up being far more than the house is worth.

10. Widow schemes

These scams involve criminals capitalizing on someone’s death by duping their grieving spouse. As morbid as this sounds, fraudsters will scan obituaries looking for their next target.

They will contact widows or widowers and use some guise to get them to hand over money. For example, they may say that they were owed money by the deceased spouse, or claim to be representing a financial institution associated with the deceased.

These victims are at their most vulnerable after the passing of their loved one, making this form of fraud particularly heinous.

11. Romance scams

This is another type of online fraud that often targets older people, in particular those who have lost their spouses and may be seeking companionship. Romance scams heavily target women over 50 but men are often victims too. Some seniors have lost hundreds of thousands of dollars in these schemes.

You can read more about romance scams in our dedicated post, but these generally follow a similar pattern. The perpetrator poses as a potential love interest or companion and earns the victim’s trust. Eventually, the criminal asks for a small amount of money followed by larger sums.

While it seems unlikely that someone will fall for this type of scam, in the US, people lose more to romance scams than any other type of online fraud.

12. Tech support schemes

In this type of scam, a fraudster poses as a tech support representative, often purporting to be from a large company such as Microsoft. This scam usually takes place over the phone. You might receive a call or be prompted to make the call yourself via an email, text, or on-screen message (the latter resulting from malware).

These schemes can play out in a variety of ways, but often the representative (scammer) “fixes” your (fake) computer issue and requests payment. When they request payment, they might simply be after your money, or they could be seeking to obtain personal and banking information for later use in fraud.

The fix might be as simple as explaining how to remove malware from your system yourself, but often it will involve allowing them remote access to your device. In the latter case, there are lots of things they can do, including secretly installing spyware on your computer, such as a keylogger that will help the fraudster learn your usernames and passwords for your online accounts.

They could even configure the remote access software such that after being granted access the first time, they can enter your system whenever they choose. They can use this access to snoop or to install additional malware, such as spyware or ransomware.

How to recognize if elder fraud is happening

Sometimes it can be painfully obvious when fraud has occurred. A suddenly empty bank account can make it pretty clear that you’ve been scammed. In other cases, the fraud can be more of a long-term process during which small amounts of money are siphoned off over time. If you’re vigilant, you may be able to spot the signs of elder financial fraud happening to yourself or to a loved one.

How to spot elder fraud happening to someone else

It can be very difficult to detect elder fraud unless you’re in frequent contact with the victim. As a caregiver or family member, you may be able to detect telltale signs that things are not normal. Some signs can be:

- A change in daily habits that could indicate a loss of money. People who know they have been scammed are sometimes embarrassed to admit it, but changes in their behavior may help you spot financial struggles. For example, changes in spending habits or out-of-character comments about not being able to afford certain things could be signs.

- Suspect documents. If you have authorized access to their mail and banking documents, you may find unpaid bills, returned checks, or unusual payees on statements.

- Outright complaints from the victim that they are missing money. Someone who is confused or may be operating at a diminished mental capacity may not know they’ve been scammed and just can’t figure out where their money is going. Or it’s possible that the victim does know they’re being defrauded somehow, but just can’t figure out how it’s being done.

- Flush family members or friends. Caregivers or other people close to the victim who seem to have items or a lifestyle above what you would expect to be affordable can be a red flag. They may just be good savers, or they may be supplementing their income in other ways.

How to spot elder fraud happening to you

While we’d all like to think we’re savvy enough not to fall victim to any type of fraud, criminals can be surprisingly clever and persuasive. In many cases, the fraud is happening in plain sight and someone is asking you to hand over money. However, in other cases, it could be happening without your knowledge. Here are some tell-tale signs that someone is trying to use you for their financial gain without contacting your directly.

- You have unexplained charges on your credit card. It’s prudent to review your credit card and bank statements at least monthly. If you see any unexplained charges, you should report them to your bank. Even very small charges should be explained. When credit card numbers are stolen, it’s common for the thieves to put through a small initial charge to ensure the card is still valid. This can increase the value of the credit card details on the black market.

- You get an alert from your bank. Many credit card companies and banks have default fraud alert systems, and some will allow you to set up your own activity alerts. This will let you keep track of banking activity in real time rather than waiting for monthly statements. You’ll likely be able to set up online access to your accounts as well to monitor account activity.

- You credit report looks odd. Credit monitoring companies are required to provide free credit reports at least annually. Ensure you take advantage of that and review your reports, looking for accounts that you didn’t open. And look for a change in your score that indicates someone may have been racking up bad debt in your name. In Canada, you can review your credit report monthly for free at Credit Karma.

How to prevent elder fraud

The Canadian Network for the Prevention of Elder Abuse has some guidelines to help prevent elder abuse in general, including fraud. One of the less obvious things you can do to prevent fraud is to be socially active.

If you maintain a group of friends or stay close to your family, you’ll have a peer group to bounce ideas off. If something seems suspicious, you’ll have someone to talk to. Also, you’ll have people in your life who know your day-to-day lifestyle and may be able to recognize if something is wrong.

Other steps you can take to prevent fraud include:

Never give out any information or money based on an email

Email is an insecure means of communication and is used in a wide variety of scams. It’s easy to craft an email to make it look like it came from a trusted entity. There should be no reason to send anyone money based solely on an email request, even to people who appear to be friends or family.

The same goes for personal information. If someone asks for your full name, phone number, address, date of birth, social security number, or banking information over email, this should raise flags.

Before considering responding, do some research into the company or person making the request. Always follow up email requests with a phone call or some secondary method of communication to ensure it’s a legitimate request. That said, avoid calling numbers that are included in a suspicious email. Instead, use a search engine to look up the real number for the company or person involved.

If emails become more frequent or have a sense of urgency, these should not be seen as signs that you should comply. Rather, they are big red flags indicating that this is a scam.

Never give out information or money based on a phone call unless you know and trust the person

This sounds similar to the previous point, but it is slightly different. Criminals use email because it’s possible to hit an extremely large number of potential victims with almost no effort. But, that doesn’t mean all criminals are lazy.

Some will take the time to identify victims and make telephone calls instead of sending emails. The scammer is not able to hit as many victims over the phone as he could over email, but the personal touch of a phone call makes the success rate higher.

If you do agree to send money to someone you know over the phone, ensure that they are who they purport to be. There can be warning signs that something is amiss, such as:

- The information or amount of money being requested seems out of line with the reason for it.

- The story behind the purpose of the information or money seems outlandish.

- The caller indicates that there a sense of urgency.

- The caller tells you that you shouldn’t inform anyone else about the request.

One way to spot a fraudulent caller is to ask lots of questions. In some cases, they will simply hang up. Others are well-prepared and will try to use their answers to convince you further, but multiple probing questions will often reveal holes in the story.

Designate a trusted person for your financial advisor to talk to

Financial advisors are in a good position to spot fraud attempts. If your money is invested and managed by an advisor, then fraudsters have to attempt to deceive the advisor, which is (hopefully) hard to do.

In the event that your advisor does spot fraud but is unable to work with you directly due to illness or advanced age, the advisor should be able to work with someone else on your behalf. Your advisor generally won’t have the legal authority to disclose your financial information to anyone else unless you’ve specifically designated someone in advance. If your advisor doesn’t ask you to fill out an authorization form for this purpose, ask how you can do that.

Set up powers of attorney and other legal documents in advance

The key phrase here is in advance. We don’t always see problems coming and if you suddenly become too infirm to deal with financial matters, it may not be possible to set up powers of attorney at that time. Much like designating a trusted person for your financial advisor to talk to, you should designate a trusted person to have your powers of attorney before you need them.

Use a VPN

Short for Virtual Private Network, a VPN encrypts all of a device’s internet traffic and routes it through an intermediary server in a location of your choosing. This prevents hackers and other bad actors from monitoring online activity and tracing it back to the user. This is especially useful for people who connect to public or shared wifi, such as elderly people who reside in assisted living facilities.

VPNs might seem a bit too technical for some elderly people, but they can usually be configured to connect whenever internet is available, allowing you to set it and forget it.

How to report elder fraud

Elder fraud is a form of abuse and is therefore against the law in most countries. Your local police force should be a good first point of contact in all cases. Depending on your country, there may be other organizations that can help as well.

Australia

In Australia, each state or territory handles incidents in their area. The Australian government has a list of agencies that can take reports of elder abuse, as well as help in other ways.

Cybercrimes can also be reported through ACORN.

Canada

The federal Royal Canadian Mounted Police investigate elder abuse. You can contact them directly or get in touch with your local police force.

United States

Each US state operates an Adult Protective Services agency. Each agency appears to be run autonomously, but you should be able to locate the proper one by searching for your state name and the phrase “Adult Protective Services.”

In addition, the AARP (formerly the American Association of Retired People) is a helpful resource. It maintains a list of agencies in various industries that can help.

You may also report cybercrimes through IC3.

United Kingdom

The UK government website directs fraud cases to your local police force, and provides a number for the Action on Elder Abuse hotline.

You can also contact Action Fraud, the UK’s national fraud and cybercrime reporting center, for guidance.

Fraud of all kinds can usually be detected by simply being vigilant and involved in your day-to-day finances. However, elder fraud can be more difficult to spot because of the potential for confusion and isolation in our elder population. Maintaining social contact with your family and friends throughout life, and remaining as wary as possible are the best preventative measures.

Ms pritchitt you are so rights the judges lawyers and politicians prey on the elderly. The should be jailed it racketeering a nationwide problem

Hi Paul,

In reference to your reply to Caroline Pritchett telling her to “call the police”, your advice sounds reasonable, but calling the police, at least where I live, did nothing to help my father when he was scammed in 2015. Nor did calling our State’s Attorney General.

In the waning months of 2014, my aging father received an email that claimed he had won the “Mega Million Lottery”. He called the number on the email and over the following 14 months the fake “Mega Million Lottery” people had convinced him to hand over every last bit of money he had to his name, draining the IRA account he and my mother had saved over their lifetimes, totalling more than $400,000.00!! They also convinced him to send them all the money he would have ordinarily sent to the his Mortgage Company to make his house payments, the finance company to pay for his car, all the other bills for his electricity, his gas, his water, money he would have paid to the Credit Card Company. They also encouraged him to take out loans – one $15,000.00 and another $25,000.00 and send them THAT money as well. All the while telling him that he couldn’t tell ANYONE, until they hand delivered his HUGE winning check in the amount of $825,000,000.00!!! Eight Hundred Twenty Five MILLION Dollars (U.S.). They told him that once he had the check he could pay everything back!!

Now, my father is not a stupid man. He’s not even dumb. But they had him SO thoroughly convinced through months of “grooming” conversations over the phone. They would call him up to 25 times a day, sweet talking him into believing this was real. Dad WAS however, 84 years old, a widower who lived alone, and was missing my mother and all of his friends. He moved half way across the country to live close to me after my Mom’s death, even though he had lived within 3 miles of both of my brothers, because one of his friends told him that “a daughter would take much better care of a widower father than any son would.”

We ended up having to sell his house, and we did accomplish that, three days before it was scheduled to be sold at auction for non-payment. We had to file for bankruptcy on his behalf because he no longer had the money to pay back everything else. He insisted on living alone so I had to find a place that he could rent. I handle his finances now and he barely has enough income from his small Social Security check and an even much, much smaller retirement fund that pays him monthly. If he would have told me about this scam in the beginning, instead of me finding out about it by sheer accident, I could have saved him, and myself, a WHOLE LOT of money. And GRIEF. And tears, anger, frustration, heartache, and too many arguments to count!!!

I thank you for spreading the word to seniors, and their caregivers and I truly hope that you continue to do so. Mostly, I pray that seniors, and especially those tasked with looking out for them, keep their eyes open and be on the lookout for scammers!! They’re out there ~ they’re patient ~ and they’re just dying to get their hands into the pockets, purses, and bank accounts of your elderly loved ones!!!

How can you get back borrowed property I have receipts and proof the items are mine. But the person who borrowed said I gave to her. I have ask repeatedly for the computer to be returned and she has used my social security card to buy things for herself. I’ve changed numbers cards but she poses as a friend then steals. I found out after the fact. I believe she thought I didn’t know or wasn’t competent. I told her my memory was perfect but think her mind has slipped a couple of notches.

Call the police.

I have had all kinds of fraud but local and county law officers will not go get my property or getting my stolen property back after giving pictures telephone number still would not even take a statement. I had money until I moved here the illegal operations are mind boggling. I’m 74 disabled widow. Have no famly and all I did know here have passed. It’s hard to be almost 75 unable to work but worked two and three jobs all your life never had one thing stolen until here. I’m a good person and do feel sorry for some but the majority are lying thieves the police are the same way good and bad. The Court House is not disability friendly no is post office. My disability papers say no more than 2 steps up on stairs. But if not a large angled steps up or walk a ramp at a 45 degree angle. The sidewalks are deadly but the city will not keep them up normal do they fix the streets. This is the Hell Hole of our United States.